Bear With Us?

Bear Market Or Rebound?

In a previous post, we looked at a way to hedge investments you already have, but a reader asked about putting new money to work in this market. A challenge with that, of course, is we don't know if this will turn into a bear market, or we're set for a rebound. So our first suggestion would be to take whatever dollar amount you were thinking of putting to work now, and split it in half. That way, you can put half to work now, and then put the other half to work in a couple of months, when the market direction might look clearer. So what to do with the tranche you're putting to work now?

Janko Ferlic/Pexels

Building A Bear-Proof Portfolio

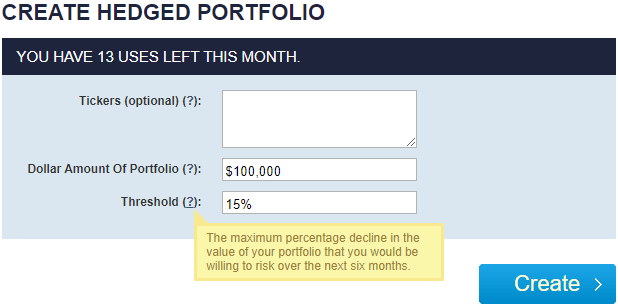

Our approach to investing in a state of fear is to buy likely winners and hedge away the fear. Here's an example, followed by an explanation. Let's say that you have $200,000 in cash you want to put half of it to work now, but you aren't willing to risk a drawdown of more than 15% over the next six months. If you indicated that in our hedged portfolio construction tool on Tuesday,

This and subsequent screen captures are via Portfolio Armor.

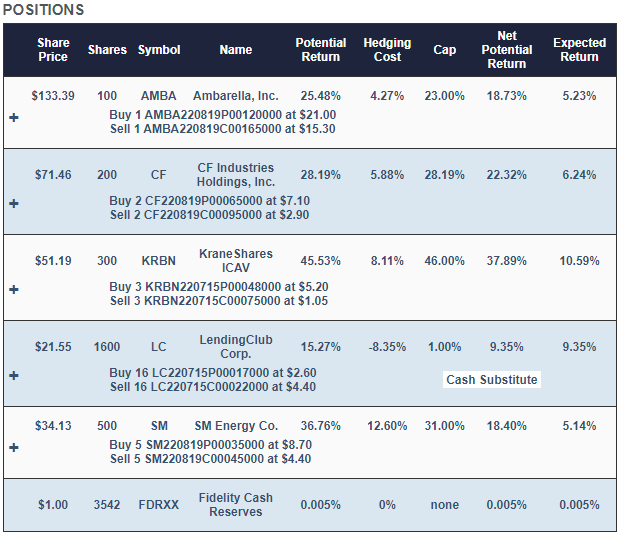

This is the portfolio it would have presented to you.

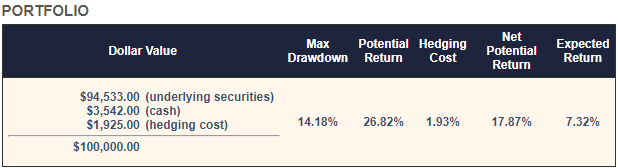

With this, your maximum drawdown over the next six months--that is, if every underlying security went to zero--would be a decline of 14.18%. Your best-case scenario would be a gain of about 18%, and your expected return (a more likely scenario) would be a gain of a bit more than 7% in six months.

Why These Stocks?

Each trading day, our system analyzes total returns and options market sentiment to estimate potential returns for thousands of stocks and ETFs. The chipmaker Ambarella (AMBA), the chemicals company CF Industries Holdings (CF), the oil & gas E&P SM Industries (SM), and the carbon capture ETF KraneShares ICAV (KRBN) were selected because they were among our top names: the ones that had the highest potential returns, net of hedging costs. Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged LendingClub Corp. (LC) position, to further reduce hedging costs.

Why Those Hedges?

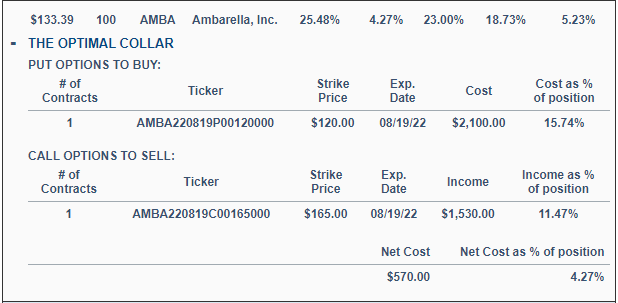

On our website, if you click the plus signs in the portfolio above, the positions expand to give you a better look at the hedges. For example, this is what the AMBA position looks like expanded.

AMBA was hedged with an optimal, or least expensive, collar, as were all of the other positions, in this case. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a previous post: When To Hedge With Puts Versus Collars.

If This Does Turn Into A Bear Market

If this turns into a bear market, your downside will be strictly limited with the portfolio above. Our system's universe includes inverse and bearish ETFs, so when it's time to put the second half of your money to work in a couple of months, if we're in a bear market, your portfolio may include some of those. Of course, each position will be hedged, in case the market reverses while you're holding them.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more