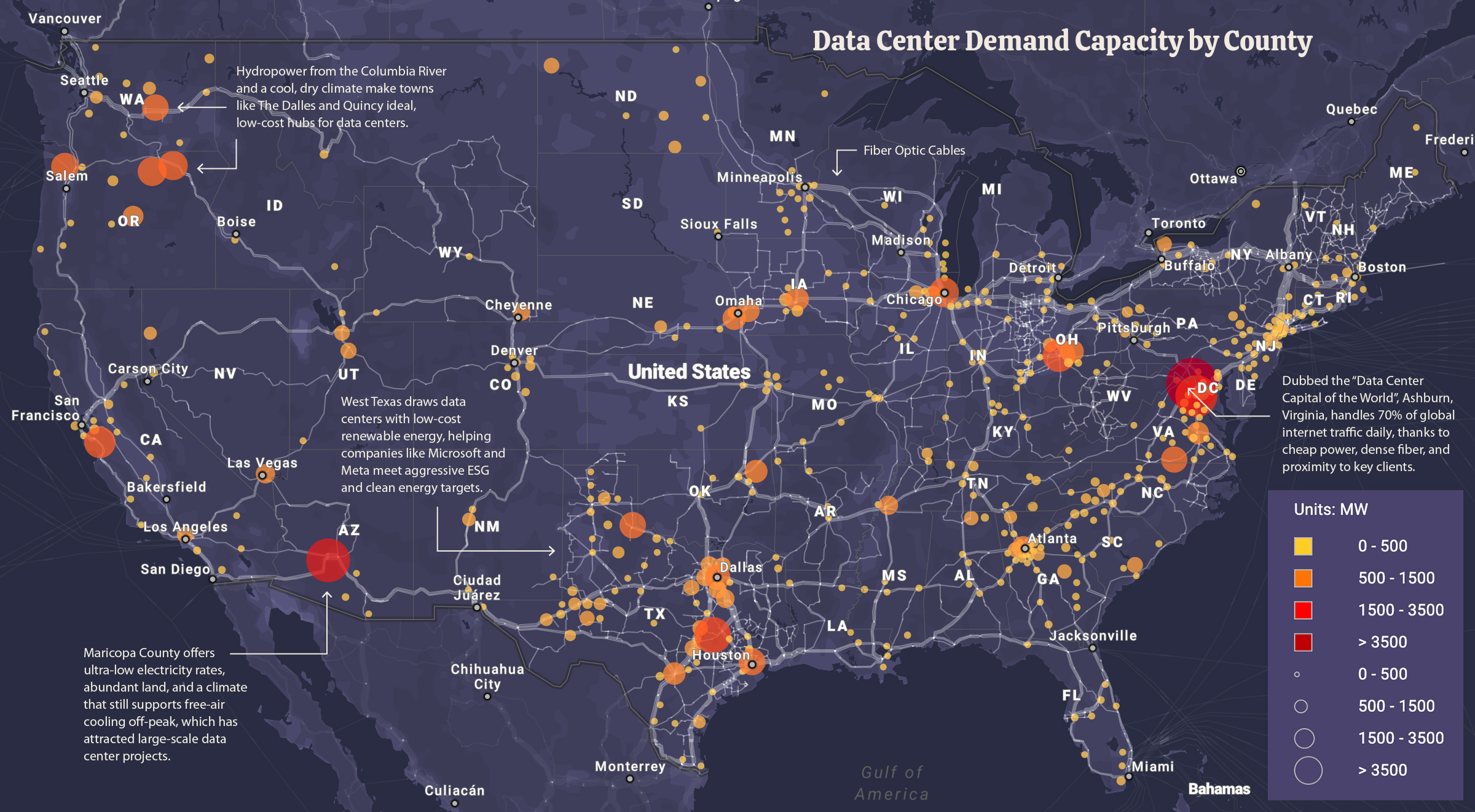

Mapped: The Massive Network Powering U.S. Data Centers

(Click on image to enlarge)

- Virginia’s Loudoun County alone supports nearly 6 GW of operating and under-construction data centers—more than any other U.S. county.

- Many top data center locations prioritize access to affordable electricity and fiber, not population centers.

- U.S. data center energy consumption could double by 2030, posing challenges for the nation’s grid infrastructure.

The map above, produced by the National Renewable Energy Laboratory (NREL) on behalf of the U.S. Department of Energy’s Grid Deployment Office, shows the sprawling and powerful infrastructure behind America’s data center boom. Using a range of public data sources, it visualizes power transmission hubs in megawatts (MW), highlighting where the electric grid is already working hard, and where future pressure may build.

The table below highlights counties that use the most power for data center facilities:

| County | State | Data Centers Operating and In Construction (MW) | Planned (MW) |

|---|---|---|---|

| Loudoun | VA | 5929.67 | 6349.4 |

| Maricopa | AZ | 3436.1 | 5966 |

| Prince William | VA | 2745.4 | 5159 |

| Cook | IL | 1478.13 | 2001.8 |

| Milam | TX | 1442 | 0 |

| Santa Clara | CA | 1314.73 | 552.5 |

| Dallas | TX | 1294.58 | 2911.2 |

| Franklin | OH | 1257.4 | 483 |

| Morrow | OR | 1177 | 0 |

| Umatilla | OR | 1118.5 | 101 |

| Mecklenburg | VA | 1019.5 | 502.5 |

Loudoun County, Virginia (home to “Data Center Alley”) tops the list with nearly 6,000 MW of active capacity and another 6,300 MW planned.

Why Are Data Centers Located Where They Are?

It’s tempting to assume that large populations drive data center development, but that’s often not the case. Instead, it comes down to a mix of factors:

- Electricity availability and cost: Data centers consume vast amounts of power. States like Virginia, Texas, and Oregon offer competitive electricity pricing and stable infrastructure.

- Access to water: Many facilities use water for evaporative cooling, so proximity to aquifers or rivers can be crucial.

- Fiber networks: Low latency is king. Proximity to fiber optic infrastructure and subsea cable landing stations is critical.

- Zoning and incentives: Tax incentives and permissive local zoning laws can make or break a deal.

With this in mind, here are a few areas on the map worth highlighting:

Ashburn, VA and Surrounding DC Suburbs

The data center cluster around the DC suburbs, especially Ashburn, is known as the “Data Center Capital of the World” and “Data Center Alley.” It hosts the largest concentration of internet infrastructure globally, where about 70% of the world’s internet traffic flows daily. This area offers abundant and reliable power from Dominion Energy, dense fiber connectivity, aggressive state tax incentives, and proximity to major government and enterprise customers, making it the preferred hub for hyperscale cloud and data companies.

The I-85 Corridor

This region, which roughly runs from Atlanta up into Virginia, is emerging as a strategic data center hub. The corridor benefits from improved transmission infrastructure, and growing local tax incentives. Atlanta’s proximity to major East Coast markets and Virginia Beach’s new subsea cable landing stations make this region a digital on-ramp to global networks.

West Texas

Known for its vast open spaces and powerful winds, West Texas offers some of the lowest electricity prices in the country. It’s also home to major renewable energy projects, including wind and solar farms that help data center operators meet clean energy goals. This has drawn attention from major players like Microsoft and Meta.

Eastern Washington and Oregon

The Columbia River powers a dense cluster of hydroelectric dams, which in turn support energy-hungry data centers in towns like The Dalles and Quincy. The cool, dry climate further reduces the need for mechanical cooling, making this region one of the most cost-efficient for data center operations.

Can the Grid Keep Up?

U.S. data centers already consume 2-3% of the country’s electricity. According to WRI, this could double by 2030, especially with AI workloads driving GPU server farms that are far more energy-intensive than traditional ones.

Meanwhile, the pressure is on utilities and policymakers to expand grid capacity faster than ever before. Interconnection queues are long, and power disputes are already delaying projects in places like Northern Virginia and Silicon Valley.

Yet, the demand shows no signs of slowing, making the power grid one of the most important tech battlegrounds of the next decade.

More By This Author:

Charted: America’s EV Charging Boom

Visualizing Gold Production By Country

Ranked: The iPhone Price Index In 2025