Elliott Wave Technical Analysis: NEO Crypto Price News For Thursday, July 10

Image Source: Pixabay

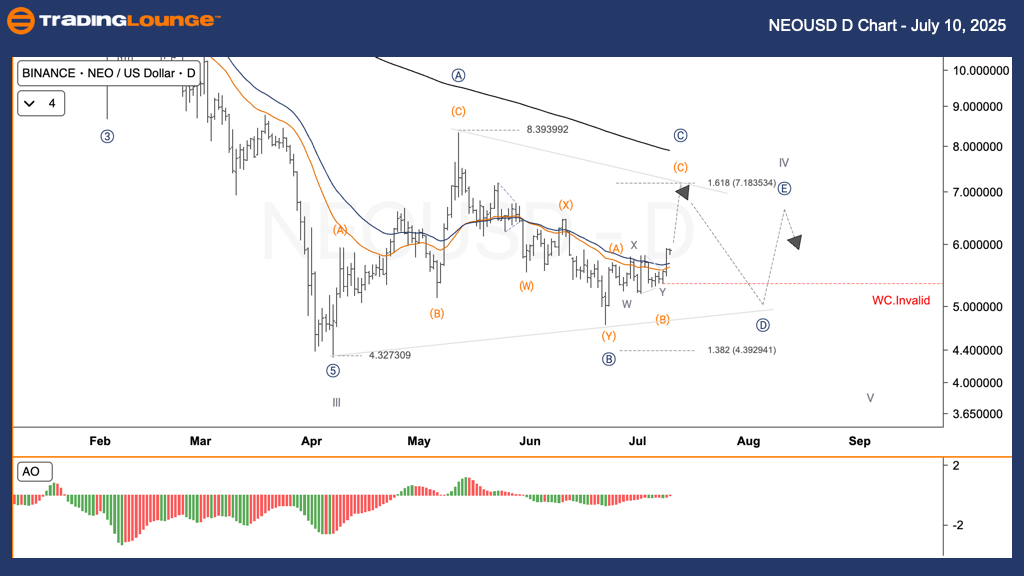

Elliott Wave Analysis TradingLounge Daily Chart, 10 July 2025, NEO / U.S. Dollar (NEOUSD)

NEOUSD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Triangle

- Position: Wave C

- Next Direction (Higher Degrees): Pending

- Invalidation Level: Below $5.30

NEO / U.S. Dollar (NEOUSD) Trading Strategy

NEO has been forming a classic A-B-C-D-E triangle pattern within a larger wave IV since early 2025. The price action continues to narrow, bouncing between trend lines as bulls and bears alternate control. The latest move has touched the upper boundary of this formation, which may indicate the completion of wave E and a potential breakdown toward the final downward wave V.

Trading Strategies

- ✅ Swing Trade (Short-Term Traders):

This is a potential entry point where wave D could transition lower, aligning with the triangle’s expected behavior. - 🟥 Invalidation Point:

If the price breaks below $5.30, the current wave count is no longer valid.

Elliott Wave Analysis TradingLounge H4 Chart, 10 July 2025, NEO / U.S. Dollar (NEOUSD)

NEOUSD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Triangle

- Position: Wave C

- Next Direction (Higher Degrees): Pending

- Invalidation Level: Below $5.30

NEO / U.S. Dollar (NEOUSD) Trading Strategy

The 4-hour chart shows NEO steadily moving within a rising channel, aligning with a developing wave C within the triangle of a broader wave IV. This upward move in wave C appears strong and could peak around the Fibonacci 1.618 level at $7.18 before turning lower.

Trading Strategies

- ✅ Swing Trade (Short-Term Traders):

Price could soon transition from wave C to wave D, a potential short-selling opportunity per triangle expectations. - 🟥 Invalidation Point:

Any decline below $5.30 will invalidate the current wave count.

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Elliott Wave Trading Strategies: SP500, Nasdaq, DAX, ASX – July 10, 2025 Market Forecast

Unlocking ASX Trading Success: Mineral Resources Limited - Wednesday, July 9

Elliott Wave Technical Analysis - Nifty 50 Index

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more