Market Briefing For Tuesday, March 10

Panic in 'real life' situations vary - from total irresponsibility, to wisely empowering survival, depending on a situation. 'Situational awareness', in our case, has driven both our 6th sense (a sort of a sum-total of life experiences) about the market rising earlier in the year, based on seasonal retirement funds augmented by viral-fear-money flows from Asia, that contributed to the S&P holding up through January as we had anticipated, and (regardless of anything else), facing February risks.

Strength in the market, assuaged by absurd rationalizations elsewhere, masked what we said at the time was buying resulting ironically from the panic related to coronavirus (which is Covid19, C-19, or WuFlu as I tend to alternatively call it), and hence was a sucker rally to get investors into a market headed for problems in February regardless of the impact of the virus, which we thought was 'out there'.

It was that 6th sense perhaps that caused me to share preparations for a potential spread to Europe and the United States, that triggered lots more than advising a defensive stance as I did, but personal preparations that a few called 'alarmist', as I shared precautions taken like ordering N-95 respirators with the relief valves, as well as nitral gloves, and mentioning that normal 'swimming pool' partial face masks (eyes only) would suffice along with (another unique idea) my Apple AirPod Pros (turning off noise cancellation with no audio playing allows hearing with some protection).

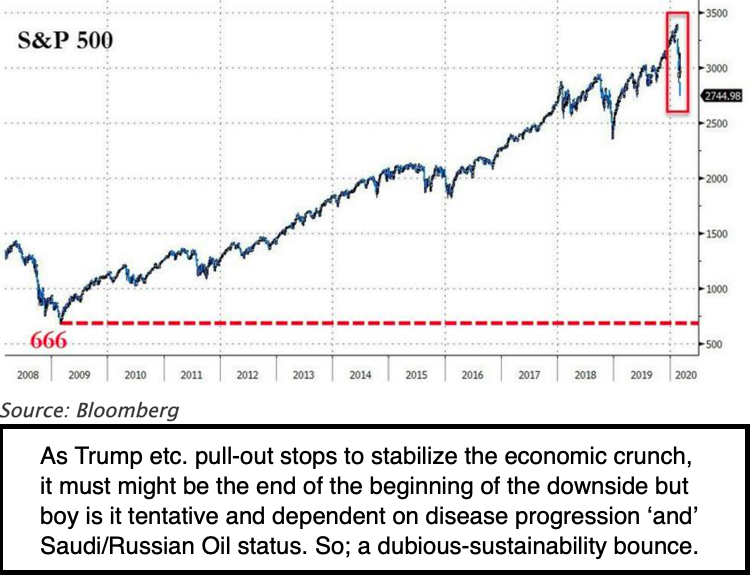

Now we have the biggest single day DJIA (DIA) decline as the projected break of prior lows occurred; with the oil (OIL) price massacre creating more than the market influence, but vast political implications with us and the Saudi's for that matter (although the primary tension is Saudi vs. the Russians, Putin fuming over being outflanked by Riyadh). It all looks so awful to the many who were optimistic in the past six weeks, that maybe it will bounce, but if so I doubt it will hold, payroll tax cut or not.

Ignorance is bliss, until it isn't..

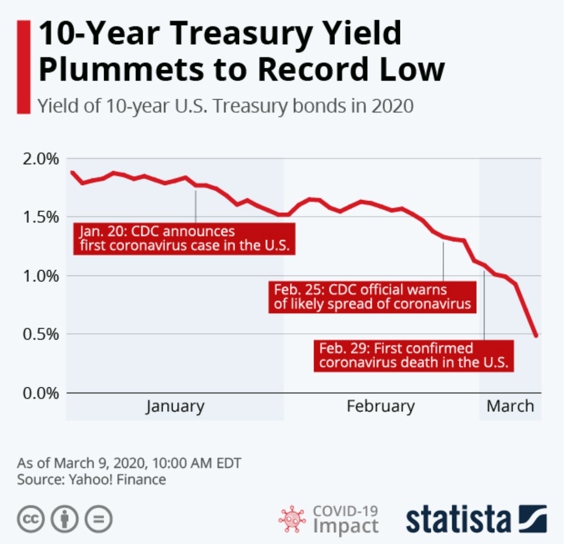

Concurrently believing the 'all is well, live life as usual', as polyannish or denial, we thought all that was necessary in February was to watch South Korea or then Italy, to see how well limited containment efforts worked, of course unfortunately not well. Why should anyone believe that a Friendly Fed or fiscal stimulus would do much, even if they helped stabilize some aspects; short of a crush on small businesses, which are in big trouble.

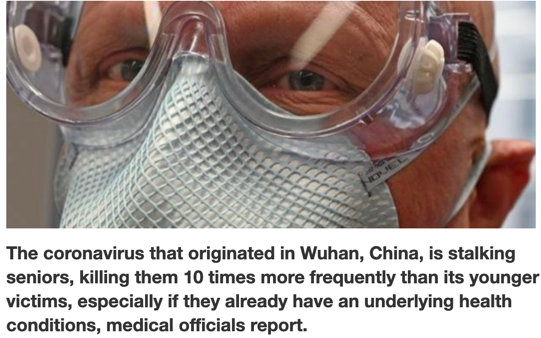

People are frightened, and rightfully so. The virus is and has been on the rise and spreading faster than most people, including some doctors, are willing to realize. Others are candid enough to recognize we don't know in a sense how exposed the United States genuinely is. Odds are serious. It is unfortunate, but awareness of epidemiology sadly suggests 2-4 weeks from now will likely find the US in a situation like Italy faced by stalling for a couple weeks before truly shutting-things down (which might have had a better shot at 'real containment' if it was done instantly during the Milan Fashion Week), when airlines cut flights quickly, but nevertheless exposed other countries as visitors to the Show returned home, carrying the virus.

Essentially it's not just our President being out-of-line with science, but as he tries to walk the fine-line between reassurance to avoid panic and the behind-the-scenes awareness of how bad this could be, it's a disservice to avoid transparency or urge excessive calm, in some ways. The stance in Beijing of 'return to normalcy' is premature by the way, while we've not even gotten to the point of sufficiently drastic quarantines to really effect the communicable disease spread approach exponential spread levels.

Panic, not comfort, is actually what is needed. Learn from Rome's moves, belated as they are, rather than somehow expecting that 'doing the same things others have done' will most likely yield similar results. Hence that's a declaration of recession (we're already in), not nonsense about growth that's not going to occur for awhile. However, progress towards treatment or a vaccine (we need both, the former more urgently than the latter) can change the market's response to all this, once they are 'recognized' as a viable efficacious pathway to protecting the society.

Hence, the broader availability (even now not yet) of WuFlu testing will be a shocker to many Americans, some of whom still embrace the nonsense of C-19 being an influenza, which it's not. It's really a plaque that most do survive, but can be extremely widespread on a societal basis, because it is mild in a sense for most. (Killer plagues like SARS and MERS faltered to spread widely, because victims got sick 'so quickly' that they barely got to hospital before often dying, so it never spread widely. Here, C-19 does not even 'present' symptoms for days or weeks, hence it can 'shed' its viral particles among crowds and widely, before it's even noticed.)

So, urging calm is counterproductive for officials. Panic gets adrenaline to spike, and that means scientists and politicians also panic, and fund the research needed to solve this, while more adequately mitigating spread, because (for major metro areas) it's already too late for containment due to the feeble (I'd rather say shameful) response by most agencies and at least enough of a delay that puts a blemish on some sterling reputations.

Conclusion: the room for policy response to fight the virus or recession at this point are more limited, than had health and financial resources in a sense 'mobilized' when the course of the viral progression was already a visible enemy advancing towards the world beyond China, a month ago.

Instead of censoring news, worrying about whether details of the genome of the virus was a conspiracy, espionage, or just a quirk of nature, there were a series of efforts to squash public discussion or media investigation rather than the 'transparency' that was needed to get everyone focused on it.

Hence it was the 'failure to panic', not panic, that was the problem. So if it takes a Manhattan Project to solve it, so be it (it won't be because the cure and vaccine will be found, but millions will suffer because they failed to be more pro-active), while it's the near-term that's terribly concerning. I believe 'community spread' is already here, and won't be resolved by the decisions coming from The White House, Fed or others. But it will kick-up awareness when 'testing results' reveal the perils of 'blissful ignorance'.

The tweets to assure us that 'life goes on' are again missing the point and I understand calming the public. The President has to know more than 'being out of touch' as many think, because two Congressmen on Air Force One today, with The President miles from me by the way, have just gone into quarantine. Late today the Italian PM Conte extended the restrictions to the entire country ... effective now for all of Italy. A western democracy has now moved to the draconian measures like China or South Korea did and that again evidences how dire things are, and how much more stock markets need to decline (the big expensive stocks) to revisit reality.

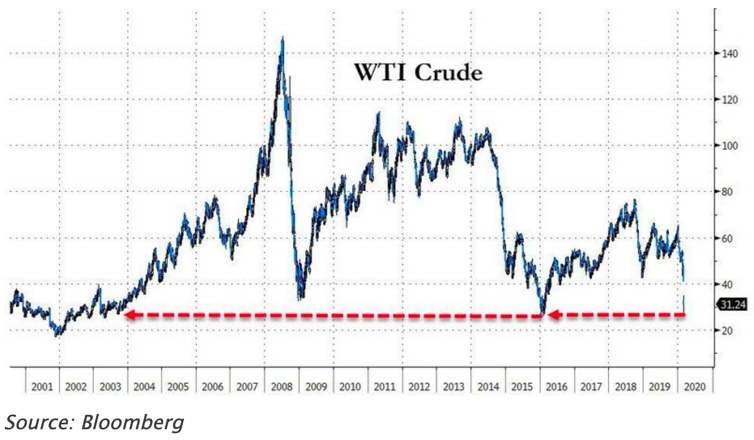

Meanwhile the oil situation was discussed in the 'special update' late on Sunday; and it's all pretty obvious. Only about 4% of Saudi Arabian oil is ending up here in the USA, so it matters not, but does on world markets. It's even more pertinent when it comes to the more-competitive LNG (UNG). So sure, Oil (OIL) will drop into the 20's and that changes dynamics in many ways, so that even impacts the popularity of EV's with gasoline cheap for a while.

Speaking with a couple of oil producers in Middle America, it's apparent a view exists that this plunge will eliminate overproduction of shale oil here in the US. Private equity and funders or the shale industry are not making huge profits to start with. Oil's being produced but investment costs along with quick depletion and high upkeep work against sustained margins as do contract after initial 'flush' production.

As for the macro global picture, the world energy market has been at war, ever since the ability to transport liquefied natural gas. With the ability of the US to transport across seas to European markets something we've emphasized in the past (the President's and Poland's initiative). Russia has controlled this LNG market for a long time without competition, with these last 5 years having changed that. Russia wants the markets back, the Persian Gulf countries want to penetrate it, and the U.S. has a degree of leverage on this, due to tying-it to NATO and other alliance reasons.

It is at the same time silly for the President to emphasize cheap gasoline to US consumers, rather than the cost to communities and industries and huge financial risks to investor and banks, on-top of oil producers. This is a 'financial fracking' of the oil industry however, due to the cost-per-bbl in the Middle East being a fraction of Russia's, there may be a time-line on how long this particular crisis lasts, not resolved 'this week'. Stay tuned.

In-sum: we all know where this stands. As C-19 tests rollout and results become known in the next week or two, there will be renewed shock that this was already simmering. To wit: 'ignorance no long will be bliss'.

Gene, this is an incredibly sober assessment and the argument is strong that we need more tests and fast. And then we need a plan to stop the clusters. These are sad times indeed, but a mustread article.