Bitcoin, Ethereum ETFs Face December Pullback With $1.13B In Outflows

Image Source: Unsplash

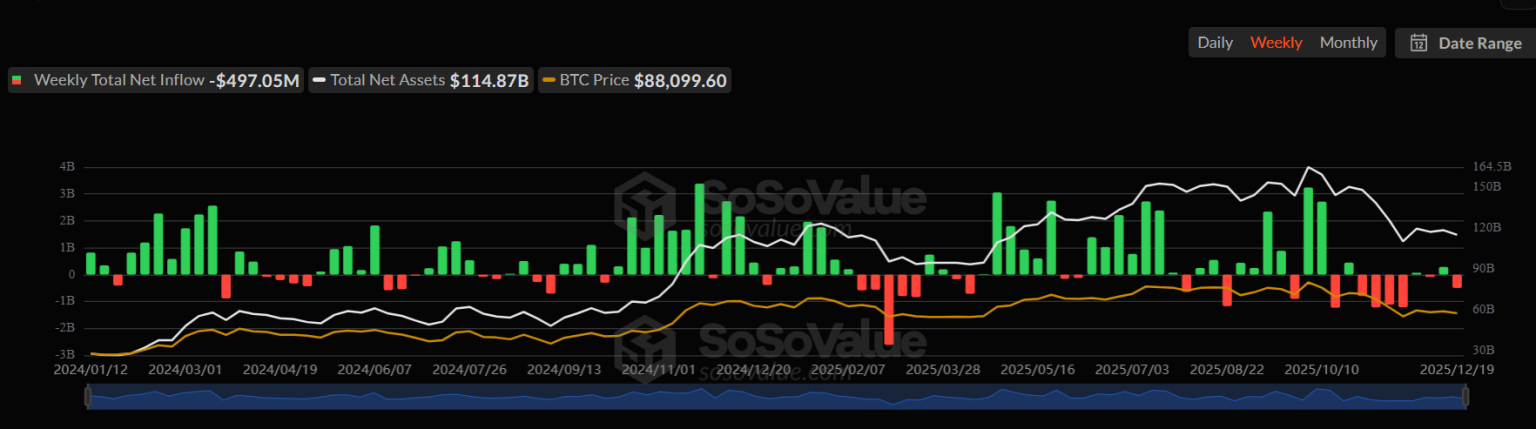

Yet another stark reality check for crypto investors unfolded last week. After the early December rollercoaster of ETF flows, the market had seen a modest recovery of roughly $465 million across Bitcoin and Ethereum ETFs in the two-week stretch ending December 12, 2025.

That rebound, however, proved short-lived. The mid-December period, from December 15 to 19, 2025, saw U.S.-listed Bitcoin and Ethereum ETFs face a fresh setback, recording net outflows of approximately $1.13 billion, as top funds including BlackRock, Bitwise, and Ark posted the largest withdrawals.

Bitcoin ETF weekly flow summary

(Top issuers—Dec. 15–19, 2025)

| ETF Issuer | AUM (US$) | Inflows (US$m) | Outflows (US$m) | Net Flow (US$m) |

| BlackRock (IBIT) | $69.95B | 144.0 | -384.3 | -240.3 |

| Fidelity (FBTC) | $18.42B | 433.5 | -400.4 | +33.1 |

| Bitwise (BITB) | $3.52B | 0 | -115.1 | -115.1 |

| Ark (ARKB) | $3.42B | 0 | -100.7 | -100.7 |

| VanEck (HODL) | $1.47B | 0 | -39.2 | -39.2 |

| Grayscale (GBTC) | $14.99B | 0 | -27.5 | -27.5 |

| Grayscale (BTC) | $4.39B | 0 | -7.4 | -7.4 |

Total Inflows: ≈ $577.5M

Total Outflows: ≈ -1,074.6M

Net Flow: ≈ -$497.1M

Bitcoin ETFs saw a broad pullback after early December optimism. BlackRock’s IBIT was the largest contributor to outflows, losing $240.3 million, while Bitwise and Ark combined for –$215.8 million. Fidelity’s FBTC was a rare bright spot, posting modest inflows of $33.1 million, an unexpected performance despite the huge outflow of other big firms.

(Click on image to enlarge)

Source: SoSoValue

Ethereum ETF weekly flow summary

(Top issuers—Dec. 15–19, 2025)

| ETF Issuer | AUM (US$) | Inflows (US$m) | Outflows (US$m) | Net Flow (US$m) |

| BlackRock (ETHA) | $7.92B | 0 | -558.1 | -558.1 |

| Fidelity (FETH) | $1.87B | 0 | -16.7 | -16.7 |

| Bitwise (ETHW) | $602.4M | 0 | -13.0 | -13.0 |

| 21Shares (TETH) | $1.11B | 0 | 0 | 0 |

| Grayscale (ETHE) | ~$2.9B | 2.7 | -35.1 | -32.4 |

| Grayscale (ETH) | ~$2.3B | 2.9 | -20.2 | -17.3 |

Total Inflows: ≈ $5.6M

Total Outflows: ≈ -$649.5M

Net Flow: ≈ -$643.9M

Ethereum ETFs were hit even harder last week. BlackRock’s ETHA alone accounted for the bulk of outflows at –$558.1 million, while Fidelity’s FETH saw –$16.7 million leave and Bitwise’s ETHW recorded –$13.0 million. Smaller ETFs, such as 21Shares TETH, remained flat with no flows, while modest inflows into Grayscale’s ETHE ($2.7 million) and ETH ($2.9 million) barely offset the negative momentum.

(Click on image to enlarge)

Source: SoSoValue

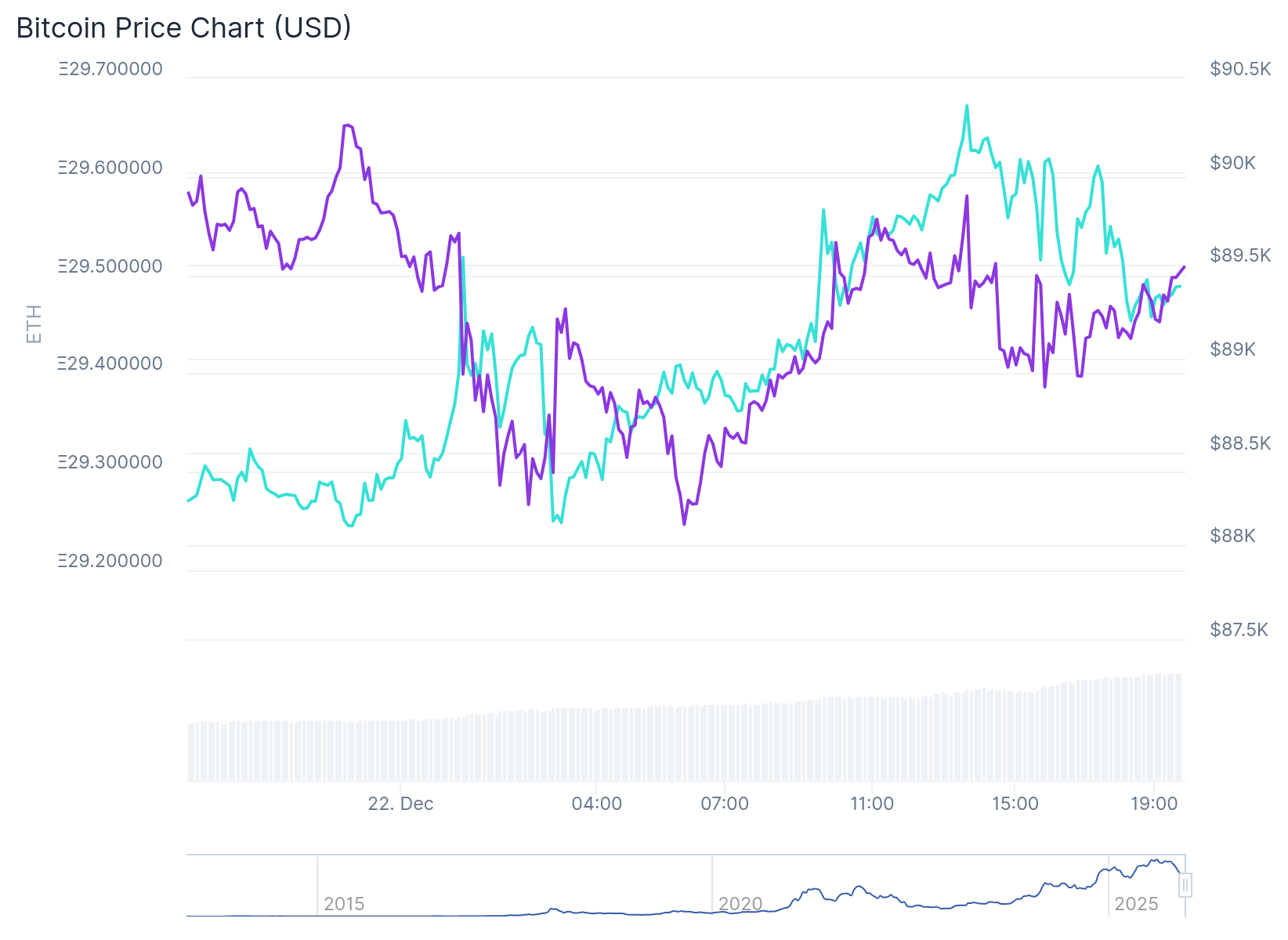

Mid-December Profit-Taking Sets the Tone for BTC & ETH

After a strong rebound in early December, last week saw some ETF outflows as investors took profits and pulled back from high-cap crypto positions. Bitcoin and Ethereum prices responded accordingly. BTC drifted below $90,000 after briefly testing $94,000, while ETH hovered near $3,200.

(Click on image to enlarge)

BTC and ETH Chart Source: CoinGecko

The mid-December pullback suggests investors are reassessing allocations, particularly in large, liquid ETFs such as BlackRock’s IBIT and ETHA. While smaller ETFs like Fidelity’s Bitcoin fund saw inflows, the overall trend shows a consolidation phase rather than a surge in investor activity.

Looking forward, a combination of macroeconomic factors and market sentiment may continue to determine whether ETFs can regain momentum.

More By This Author:

Will The Bull Market Continue To Charge In 2026?

The Top 3 Stocks Of 2025

Will 2025 End With A Santa Claus Rally?