Elliott Wave Technical Analysis: Theta Token Crypto Price News For Friday, May 16

Image Source: Upsplash

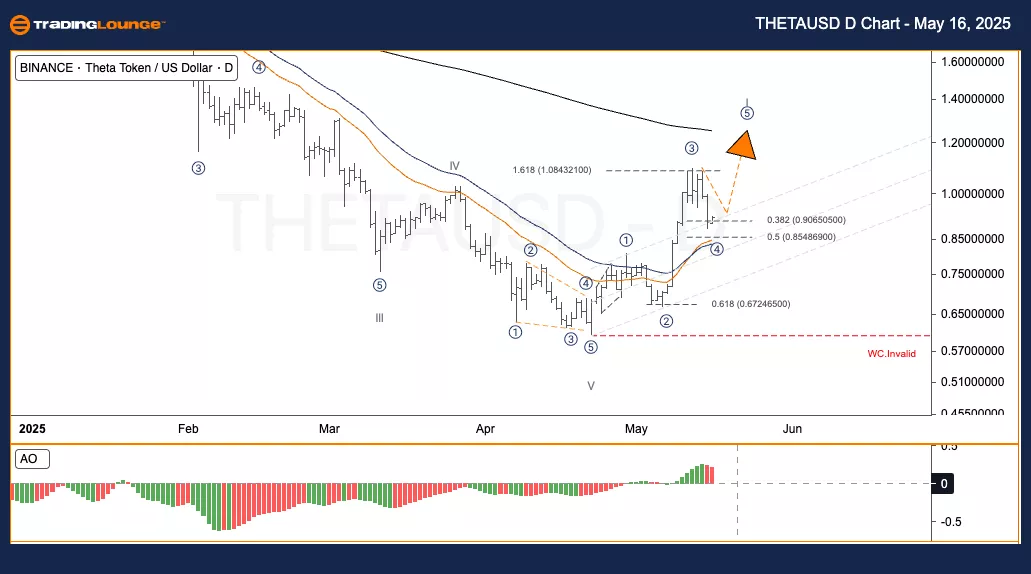

Elliott Wave Analysis – TradingLounge Daily Chart | Theta / U.S. Dollar (THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Next Direction (Higher Degrees):

Wave Invalidation Level:

Theta / U.S. Dollar (THETAUSD) – Trading Strategy:

Theta (THETA) has recently completed a significant correction, forming a V wave at a key support level. A new upward structure is emerging. The price is forming an Impulse wave I and is now potentially pausing at wave ④. Currently, the price is testing the Fibonacci Retracement zone between 38.2% and 50% (approx. $0.906 – $0.854) from wave ③. If it maintains above this zone and starts to move up again, it may confirm the start of wave ⑤ – the final bullish wave in this sequence.

Trading Strategies

Strategy

For Swing Traders:

✅ Look for buying opportunities. Focus on price behavior between $0.85 – $0.90, especially if a reversal pattern forms.

Risk Management:

🟥 Watch the $0.672 level. A break below it invalidates the bullish wave count and requires reassessment.

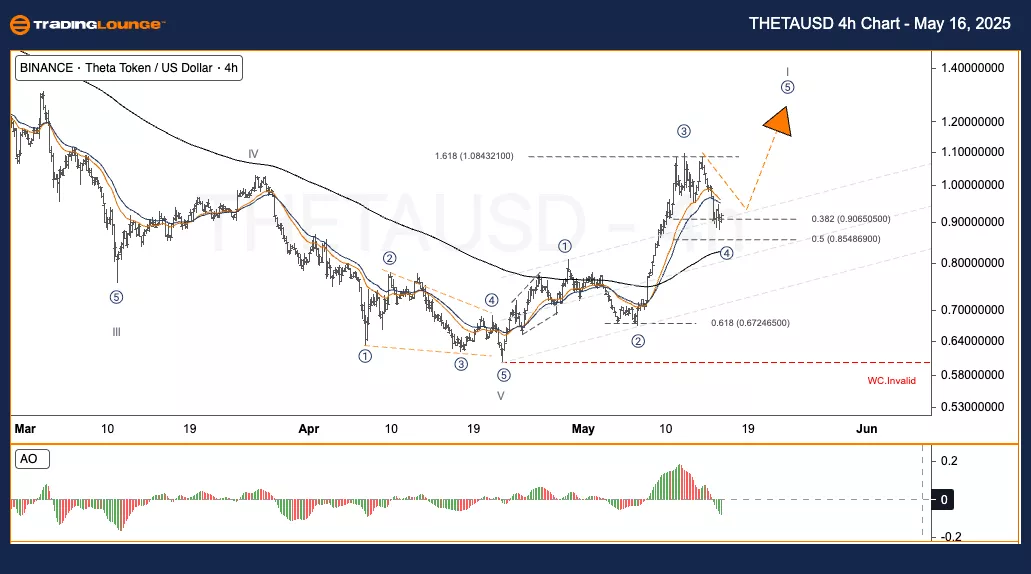

Elliott Wave Analysis – TradingLounge H4 Chart | Theta / U.S. Dollar (THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Next Direction (Higher Degrees):

Wave Invalidation Level:

Theta / U.S. Dollar (THETAUSD) – Trading Strategy:

Theta (THETA) completed a deep correction with a V wave near strong support. A new recovery trend is underway. It’s forming an Impulse wave I and is likely in wave ④. Price is currently testing the 38.2% – 50% Fibonacci zone ($0.906 – $0.854) from wave ③. Holding this range and moving upward would likely signal the start of wave ⑤ – the concluding wave of the trend.

Trading Strategies

Strategy

For Swing Traders:

✅ Monitor closely for buying setups between $0.85 – $0.90, especially if a clear reversal candlestick appears.

Risk Management:

🟥 If the price drops below $0.672, it challenges the current bullish scenario.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Analysis & Technical Forecast: Block, Inc.

Elliott Wave Technical Analysis: Advanced Micro Devices Inc. - Thursday, May 15

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Thursday, May 15

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more