Anticipation Builds

It’s a day that doesn’t begin with “S” which these days means that stocks are poised to open higher with the S&P 500 indicated to open up 0.25% while the Nasdaq looks likely to gap up 0.43% at the open ahead of what will be a big day for earnings as three of the megacaps – Microsoft (MSFT), Alphabet (GOOGL), and Meta (META) – will report after the close. Also, don’t forget today’s Fed decision at 2 PM Eastern.

With equities indicated higher, treasury yields have also moved higher, but at 3.99%, the 10-year yield remains below 4%. Crude oil prices are slightly higher, while gold has rallied more than 1%, moving back above $4,000 per ounce.

In Asia, most indices were higher as positive headlines emerged from the President’s trip to the region. Consumer sentiment in Japan came in higher than expected, but inflation in Australia came in unexpectedly high. All eyes in the region will now shift to tomorrow’s meeting between President Trump and Chinese President Xi after headlines this morning suggest that China has already placed soybean orders with American farmers, while the US is likely to reduce fentanyl-related tariffs. The positive tone in Asia made its way over to Europe as the STOXX 600 rallies 0.3% with the UK and Spain up more than twice that.

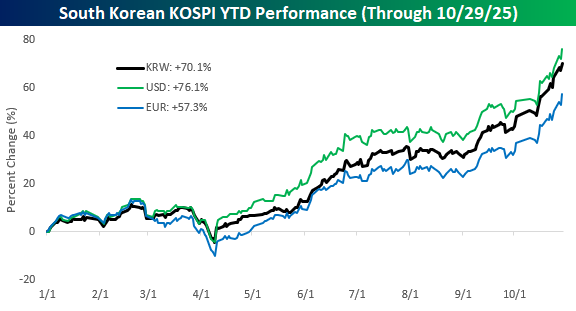

With Asian stocks mostly higher overnight, South Korea, after announcing a trade deal with the US, saw the KOSPI rally 1.8% to another in what has been a string of recent record highs. For the year, the KOSPI has now rallied more than 70%, which pretty much outdoes every other major stock market around the world on a YTD basis. Not only has the KOSPI rallied, but with its currency rallying against the dollar this year, from the perspective of a US investor, the gains are even greater at 76.1%. Even in euro terms, South Korean stocks are up over 57%!

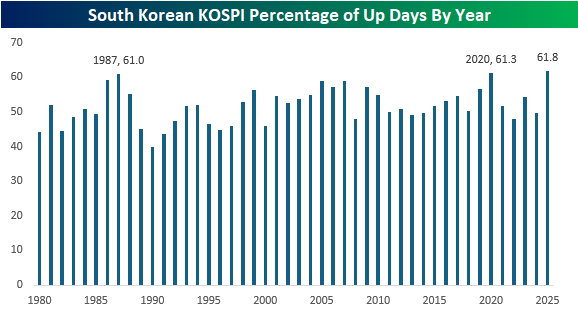

The gains in the KOSPI have also been consistent. Through last night’s close, the index traded higher on nearly 62% of all trading days, putting it on pace for the highest percentage of up days in a year on record. The only two other years when up days exceeded 60% were 1987 (61.0%) and 2020 (61.3%).

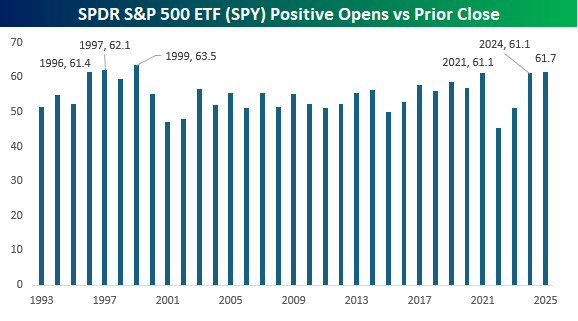

In the US, where we’ve seen strength this year has been at the opening bell. Just like today, the SPDR S&P 500 ETF (SPY) has gapped up at the open on 61.7% of all trading days. Since its inception, the only years with a higher percentage of positive gaps were 1999 (63.5%) and 1997 (62.1%), while 1996, 2021, and 2024 were the only three other years when SPY gapped up at the open more than 60% of the time.

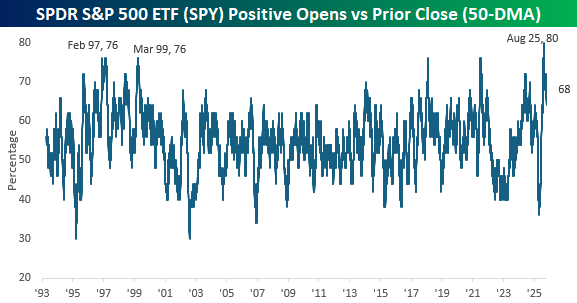

Much of the strength in SPY at the opening bell has come more recently since the tariff-tantrum. Over the last 50 trading days, SPY has gapped up at the open on more than two-thirds of trading days, and back in August, that percentage spiked up to a record high of 80%, exceeding the twin peaks of 76% from February 1997 and March 1999. What makes the current spike even more unique is the fact that it immediately followed a period of extreme selling at the open. Just as recently as this Spring, SPY gapped down on nearly two-thirds of all trading days, which was the lowest reading since December 2006.

More By This Author:

Strong Run Of Earnings ContinuesSmall Business Hesitation

Q3 Earnings Season Begins

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more