S&P 200 DMA, Higher For Longer Isn’t Sustainable, CAG Is Too Cheap

(Click on image to enlarge)

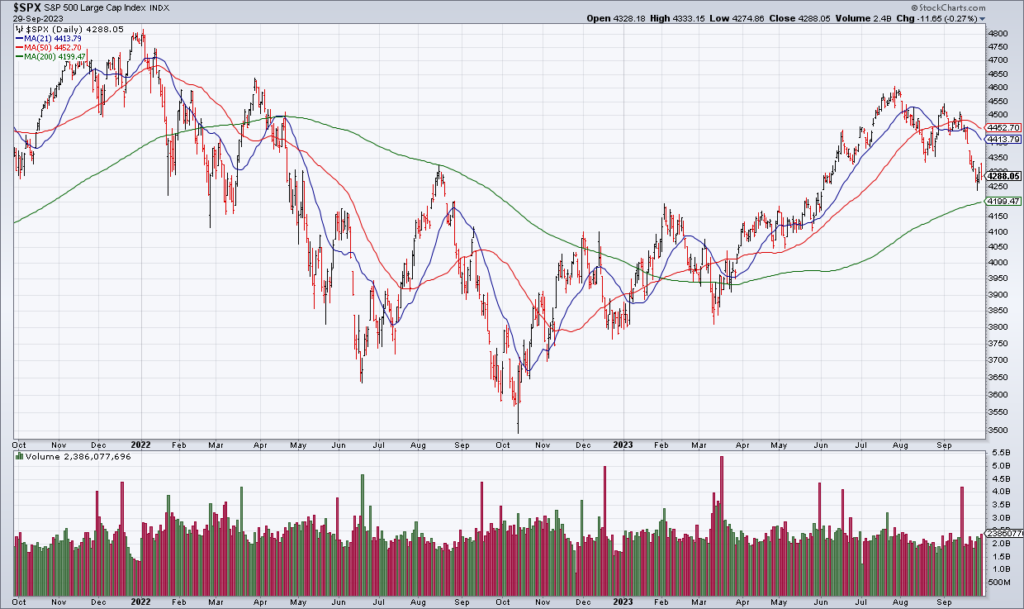

September was a tough month for stocks with the S&P down 4.87% and the NASDAQ 5.81%. In fact, the S&P is currently sitting only 2% above its 200 DMA. The 200 DMA is the most important indicator in technical analysis. Securities trading above an up trending 200 DMA are thought to be in a bull market while those trending below a down trending 200 DMA are thought to be in a bear market. You can be sure that many will be paying close attention if the S&P approaches this level.

The main narrative driving stocks – and bonds – lower the last two weeks was the Fed’s “higher for longer” theme at its last meeting. Obviously keeping interest rates higher for longer is restrictive monetary policy and therefore bad for risk assets. The question is whether the Fed can really do this without breaking something. I have my doubts.

(Click on image to enlarge)

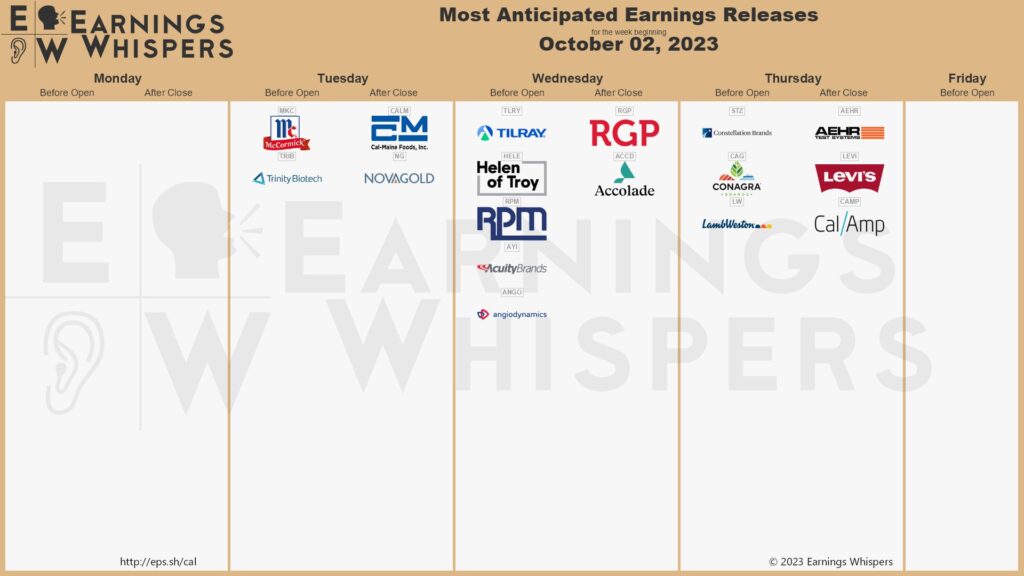

On Thursday morning, frozen food maker Conagra Foods (CAG) reports earnings. I once called CAG “the most boring stock in the world” because of its narrow trading range. But like many food stocks, CAG has absolutely fallen off of a cliff in recent months. I sense value. CAG’s last earnings report marked the end of its FY23 and it gave FY24 guidance. CAG expects 1% organic sales growth and $2.70-$2.75 in adjusted EPS in FY24. In other words, it’s not like the business is by any means falling apart and the stock is trading for 10x current year EPS guidance. CAG also pays a whopping 5,11% dividend.

I favor selling the CAG $27 Oct6 Puts for ~40 cents. It’s an aggressive trade because the strike price is so close to the current market price but I wouldn’t be afraid to exercise the options and pick up a few hundred shares of CAG if the stock dropped below it after earnings. If it doesn’t, you just collect the premium and that’s that.

(Click on image to enlarge)

More By This Author:

Nibbling On NKEEarnings Preview: UNFI & COST

Yields Break Out, The Olive Tree Barometer