Elliott Wave Technical Analysis: Ethereum Crypto Price News For Tuesday, June 17

Image Source: Pixabay

Ethereum (ETHUSD) Elliott Wave Analysis – Daily & H4 Chart

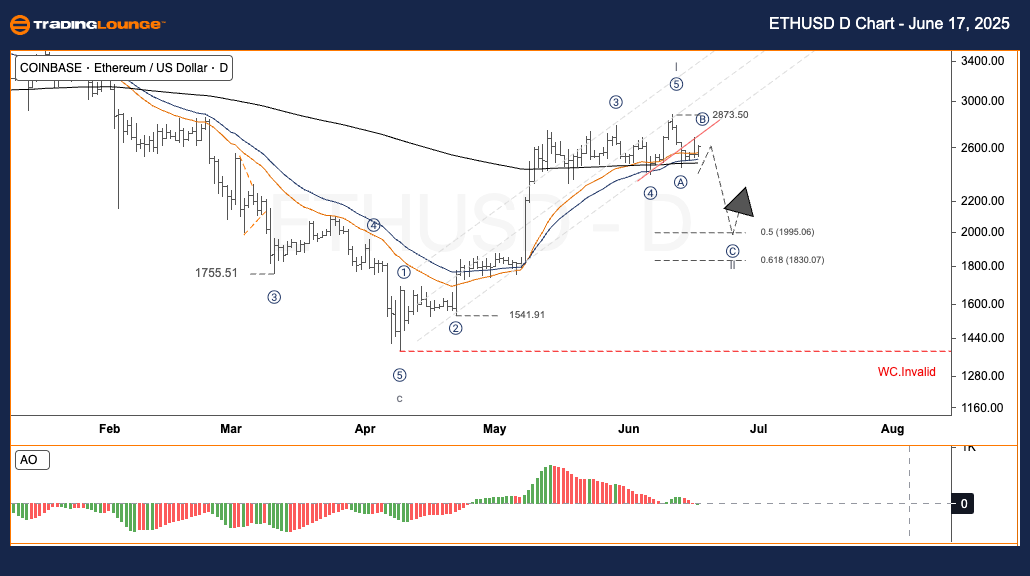

Daily Chart – ETHUSD Technical Analysis by TradingLounge

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave 2

- Wave Cancel Invalid Level: Pending

Technical Overview:

Ethereum (ETH) surged above the $2,800 mark during Wave I, showing a solid bullish impulse. Following this, price action weakened, indicating a consolidation that fits into a Wave II bearish correction scenario. As per Elliott Wave principles, if prices remain above key Fibonacci support and bullish momentum returns, a powerful Wave III may follow—potentially the strongest in this cycle.

ETHUSD Trading Strategy

- Short-Term Strategy (Swing Trade):

-

- Entry Zone: Wave II may offer accumulation opportunities. Look for bullish reversals from the $2,100 to $1,950 zone.

- Risk Management:

-

- Invalidation Level: $1,385.76 – Breaching this level would nullify the current wave count and necessitate a reassessment.

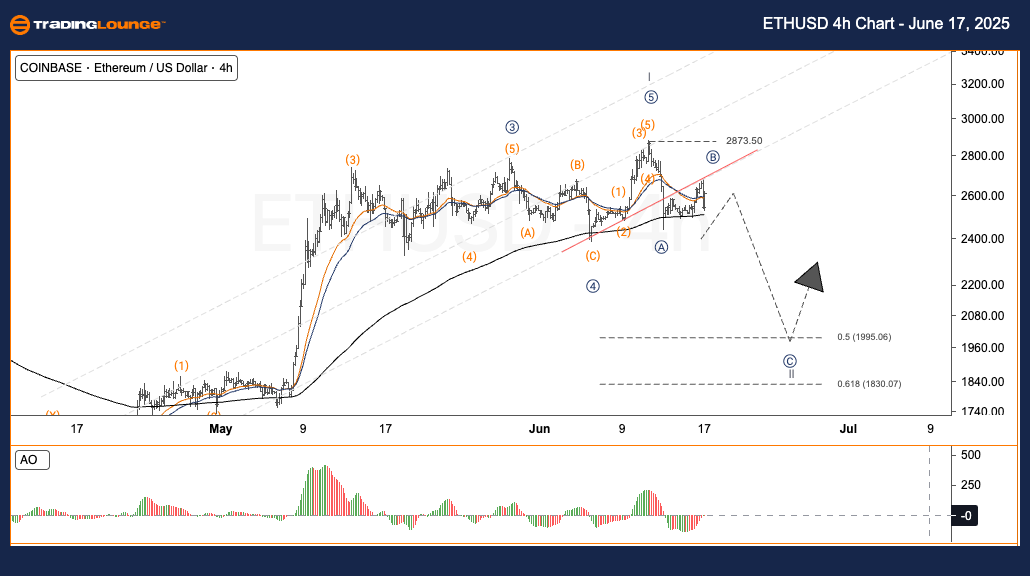

H4 Chart – ETHUSD Technical Analysis by TradingLounge

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave 2

- Wave Cancel Invalid Level: Pending

Market Summary:

Similar to the Daily Chart, Ethereum’s H4 structure reaffirms the transition into a Wave II correction. A potential bullish Wave III could emerge if the price structure holds above the $1,950–$2,100 region. Traders should watch this zone for confirmation signals.

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Elliott Wave Technical Analysis: Natural Gas - Monday, June 16

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Monday, June 16

VeChain Crypto Price News Today - Monday, June 16

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more