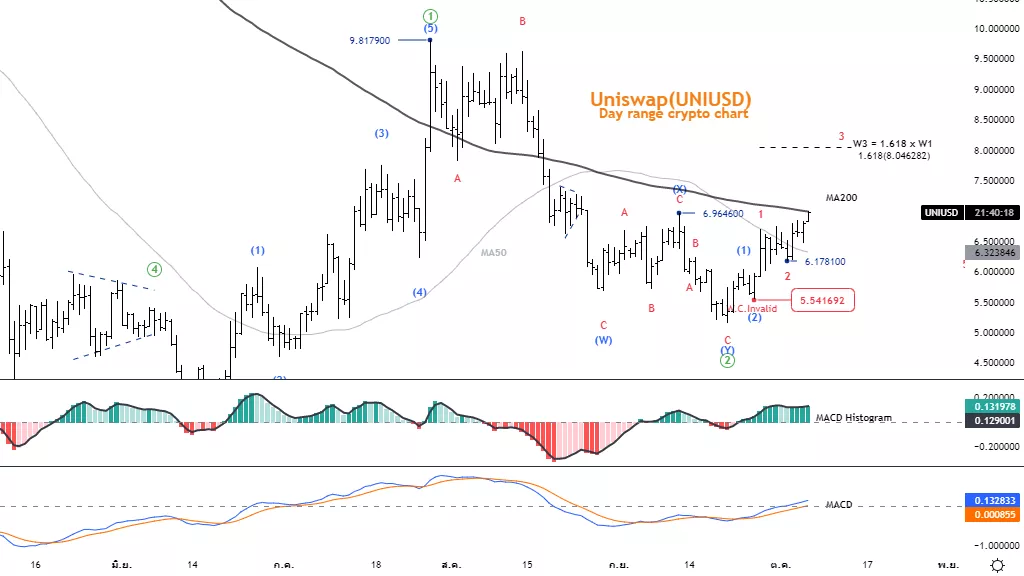

Elliott Wave Technical Analysis: Uniswap, Oct. 6

Elliott Wave Analysis TradingLounge Daily Chart, 6 October 2022,

Uniswap (UNI-X)

UNIUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next higher Degrees: wave ((3)) of Motive

Details: Price tends to trade above 9.817, but must not reverse below 5.552

Wave Cancel invalid Level: 5.552

Uniswap Trading Strategy: The price tends to trade above 9.817, but be aware

of the important resistance at the MA200 line, if it fails, there is a chance to reverse again.

And it could be an opportunity to join the trend.

Uniswap (UNIUSD) Technical Indicators: The price is below the MA200, and

MASO line. momentum is bearish.

Tradinglounge Analyst : Kittiampon Somboonsod

Uniswap

UNIUSD Elliott Wave Technical Analysis 4Hr Chart

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next higher Degrees: wave ((3)) of Motive

Details: Price tends to trade above 9.817, but must not reverse below 5.541

Wave Cancel invalid Level: 5.541

Uniswap Trading Strategy: The price tends to trade higher steadily, but the

MACD is declining. You may need to be cautious when trading during this period. But

even then, Momentum is still positive above the MA200 and MAS50 lines.

Uniswap Technical Indicators: The price is above the MA200, and MASO line. Momentum is Bullish.

More By This Author:

S&P 500 Elliott Wave Technical Analysis

CSX Corporation, Elliott Wave Technical Analysis October 5 2022

DAX 40, FTSE 100, EUROSTOXX 50, Dollar, GBPUSD, EURUSD - Elliott Wave Technical Analysis

Disclosure: As with any trading or investment opportunity there is a risk of making losses especially in day trading or investments that Trading Lounge expresses opinions on. Note: Historical ...

more