Apache Corporation - Vpa Stock Of The Week

Yesterday’s very modest reduction in US inflation may have given the market a bit of a lift but we still have the PPI today and the PCE (the Fed’s preferred inflation metric) later this month. However, as the saying goes, ‘one swallow does not a summer make’.

Meantime, it is the energy sector (XLE) that continues to be the best performer YTD despite two sharp recent sell-offs, and yesterday’s large build in the oil inventories at Cushing does not seem to have dented the WTI June contract either which is back at $103 per barrel at the time of writing. In my April post on the XLE, I mentioned this month should see an increase in supply from OPEC along with the oil from the US Strategic Reserve in the hope this will reduce the cost of gasoline for consumers which in turn will feed into the inflation data. However, the extent to which this will happen is debatable given that energy costs along with food are excluded from most inflation calculations as they are deemed ‘too volatile’.

For the XLE today the ETF continues to move away from the volume point of control which sits at $76 on the daily chart to briefly regain the $80 price point before falling back to the resistance at $78. This price action is not only reflected in a number of energy stocks including Exxon and Chevron which carry the two biggest weightings of the XLE but also Apache Corporation (AP) which accounts for less than 2% of the ETF!

But it is Apache Corporation (APA) that I want to focus on in this post as the daily, & monthly charts offer some great vpa lessons and insights into where this stock may be heading, and which also be applied to other markets and sectors.

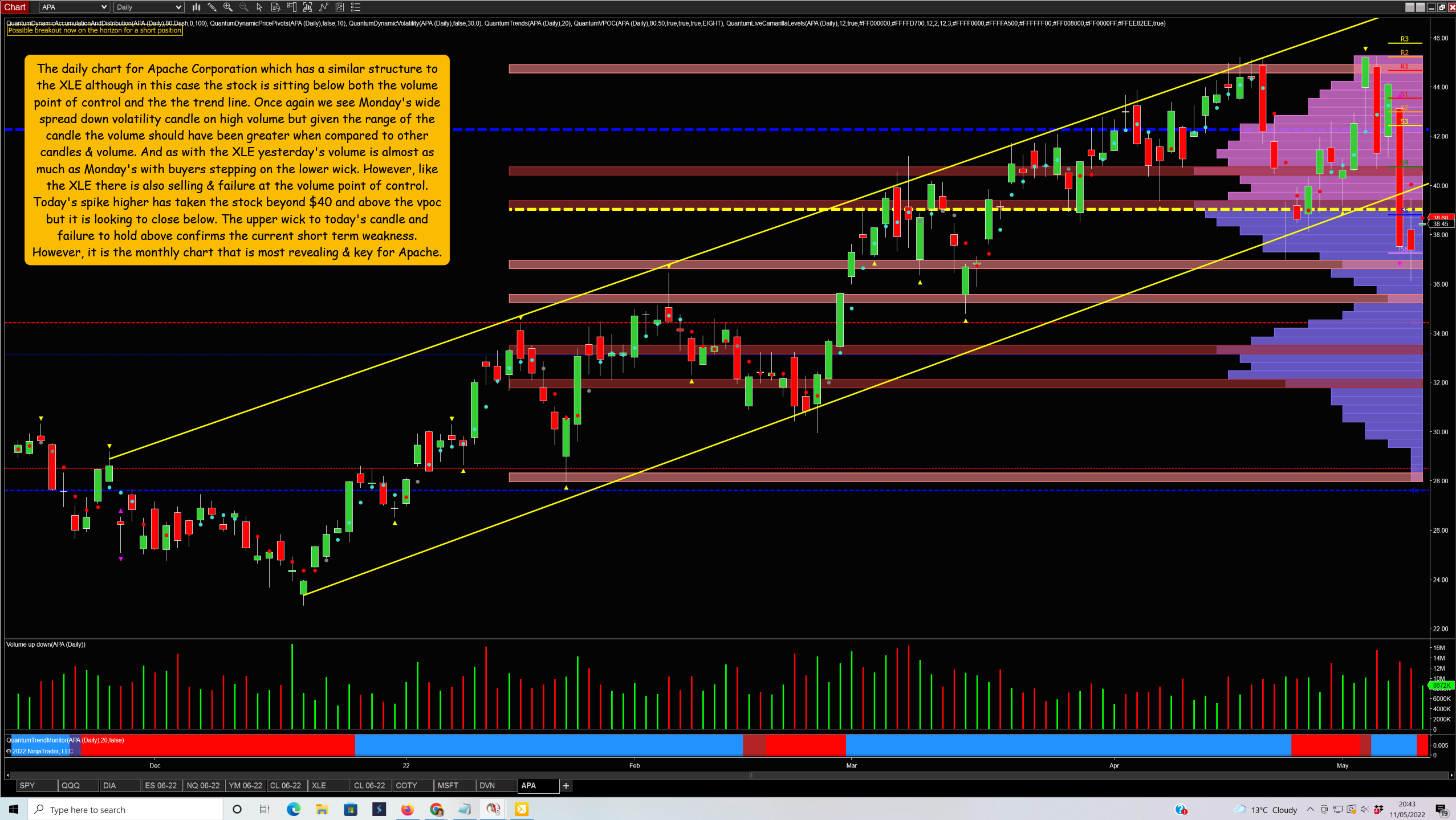

If we start with the daily chart we can see clearly how it mirrors the price action of the daily chart for the XLE with APA having a similar chart structure to the ETF.

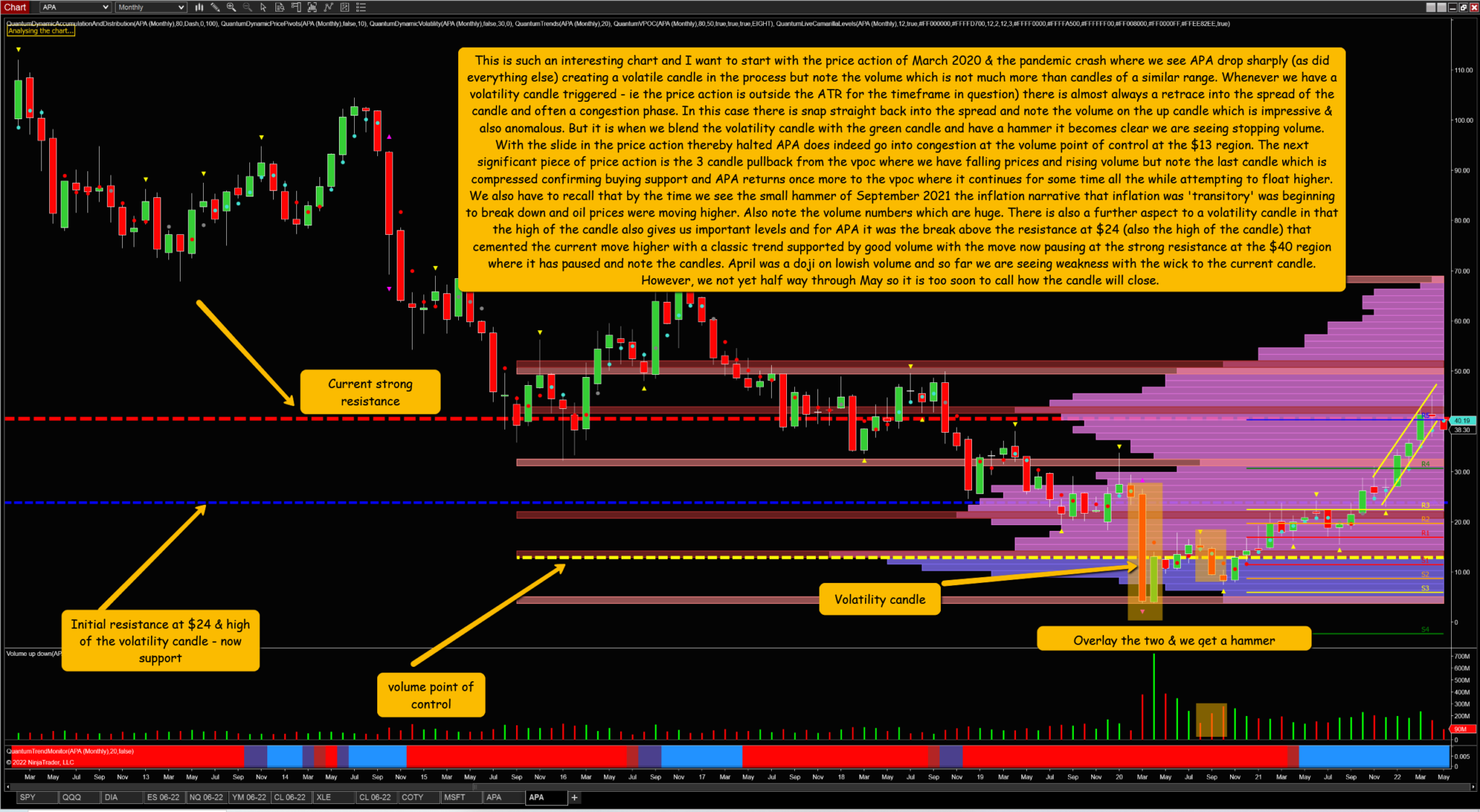

But it is the monthly which not only has some great vpa signals but is also highlighting why the stock is pulling back on the daily with the price action now paused at the strong resistance at the $40 region (red hatched line on the chart). Note too the density of volume resistance at this level as displayed on the volume point of control histogram which also suggests a period of consolidation is likely to follow for APA. If this happens and the histogram subsequently created is deeper than the current one at the vpoc the volume point of control itself will move up giving us a fresh fulcrum for this chart.

$40 is the level that needs to be taken out on good volume for APA to progress higher where the $50 price point awaits and thereafter $70, which is the December 2016 high.

From a fundamental perspective inflation concerns will continue to drive flows into the energy sector not only for returns but also as a hedge. Rising oil prices can only benefit oil stocks but increased supply and a reduction in demand owing to the high cost of gasoline will hamper any move higher.

As a company, APA is defined as a large-cap stock (over $10bn) and was first incorporated in 1954 and is very much on analysts’ radar with some expecting the stock to outperform the energy sector in the coming months. It also pays a nice dividend!

Charts courtesy of Ninjatrader.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more