Buy Health Care Now? It All Depends On The Election

It is, regrettably, impossible to separate market strategy from the presidential campaign as we approach the Final Days (of the campaign! Of the campaign! It won't be The End of Days no matter who wins and who loses.) Bear with me as we wend our way through the opinionated land mines here...

Many voters and investors have been disgusted by Donald Trump's inability to focus on the Big Issues rather than trying to sell us the blather that he is some kind of Boy Scout. And many have been disgusted, but not surprised, by the revelations now in plain view on Wikileaks of the greed and double-dealing of Hillary Clinton as she claws her way to reach the presidency. It seems strange that Wall Street didn't at least get a little bit of the jitters. But, then, what am I saying? It's Wall Street, and they'll only be chagrined if they find their funding failed to buy them the candidate with their interests uppermost in mind!

(We've all seen "the Real Donald" - regrettably, what you see is what you get - but if you are of a curious bent, you might also want to see some of what Hillary Clinton's thoughts, and her staff's, are, by viewing the actual e-mails at this site: http://www.mostdamagingwikileaks.com.)

I sent a note recently to our clients reading in part, "...The market is steady because 76% of the volume is institutional -- Wall Street traders, pension funds, etc. No one (except the trial lawyers, of course) has contributed more to Hillary Clinton's campaign than Wall Street so it makes sense that they are cautiously optimistic that they'll get a win for their money.

"But what if? What if they are wrong and Donald Trump actually wins? I expect Wall Street will sell, sell, sell and I want to be ready if that happens. We're now marking time, in securities that are liquid and provide income, 'just in case.' If Ms. Clinton wins, the rally is likely to be underwhelming since most institutional money is already in the market. If Mr. Trump wins, we want to be there to pick the newly-low-hanging fruit. We'll see."

If you'd like to see my logic in thinking this might just happen, whether you agree or not, you are welcome to visit my new national and global affairs blog and look at the most recent entry, "Election 2016." You'll find it at jlshaefer.blogspot.com.

So -- the first Wednesday in November could prove to be a real yawner, or it could see a 500-point move (or moves) in one (or more) directions. I maintain this is no time to become overly fearful or overly excited about a particular sector or security but, rather, a time to do research and have cash ready to pounce upon any irrational over-reaction.

How, specifically, might the market landscape change based upon which of the two least popular/most voted for candidates becomes the next chief executive of our country?

In thinking about this, we may, thankfully, leave the realm of character and personality, and may consider instead the likely policy changes each candidate might pursue upon their election.

I have always made money buying the best gas & oil companies, along with their contractors and equipment suppliers, when they are really out of favor. I'd like to be able to do so again. But if Ms. Clinton ascends to the office, I may have to wait a while longer to buy them, as cheap may well become cheaper. She will likely advocate continuing subsidies for more solar and wind companies. The current administration's subsidization of solar and other renewable energy in the U.S. has totaled just under $200 billion the past 5 years. These subsidies have done little to increase the contribution of solar power to the grid as it is still expected to comprise just 0.6 percent of electricity generation this year.

These subsidies haven't done much to generate power; they have, however, increased the money sloshing around for "pay-for-play" favoritism. I imagine a Clinton presidency would continue the current policy of support for massive federally-funded projects. I would also want to consider that horizontal fracturing might be outlawed, and offshore and onshore drilling sharply curtailed. The Saudis would pay dearly to see such a scenario!.

If Mr. Trump is elected, who knows what will happen? He has exhibited a mercurial bent since the campaigning began (and long before.) But I believe he believes his own promise to put Americans back to work in real jobs again and therefore it is likely that we would see a resurgence in American gas and oil exploration and production, along with continued renewables research, in order to make America as energy-independent as possible while creating those jobs. This might not please Saudi Arabia quite as much. In this case, I would look to move into the best domestic gas & oil companies immediately, buying those most currently depressed with the best prospects for success. (Indeed we have already begun nibbling at Southwestern Energy (SWN)

In terms of another favored sector of mine, the banking, insurance and brokerage industries, we know that Ms. Clinton at least "says" she favors more regulation and wants to expand the long arm of Dodd-Frank even more intrusively. Given the funding she has received from Wall Street, we might take her instinct for more and more regulation and contrast it with the biggest firms' desire to see less regulation. It will be interesting to see which wins out, her public platform or private promises.

Mr. Trump, on the other hand, says he would shrink the reach of Dodd-Frank, but still believes that financial regulation of the biggest and baddest is necessary. For those who want to see the stock market as Big Casino, a vote for Ms. Clinton would likely be a vote for keeping low rates for longer. For those who would rather save than spend, an increase in rates would be most welcome. Mr. Trump is likely to appoint a Fed Chair focused on normalization of rates shortly after he enters the office.

Looking at another of my favorite sectors, healthcare, Ms. Clinton is a rock-solid advocate of the Affordable Care Act (Obamacare.) She believes more government intervention is the solution to its current ills and has said larger subsidies supported by taxpayers are necessary to make certain that everyone is covered, regardless of lifestyle, medical history, or personal provision for care. Managed care companies and hospitals would certainly like to see this, though Ms. Clinton's belief that firms that do the research, clinical trials, etc., like biotech and pharmaceutical companies, are merely price gougers. These firms are unlikely to do well in a Clinton presidency.

Mr. Trump has vowed to repeal Obamacare and shift more responsibility as well as funding to the states. Without Obamacare, the number of insured enrollees may drop - or rise, if the individual states do a better job of working with their own health care providers and insurers.

Under either president, I think healthcare firms have been hammered down enough over the past year (down 9.06% , more than any other sector) that smart selections among the various sub-sectors are likely to be profitable as long as we think as investors, not traders; months, not weeks.

Since health care has been so bloodied and battered this year, I'm considering placing a preliminary toe in the water. Here are two of my favorites…

An Opportunity in Generic Drug Firms?

According to the Generic Pharmaceutical Association, generic drugs account for 88 percent of prescriptions dispensed in the U.S.A. The industry has been consolidating over the past few years, led by Israel-based TEVA, which made a $40.5 billion acquisition of Actavis (ACT) from previous parent Allergan (AGN) just two months ago.

But now these purveyors of cheaper versions of patented drugs coming off patent protection have a new problem: U.S. prosecutors have just announced a comprehensive criminal investigation into suspected price collusion among some of the major generics manufacturers. The investigation began about two years ago and has now gone to a grand jury. The grand jury is being asked to decide if there is enough evidence that some senior executives agreed to raise prices on certain drugs to pursue formal charges. About two dozen generic drugs seem to be part of the inquiry. Firms receiving subpoenas include Mylan, Teva, Allergan, Lannett and seven others.

The DoJ must believe they have good reason to pursue; this isn't just a civil case where the perpetrators' companies are fined, penalizing mostly the shareholders. This one is a criminal investigation, which means they have had to gather enough evidence to get warrants from a judge and to ensure compulsory discovery of evidence. There is, apparently, a carrot offered along with this stick - an amnesty program for those willing to cooperate with the investigation.

It's likely that the first charges could be filed as early as next month. As the biggest generics firm Teva (TEVA,) in particular, may be on the hot seat. In May, Allergan received a DOJ subpoena requesting information about its generics business. As a result of its recent acquisition of Actavis, Allergan's potential liability has been transferred to Teva,.

This bombshell created panic selling of all these firms last week, yet there is no indication looking at the history of such investigations that criminal charges are actually warranted, that they will successfully prosecute and that the fines and other punishments would be enough to warrant the nearly 10% selloff in TEVA shares.

Without trying to second-guess DoJ's motives or the strength of its case, I view the opportunity to nibble at TEVA shares anytime I can get them below $40 a share a gift. While price-fixing schemes have been a top priority of the Antitrust Division, each company must still be presumed innocent until proven guilty. Even if charges are successfully filed and some firms found guilty, I don't think the best of these generics manufacturers will go much lower than they already have. Let's take a closer look at Teva as well as a non-generic, Novo Nordisk.

Teva Pharmaceutical Industries

We owned Israel-headquartered TEVA in our Growth & Value Portfolio years ago before the health care sector went into, first, a fearful reaction anticipating what the passage of Obamacare might do to these shares, then a full-fledged rout as the reality of how bad those effects would be. Here's what I like anew about TEVA at these prices:

First, they are the biggest fish in this rather large and growing pond. Acquiring Actavis (and selling off some other UK and Irish holdings in order to get EU approval for the Actavis deal) may bite them in the short term if there was any price-fixing before the takeover but long term, the buy solidifies TEVA's #1 position worldwide.

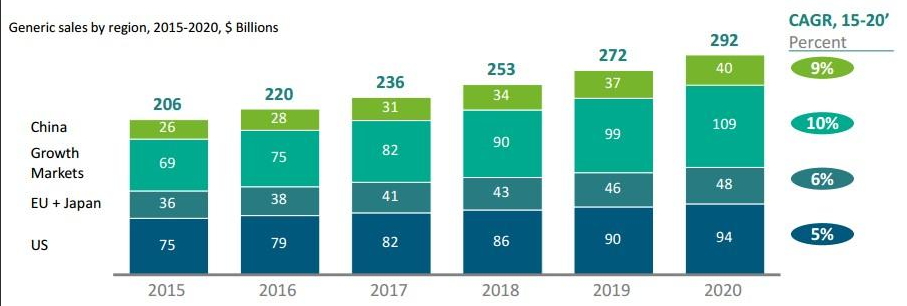

Second, no matter what the short-term results are of the DoJ probe, let's be realistic: generic drugs, at 88% of all prescriptions filled, are part of the solution to rising healthcare costs, not part of the problem. As the biggest in the business, TEVA has the research depth, manufacturing prowess, and economies of scale to outperform the rest of the generics marketplace. Their chart above shows where TEVA sees the coming growth in the generics market - and has positioned itself to dovetail perfectly with these trends.

Next, it is important to understand that TEVA's expansive and cutting-edge research laboratories allow them to be more nimble than its many competitors; more often than not they will be the "first-to-file" when a popular or important drug goes off-patent. In the U.S. alone, TEVA has more than 300 current generic filings with the FDA, the majority of which are so-called "1st Wave" opportunities while an additional third are even more coveted "first to file" generics. The FDA has made its view on first to file generics clear, indicating that it considers such applications "public health priorities" that are deemed important because they are "increasing patient access." These filings the FDA tries to provide a decision on within just 15 months. TEVA is targeting 80 new generic applications in the USA for 2017.

Part of TEVA's strength comes from the integration of their various pieces. This company is not "just" a quick and capable generics manufacturer. They also have developed their own specialty pharmaceuticals that, ironically, they must defend against their fellow generics makers as well.

In fact, TEVA currently gets almost 50% of its revenue from its Specialty Pharma business and the biggest chunk of that comes from the company's MS drug Copaxone. A number of competitors are clamoring to create their own generic version of Copaxone. Even if they were to succeed, however, it is unlikely TEVA would face generic competition until at least sometime in 2018. It will take that long, after a court decision is rendered, for competitors to get their own product FDA-approved. By then I think that TEVA's other products in their Specialty Pharma pipeline, like their joint venture with Regeneron for a promising osteoarthritis and chronic back pain drug, will have come to the fore.

This research and development capability allows TEVA to understand first-hand the process of ethical drug development and to see their world from both sides of the fence.

Finally, TEVA sets itself apart by what they have dubbed "New Therapeutic Entities" by which they create entirely new treatment modalities based on existing drugs. An example:

A subsidiary of Johnson & Johnson (JNJ) makes Risperidone, used to treat schizophrenia, bipolar mania, and autism. Schizophrenia affects more than 20 million people. Antipsychotics like Risperidone are generally effective for the treatment of schizophrenia, however -- 75% of patients are non-adherent to treatment within 2 years The economic burden of relapses and re-hospitalizations in US alone is north of $62 billion.

The reason for non-adherence is likely because it is too difficult to keep up with given current modalities. Current treatments require that the patient visit their doctor or clinic every two weeks, where 17 reconstitution steps are needed to prepare an injection, which must be delivered intramuscularly. TEVA's answer? They are currently developing Resperidone LTI (Long-Acting Injectible) which allows extended release of the drug which lasts 3 months, requires minimal reconstitution to create in the doctor's office and is delivered subcutaneously rather than via intramuscular injection.

Taking steps like this that could save up to $60 billion (just in the USA alone) is why I continue to believe that the health care sector is worthy of our investment dollars.

P.S. I don't have the medical knowledge to comment on each and every twist and turn in FDA filings and relative merits of various drugs or claims and challenges to or by TEVA and its competitors. But if you are particularly interested in this level of detail, Vivian Lewis, editor of Global Investing (global-investing.com) offers a subscription-based daily blog featuring dozens of foreign-based securities. She follows TEVA, and many others, on a far more frequent basis than anyone I know.

And Now, the Non-Generic Health Care Company

Credit where credit is due: Vivian Lewis and I have both owned and recommended TEVA for many years, she continuously and I only when I felt it offered particularly compelling value. But Novo Nordisk (NVO) has piqued my interest because of her devotion to and analysis of the company and its future prospects. All research that follows is solely my own responsibility, however!

Novo Nordisk is a multinational company headquartered in Bagsvaerd, Denmark (a suburb just outside Copenhagen) that employs more than 42,000 employees in 75 countries around the globe. NVO is the #1 obesity and diabetes care company on the planet. Their other areas of expertise and revenue include hemophilia, growth hormone therapy, and hormone replacement therapy, but diabetes care still comprises more than 80% of NVO's annual revenues.

The reason why Novo has sold off to its 52-week low most recently is mostly that Bernie Sanders and some others in Congress are asking for a DoJ investigation into price-fixing of insulin prices by a number of insulin makers. I'm not sure why the #1 company would want to collude with its lesser rivals, but then one never knows whether these bombastic diatribes have any evidence behind them or whether they are purely for political grandstanding. Please note that there is no ongoing investigation that we know of; it is merely the threat from some members of Congress that, in light of Mr. Sanders and Ms. Clinton's portrayal of all health care sector firms as bogeymen, has sent stock prices of the entire industry down.

Certainly the reason wasn't that sales and earnings are in trouble: they were both up this quarter. The company did, however, caution that the expected revenues and earnings, in the various local currencies they do business in, to be lower in the coming quarter. More likely, Novo's shift to greater R&D spending rather than resting on their laurels with current products has some analysts concerned (as analysts always are) about the next 12 weeks. They should be. Novo is taking a giant step forward that may cost them in the short term.

Managed care providers and others in the prescribing and paying chain are simply not willing to pay a penny more for drugs that barely improve efficacy. They are looking for leapfrog improvements. Novo's response has been to apply a much higher threshold for new diabetes products and to heighten its focus on related medical issues like cardiovascular disease and chronic kidney disease.

As part of this change, NVO is dropping any further research into their oral insulin project, which they now describe as "not commercially viable in the increasingly challenging payer environment." Instead, they have redoubled their efforts in the much more promising Oral GLP-1 diabetes treatment. We know that obesity management can be used to delay or even prevent pre-diabetes and type-2 diabetes. However, it's often simply not possible for the obese to lose weight on their own through diet and exercise. Novo's GLP-1 medications, including oral semaglutide, have been shown to be effective at aiding in weight loss. This alone could be a serious contributor to Novo's new revenue stream. Not to mention that oral GLP-1 has shown very early signs of possibly being effective in treating both cardiovascular and Alzheimer's diseases.

Add to this Novo's FDA approval this year for its new long-lasting insulin Tresiba. That puts Novo yet another step ahead of its nearest competitor. The company has filed for regulatory approval of faster-acting insulin in the US and the EU for the treatment of type-1 and 2 diabetes as well as for Xultophy, which lowers blood sugar. Milestones like these continue to lengthen the distance between Novo and its competitors and indicate a bright future.

The risks are there, of course, but Novo seems to have understood the risks and taken steps to address them. Those risks include a stagnant pricing posture for current insulin as more biosimilars come to market, lower margins on oral insulin, the need to secure higher-capability treatments, and the usual political kerfuffles every time a drug company saves the nation billions in health care expense and actually expects to be compensated fairly for their time and expertise.

I see Novo's risks as either known and being dealt with or, in other cases, of short-term interest only. The only thing that keeps me from buying both TEVA and NVO with both hands is the chance of a landslide victory by Ms. Clinton that also gives control of both the House and Senate to those who share her beliefs. Many of these Congresspersons think a single-payer government health care plan reliant upon government R&D, shunting aside the contributions of for-profit competitors, is best for the nation.

Even then, I think TEVA and NVO will do quite nicely beyond US borders. Still, I'm holding fire for the most part. While I'm happy to own either of these fine companies at their current prices, I'll be even happier if I can buy them for less. The odds of a stacked Senate and a stacked house are remote, but just in case...

The reason I prefaced my remarks about these two fine firms with a political analysis of what might result for them is because - you're darn right politics affects our investing decisions. Let's just hope they don't muck it up too badly.

In summary, if Mr. Trump should pull off a win, I would expect everything in the U.S. markets to plunge briefly as Wall Street realizes their bull has been gored. As a result I'm holding off buying, hoping for an even better entry point, until Wed, Nov 9 anyway. But I do believe that some energy and many financials are the best place to be in the longer run after the election, with health care added if the House and Senate remain independent bodies from the executive branch. I Even so, I will be a buyer of TEVA below 35 and NVO below 30.

What I will buy right now, today. are three floating rate mutual funds. Whoever gains the presidency, rates will rise. After considerable research, I conclude that Federated Floating Rate (FFRSX), T Rowe Floating Rate (PRFRX). and Lord Abbott Floating Rate (LFRAX) are the best in the sector, with Invesco Dynamic Credit (VTA) and First Trust Senior Loan (FTSL) the two best ETFs. I have seen nothing to convince me that "passive investing" via ETFs performs better in down markets than active intelligent investing, so I suggest the mutual funds most highly. We are now buying all three mutual funds for ourselves and our clients who seek income.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they ...

more

thank for sharing

Thanks for sharing