A Discerning Sell-Off

In listening to discussions over the market's reaction to the DeepSeek sell-off yesterday, the term "shoot first, ask questions later" came up repeatedly. However, in looking at the performance of various indices and individual stocks yesterday, the market's behavior looked more discerning than indiscriminate. At the individual stock level, most stocks in the S&P 500 finished the day higher, and the weakness was concentrated to stocks that have benefitted the most from the AI rally.

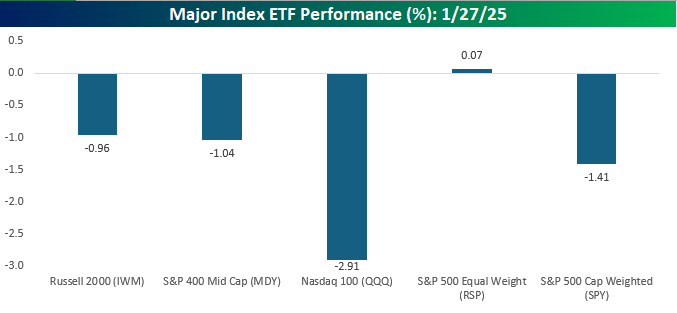

The chart below shows yesterday's performance of major US index ETFs. As you would expect, the Nasdaq 100 with its concentration in technology was the hardest hit, falling by close to 3%. The cap-weighted S&P 500 (SPY) also declined more than 1% given its large weighting in Nvidia (NVDA) and other tech companies. The equal-weight index (RSP), however, finished the day in positive territory with a modest gain. The one index where performance was not as we expected was in small caps where the Russell 2000 (IWM) also fell nearly 1%. On a day when mega-cap tech was crushed but the majority of large-cap stocks rallied and interest rates declined, we would have expected small caps to show more strength. Given the entire Russell 2000 is smaller than NVDA, it doesn't take much to get this area of the market to rally. Also, if DeepSeek means that the previous costs associated with adopting AI are now dramatically lower, shouldn't that be good for small caps which presumably have smaller budgets?

Looking at the performance of these major index ETFs over the last week, outside of QQQ, they're all still positive, even after Monday's decline. Additionally, they're also all trading right within the confines of their normal trading ranges (none are oversold or overbought) which is a level of homogeneity that it feels like we don't see much these days.

(Click on image to enlarge)

The Russell 2000's lack of a rally came within the context of a week-long period where IWM has been unsuccessfully attempting to break back above its 50-DMA. Yesterday marked the fifth straight day where it tested that level but failed to close above it.

(Click on image to enlarge)

The mid-cap ETF (MDY) finished well off its intraday high yesterday and also traded below its 50-DMA but managed to close the day just barely above that level.

(Click on image to enlarge)

The 50-DMA also acted as support for the S&P 500. After opening right at that level in the morning, the large-cap benchmark bounced throughout the session and finished at the highs of the session.

(Click on image to enlarge)

The chart of the Equal Weight S&P 500 (RSP) over the last few days looks similar to small caps with a tight range. The only difference is that, unlike IWM, RSP has closed above its 50-DMA for each of the last four trading days.

(Click on image to enlarge)

Finally, the Nasdaq 100 (QQQ) was the biggest pain point of the major indices. It started the session below its 50-DMA and made an attempt to rally back above that level intraday but came up just short by the time the closing bell rang. While QQQ failed to take out its December high in last week's rally, it did manage a higher high, and as long as yesterday's decline doesn't see much in the way of follow-through, it isn't in imminent danger of a lower low in the short-term.

(Click on image to enlarge)

More By This Author:

AI Infrastructure Stocks DropSluggish End To A Positive Week

Sentiment Swing

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more