Elliott Wave Technical Analysis: Ripple XRP Crypto Price News For Thursday, March 27

Image by WorldSpectrum from Pixabay

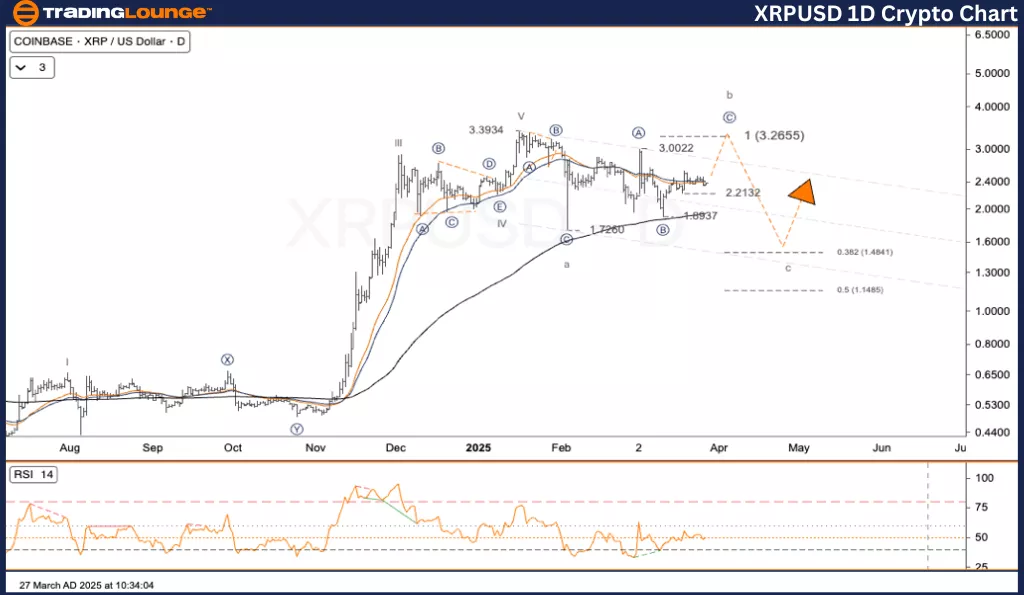

Elliott Wave Analysis – TradingLounge Daily Chart

XRP/ U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave ((B))

Next Higher Degree Direction: Wave IV

Invalidation Level: N/A

XRP/ U.S. Dollar (XRPUSD) Trading Strategy

XRP appears to be showing a short-term recovery. However, this move likely represents a “wave b” within a broader correction. If the current Elliott Wave structure continues, the next wave (wave C) could result in a sharp decline. This current setup is identified as a wave (II) correction.

Wave a completed at 1.768

Wave b is ongoing, with major resistance near 3.389

If price fails to surpass this resistance and reverses, wave c could push XRP down toward Key Support: 1.533

Trading Strategies

Strategy

✅ Swing Trading Opportunity (Short-Term)

If XRP fails to break above 2.90 – 3.39 and reverses, short positions may be considered, targeting the 1.53 – 1.60 range.

Risk Management

A clear breakout above 3.389 suggests a possible end to wave (II) and the start of wave (III), requiring a re-evaluation of the current structure.

Elliott Wave Analysis – TradingLounge H4 Chart

XRP/ U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave ((B))

Next Higher Degree Direction: Wave IV

Invalidation Level: N/A

XRP/ U.S. Dollar (XRPUSD) Trading Strategy

XRP is showing signs of recovery in the short term, which might just be wave b of a broader corrective wave. According to the Elliott Wave pattern, a significant drop may follow if wave c begins. The broader movement is part of a wave (II) correction.

Wave a ended at 1.768

Wave b continues, with resistance around 3.389

A reversal near this resistance could start wave c, aiming for Key Support: 1.533

Trading Strategies

Strategy

✅ Swing Trade Strategy (Short-Term)

Price action rejecting the 2.90 – 3.39 range can offer a short trade opportunity, with targets between 1.53 – 1.60.

Risk Management

A confirmed breakout above 3.389 could end wave (II) and trigger a new bullish wave (III), requiring a shift in analysis.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com

More By This Author:

Elliott Wave Technical Forecast: Block, Inc.

Elliott Wave Technical Analysis: Caterpillar Inc. - Wednesday, March 26

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Wednesday, March 26

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more