Cannabis Central: New AdvisorShares Pure US Cannabis ETF Is Not "Pure"

There are 10 or so "marijuana" ETFs out there purporting to reflect the true state of the marijuana stock sector (see here) and the latest ETF from AdvisorShares Pure US Cannabis ETF (MSOS) is no different.

The new ETF:

- commenced trading on the NYSE Arca Exchange on Wednesday, September 2, 2020,

- supposedly provides exclusive exposure to U.S.-listed U.S. cannabis companies,

- is actively managed by Dan Ahrens, AdvisorShares chief operating officer, who also serves as portfolio manager of YOLO and the AdvisorShares Vice ETF (ACT) and

- claims to invests at least 80% of its net assets in U.S. Multi State Operators (MSOs) that derive at least 50% of their net revenue from the marijuana and hemp business in the United States.

The above stated intentions as to where the ETF will be investing is not borne out in actuality as the ETF's holdings currently are as follows:

- 76.0% of its holdings in MSOs (16 companies)

- 6.0% in Real Estate Investment Trusts (IIPR & PW)

- 4.3% in a horticultural supplier (GRWG)

- 3.3% in a diagnostic equipment supplier (PKI)

- 2.3% in bio-pharma companies (ZYNE, ARNA)

- 1.2% in a consumption device company (GNLN)

- 6.9% in cash and derivatives (Source)

If you are reading this article because you are keenly interested in investing exclusively in the MSO segment of the cannabis industry (i.e. 100% vs. 76%) you would be better served by buying a basket of specific (your choice) MSO pot stocks that truly reflect that objective. Which MSOs? I suggest you read my latest article on TalkMarkets entitled My Personal Pot Stock Portfolio Has Gone Up 125% Since June - Yes, 125%! for some ideas.

My portfolio consists of 11 cannabis stocks with outstanding momentum in 2020 of which all but two (Canopy Growth and Aurora Cannabis) are MSOs. If you are looking for a broader selection of MSO pot stocks to chose from then check out the munKNEE Pure-Play Pot Stock Index (see here) which tracks the 25 pot stocks in the sector that trade above US$1/share and generate 100% of their revenue from the cannabis industry (15 MSOs, 9 LPs, 1 other). Remember, though, that this article is not providing investment advice, just enlightening information, so do your own due diligence.

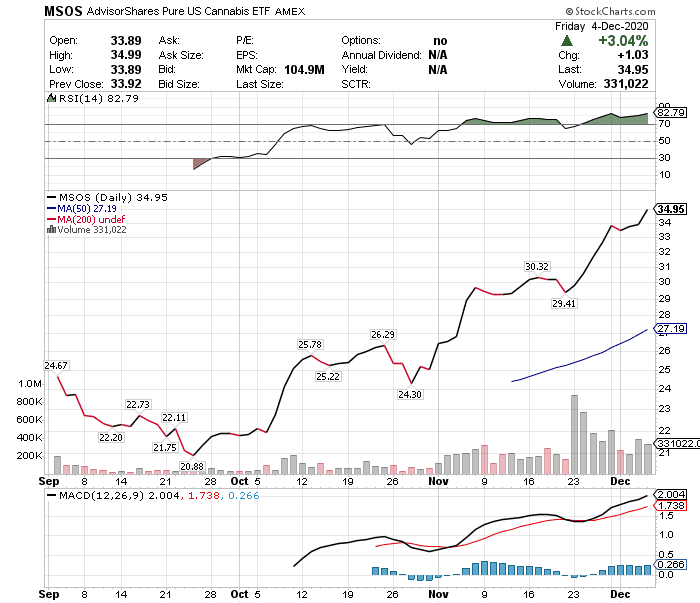

For the record, the AdvisorShares Pure US Cannabis ETF was UP 6.9% last week (w/e December 4th) thanks to the performance of the 7 ancillary stocks in the ETF. The "momentum" portfolio, in comparison, was UP "just" 6.1% and the Pure-Play Pot Stock Index was UP 5.3%. Below is a chart of the performance of the ETF since inception:

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

I disagree, most retail investors are better served letting a professional manager actively manage their investment in the fast moving Cannabis industry. $MSOS is a great long term investment for a retail investor who does not have the time or expertise to select the winners.

Another way is to just look at the top few holding by percentage in this ETF.