A New Way To Hedge Bitcoin Exposure

Ed Carpenter Racing's Bitcoin-themed number 21 Chevrolet from last spring's Indy 500.

Update On Our Hedgedable Bet On Bitcoin

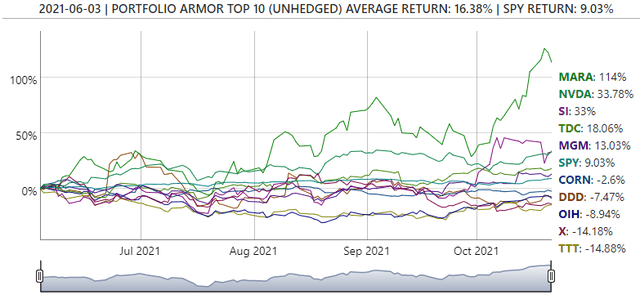

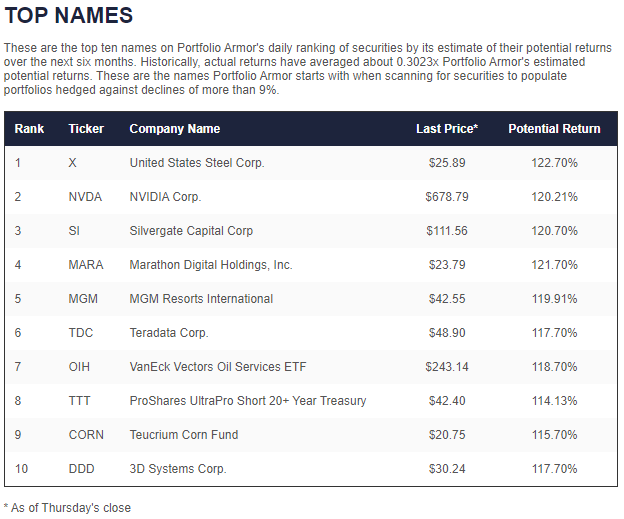

In a previous post, we mentioned that Bitcoin miner Marathon Digital Holdings (MARA) had been one of our top ten names over the summer.

Screen capture via Portfolio Armor on 6/3/2021.

Since then, it was up 114% as of Thursday's close.

A New Way To Hedge Bitcoin Exposure

In our last Bitcoin post, we mentioned MARA as a way to make a hedged bet on Bitcoin making new highs. Bitcoin has since made new all-time highs, but now there's a new way to make a hedged bet on Bitcoin or to hedge Bitcoin exposure. Options just started trading this week on the ProShares Bitcoin Strategy ETF (BITO). Below, we'll look at ways to hedge it, but first, let's address why you might want to hedge it.

Why Hedge If You're Bullish On Bitcoin?

In a nutshell, because Bitcoin is likely to have another steep pullback in the future, and if you own puts on the Bitcoin Strategy ETF when it tanks, you'll have the dry powder in the form of appreciated put options to buy more of the ETF, or more Bitcoin itself.

Finding Optimal Hedges On BITO

In the video below, we use our iPhone app to demonstrate how to scan for optimal hedges on the Bitcoin Strategy ETF.

Video Length: 00:06:23

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more