Elliott Wave Technical Analysis Dogecoin Crypto Price News Today

Elliott Wave Analysis - TradingLounge Daily Chart

Dogecoin/ U.S. Dollar (DOGEUSD)

DOGEUSD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Flat

- Position: Wave C

- Next Higher Degree Direction: Wave (III) of Impulse

- Wave Cancellation Invalid Level:

- Details: Wave C correction is in progress before the price resumes its uptrend. A reversal signal is awaited.

Dogecoin/ U.S. Dollar (DOGEUSD) Trading Strategy

Dogecoin (DOGE) is entering a crucial phase. Following an extended correction, the price is now nearing the end of Wave (II) based on Elliott Wave Theory, which may present new trading opportunities.

- 0.1822 - Key Support Level: If the price falls below this level, it may indicate a continued downtrend.

- 0.2457 - Key Resistance Level: If the price breaks above this level, it may confirm the start of an uptrend.

- 0.4846 - Long-Term Target: If the uptrend resumes, this could be a potential price target.

Trading Strategies

Strategy

- Long Strategy

- Pullback Entry: Buy when the price drops to the critical support level.

- If the price holds above 0.1822 and rebounds, traders might consider entering long positions.

Risk Management

- If the price drops below 0.1822, traders should wait for a clearer reversal signal before making a move.

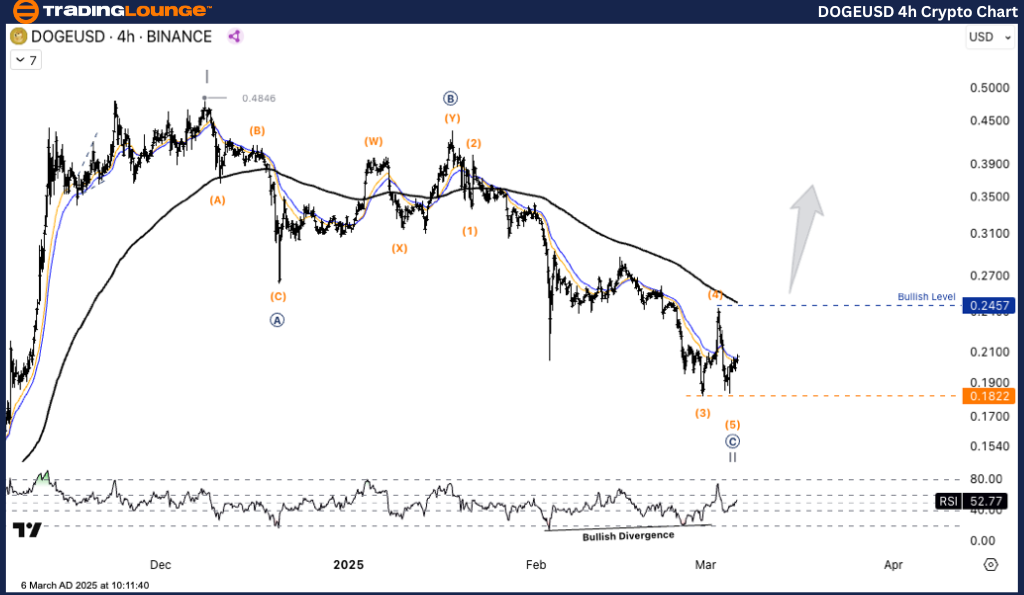

Elliott Wave Analysis - TradingLounge H4 Chart

Dogecoin/ U.S. Dollar (DOGEUSD)

DOGEUSD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Flat

- Position: Wave C

- Next Higher Degree Direction: Wave (III) of Impulse

- Wave Cancellation Invalid Level:

- Details: Wave C correction is in progress before the price resumes its uptrend. A reversal signal is awaited.

Dogecoin/ U.S. Dollar (DOGEUSD) Trading Strategy

Dogecoin (DOGE) is in an important phase. After a prolonged correction, the price is now nearing the completion of Wave (II) under Elliott Wave Theory, potentially creating new trading opportunities.

- 0.1822 - Key Support Level: A break below this level may signal further downside movement.

- 0.2457 - Key Resistance Level: If the price surpasses this level, it could confirm an uptrend.

- 0.4846 - Long-Term Target: If the uptrend continues, this could be a future price target.

Trading Strategies

Strategy

- Long Strategy

- Pullback Entry: Buy when the price dips to the crucial support level.

- If the price remains above 0.1822 and rebounds, traders may consider long positions.

Risk Management

- If the price moves below 0.1822, waiting for a clearer reversal signal is advisable.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Insights: Trading Strategies For S&P 500, Nasdaq 100, DAX 40, FTSE 100 & ASX 200

Elliott Wave Analysis: Macquarie Group Limited

Elliott Wave Technical Analysis MicroStrategy Inc.

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more