9 Monster Stock Market Predictions For The Week Of July 11

I will be away this week, and my goal is to do as little work as possible, which is never an easy goal for me to achieve. So that means that unless there is drama going on in the markets, this commentary will resume next Sunday, July 17.

The job report on Friday was reasonably strong, with some divergent information from the establishment and household survey. The establishment survey showed substantial gains, while the household survey showed some job losses. The two surveys haven’t been the same since the pandemic. My focus of this report was wages, which remain above the 5% level. That is the Fed’s focus, and this week’s CPI data will be critical.

CPI

Headline CPI is expected to rise by 1.1% month-over-month, higher than last month’s 1%. Meanwhile, CPI year-over-year is estimated to have increased by 8.8%, higher than the previous month’s reading of 8.6%. Last month’s CPI reading led to a significant drop in the markets, and generally speaking, the markets this year have found themselves lower in the days following the CPI report.

VIX

The VIX may be the key to watch this week. The index is back to its recent lows and is in the same spot it was in heading into the CPI report last month. On June 9, the VIX started spiking as traders started hedging positions going into the report.

VVIX

But the tell that something was changing came the day before, on June 8. The VVIX measures the implied volatility of the VIX. The VVIX started spiking on June 8, indicating that implied volatility levels in the VIX were rising. The VVIX is now lower than it was on June 8, and if that starts spiking on July 11, that may be the first clue that this little rally we had last week is about to be over.

S&P 500 (SPY)

The S&P 500 finished Friday down 8 bps, but a lot of implied volatility was burned to hold the index flat. The index had fallen around 85 bps to start the day, but it was able to rally due to puts being burned up all day and losing value. The chart below shows the implied volatility for the July 11 S&P 500 3900 put. There was a consistent decline in the IV starting at 8 a.m., resulting in the price of the option declining.

Additionally, implied volatility has been dragged lower by a consistent decay in realized volatility over the last few days. But the five- and 10-day realized volatilities are now back to the lower end of their ranges and have “reset,” which means the move lower in implied volatility is probably over or close to it.

Watching the VVIX is probably the best way to track where this market is going. You can see that VVIX was pushed steadily higher into the close on Friday.

The S&P 500 appears to be ready to roll over as well. The index closed on an uptrend and appeared to form a double-top pattern. You can also see that the index is back to the long-term downtrend that served as strong resistance in the CPI report in June.

The first reasonable spot to look for on the downside comes at a gap of around 3,850. A break of 3,850 can lead to a drop to 3,740, then 3,675.

Real Yields (TIP)

The TIP ETF remains a must-watch and is close to a new closing low as of Friday. If the TIP ETF makes a new low this week, the QQQ ETF shouldn’t be far behind. The two diverged last week, but I don’t see how that divergence can last much longer.

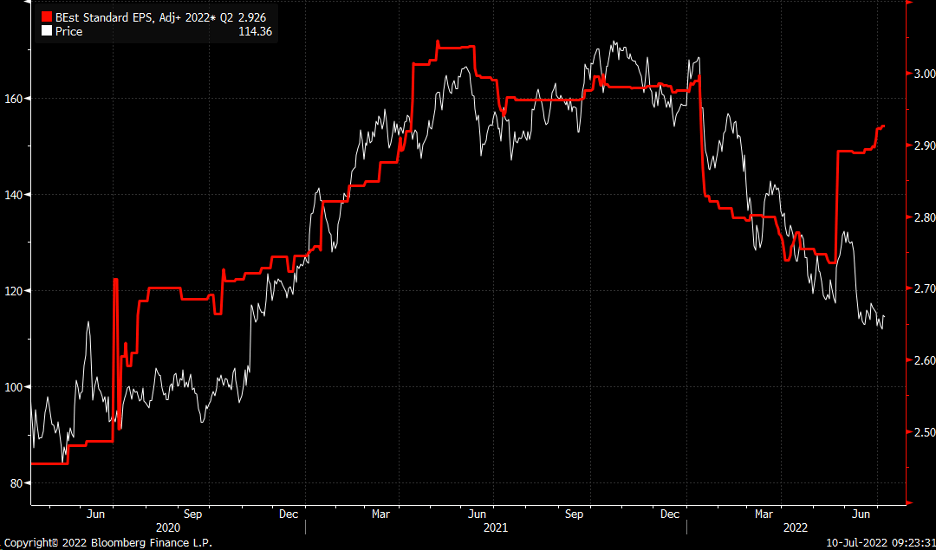

JPMorgan (JPM)

The banks are due to report results this week. JPMorgan kicks things off on Thursday. Analysts have been increasing their estimates for the company’s second quarter earnings. Indeed, this will be making things much more challenging for the bank because there will be no low bar for the company to beat. Even worse, the whisper number is for $3.06 in earnings.

Nvidia (NVDA)

Nvidia has more downtrends than I can count, which isn’t even including the downtrend in the RSI. All you have to do is look at the pricing of their GPUs falling off a cliff to understand why this stock is dropping and why a retest of $136 is probably coming.

Gold (GLD)

Sometimes I get asked about gold, and I never have anything good to say. It did break below a significant uptrend, and I don’t think much is stopping this metal from going back to $1,675.

Home Depot (HD)

I had seen some big bearish bets in Home Depot last week. The stock has held up so far, but the region between $285 to $290 will be telling. If the stock stays below that region, bearish bets will probably prevail, with the stock going below $250.

More By This Author:

Stocks May Plunge Following June Jobs DataRates And The Dollar Rocket Higher On July 6

Stocks Dump Then Jump On July 5 As Recession Fears Rise

Disclaimer: Charts used with the permission of Bloomberg Finance L.P.This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a ...

more