Buy The Dip? Israel-Palestine, 3Q Earnings Season

(Click on image to enlarge)

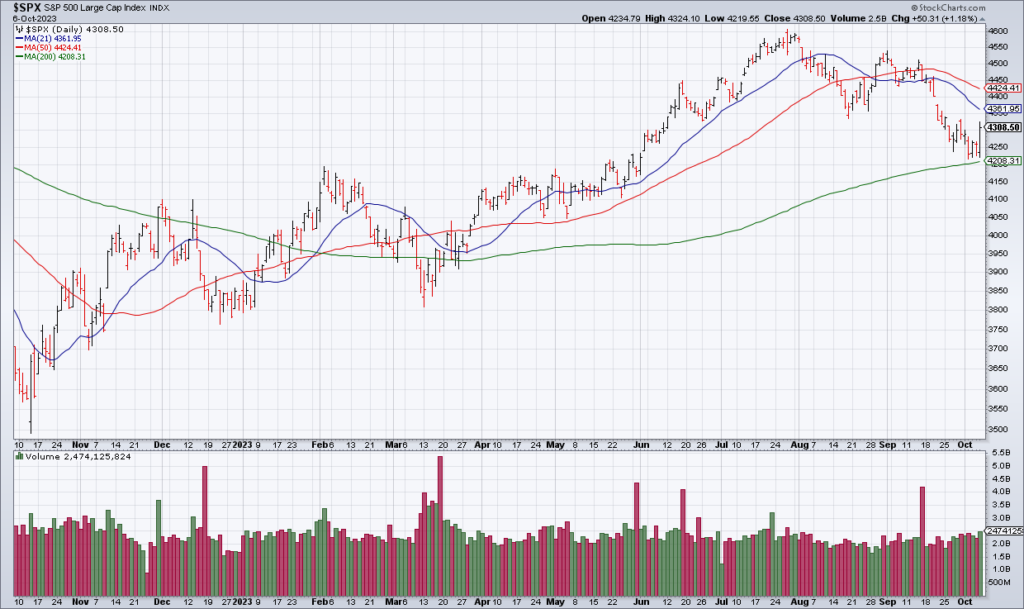

There is a dealer at Casino M8TRIX in San Jose who is also a stock trader and likes to talk to me about the market when I play poker there. When I walked in yesterday, as soon as he saw me he said: “Buy the dip”. When I said “Because of the reversal on Friday?” he said “Yes”. And that seems to be the consensus – even after Palestine’s invasion of Israel on Saturday. The market reversed right where it was supposed to – at the 200 DMA – setting the stage for a year-end rally. Not so fast….

Nobody seems to think the conflict in Israel is of any significance to the market. While I am by no means on expert on the Israel/Palestine conflict, many of the things I’ve read by those who are suggest that this is Israel’s 9/11. It also appears that Iran provided support for Hamas. In other words, the risk seems to be that this conflict could be far worse than the market currently expects. Pay attention to how things play out this week as Israel responds.

This week also marks the start of 3rd quarter earnings season – and the market seems complacent here as well. According to an article in this morning’s WSJ, while estimates call for 0.3% year-over-year decline, since companies usually beat estimates, some think we could have a year-over-year increase (“Investors Hope Earnings Season Will Revive Stocks”, B1). While I have no special insight into how earnings season will play out, my point is that sentiment on this front also appears to be leaning bullish.

(Click on image to enlarge)

(Click on image to enlarge)

Technically, even though the S&P’s 200 DMA held, the Equal Weight S&P ETF (RSP) has broken down and not recovered. In other words, as I’ve argued many times, it’s only the largest of stocks – The Magnificent 7 – that are holding the market up.

In sum, while most are leaning bullish, I’m not ready to push my bearish thesis into 2024 just yet.

More By This Author:

The Market Is About To Break

Earnings Preview: Eggs For Breakfast And Marijuana To Chill

S&P 200 DMA, Higher For Longer Isn’t Sustainable, CAG Is Too Cheap