As Rare As The Loch Ness Monster, Equities At A 10 P/E

“Nessie.” That’s the nickname for the lake-living, reclusive beast that has lured spellbound tourists to a fabled Scottish lake—Loch Ness—for decades. This raging stock market has gotten to such a point that you could be forgiven for thinking the Loch Ness Monster hoax is more believable than claims of spotting a low P/E equity basket these days.

By and large, there is not much you can do if you want a really low P/E in the U.S.—not with the S&P 500 Index loitering around 3,800, its forward P/E at 23.

To get there, you might consider turning to emerging markets (EM).

We have a couple of Funds that own a bunch of inexpensive stocks, the type of Funds you might own when you are decidedly bulled up on value relative to growth.

Here are two of our deepest value ideas: DGS, The WisdomTree Emerging Markets SmallCap Dividend Fund, and DEM, The WisdomTree Emerging Markets High Dividend Fund.

If you think 2021 will witness stocks with no dividends winning again, you don’t want these. But if you are scouring the landscape for companies with low multiples, these are the two Funds to investigate.

Note the return on equity (ROE) percentages in figure 1. Pretty good for EM value, right? Both DGS and DEM are higher on that measure than the MSCI Emerging Markets Index, with notably lower P/Es. Additionally, the dividend yields are several percentage points higher than the 1.55% of the S&P 500.

Figure 1: DGS & DEM’s Valuations

For standardized performance of the Funds mentioned in the table please click their respective tickers: DGS, DEM.

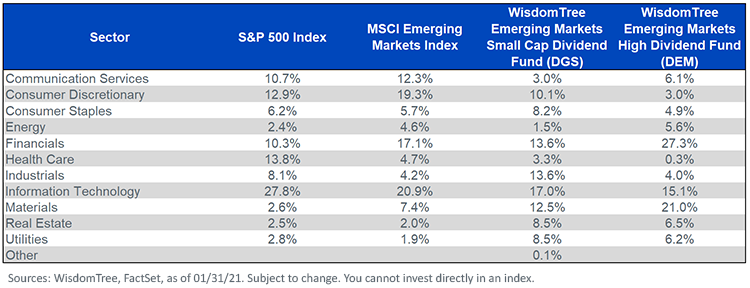

Like your search for Nessie or Bigfoot, you could be looking for a long time if you expect to stumble upon big slugs of Tech or Consumer Discretionary in DGS or DEM. These are reflation-based Funds that are overweight Basic Materials and Real Estate (figure 2).

Figure 2: Sector Weights

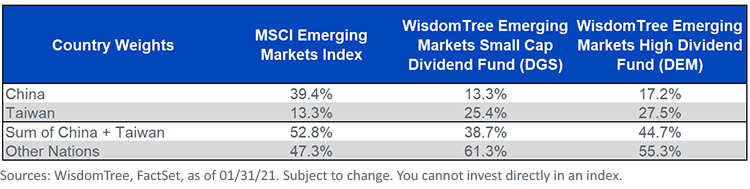

Another thing: DGS and DEM are underweight China (figure 3).

Figure 3: China + Taiwan in DGS & DEM

If you are bullish on China relative to the rest of EM, then look away from DGS and DEM and toward something like the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE), which has more in that country.

For the rest of you, guess what, value hunters content with an underweight in China, guess what? Unlike Nessie, DGS and DEM do exist.

Finally, to reiterate a critical argument: look again at the ROEs in figure 1 on DGS and DEM. That profitability measure is a touch lower than the S&P 500for both DGS and DEM, yet the two Funds trade at 10.1 and 8.4 times forward earnings, respectively. In 2021, those multiples could be about as rare as a Bigfoot sighting.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more