Elliott Wave Technical Analysis: Ripple Crypto Price News For Thursday, May 29

Image by WorldSpectrum from Pixabay

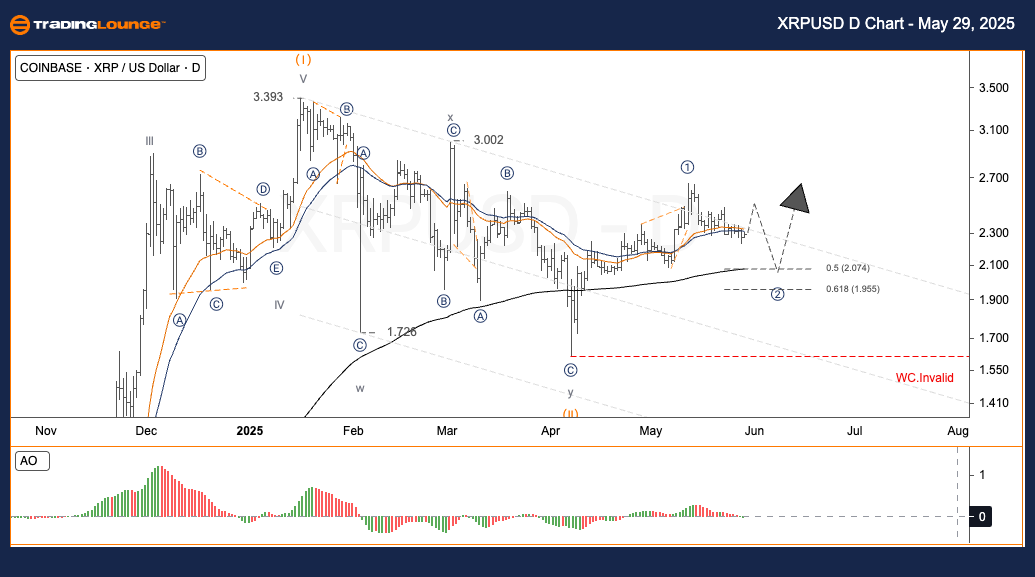

Elliott Wave Analysis – TradingLounge Daily Chart, Ripple / U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

- Function: Trend Continuation

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave 2

- Next Direction (Higher Degrees):

- Invalidation Level for Wave Count:

Ripple / U.S. Dollar (XRPUSD) Trading Strategy:

XRP/USD is progressing in a new bullish wave, having formed Wave ① from a major support. It is now correcting within Wave ②, likely to complete inside the Fibonacci retracement region, setting the stage for Wave ③ to emerge strongly as a high-momentum impulse move.

Trading Strategies

- Strategy Type:

-

- ✅ Short-term Swing Traders

-

- Watch for price action to bounce back between the 1.82 – 2.00 range.

- Risk Management:

-

- 🟥 Place Stop Loss below 1.61911 to manage potential downside risk.

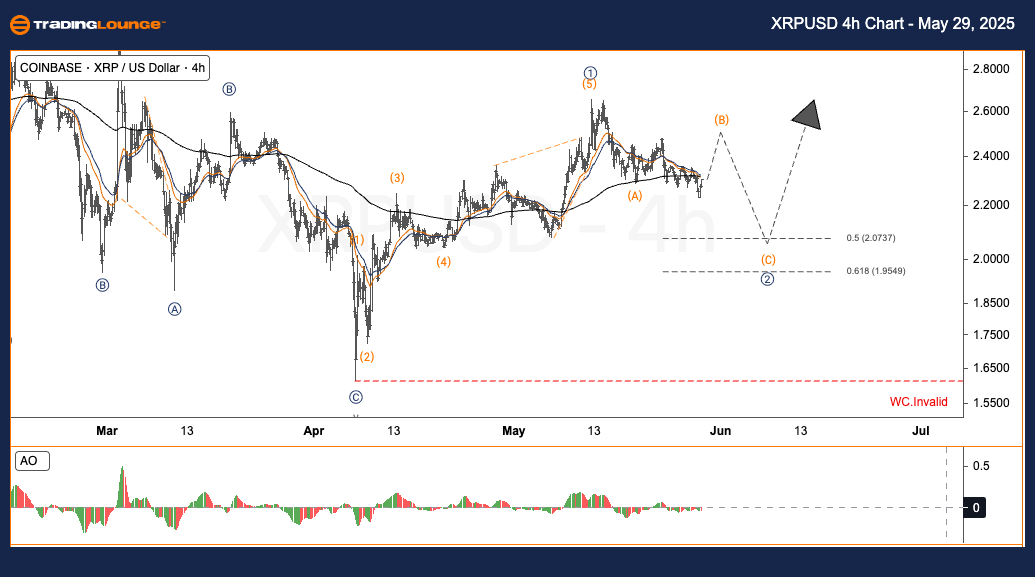

Elliott Wave Analysis – TradingLounge H4 Chart, Ripple / U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

- Function: Trend Continuation

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave 2

- Next Direction (Higher Degrees):

- Invalidation Level for Wave Count:

Ripple / U.S. Dollar (XRPUSD) Trading Strategy:

A new upward trend has started for XRP/USD from a strong support base. Wave ① has completed, and Wave ② is underway, likely ending within the Fibonacci retracement zone. Wave ③ is projected to be a strong impulsive move with significant upward momentum.

Trading Strategies

- Strategy Type:

-

- ✅ Short-term Swing Traders

-

- Wait for a reversal around the 1.82 – 2.00 zone.

- Risk Management:

-

- 🟥 Stop Loss should be placed below 1.61911 to mitigate risk.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Unlocking ASX Trading Success: Cochlear Limited - Wednesday, May 28

Elliott Wave Technical Analysis: Caterpillar Inc. - Wednesday, May 28

Elliott Wave Technical Analysis: Australian Dollar/Japanese Yen - Wednesday, May 28

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more