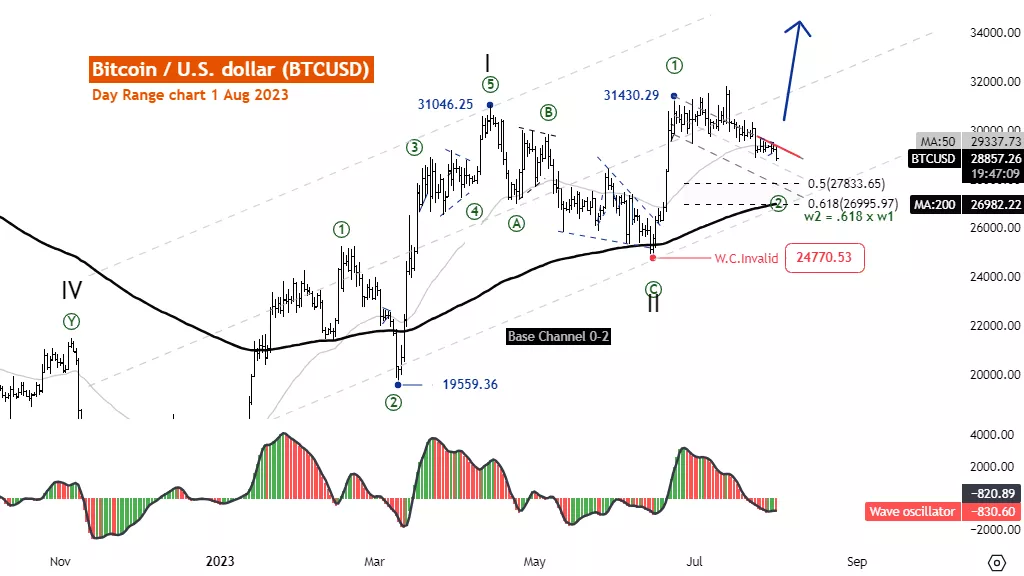

Elliott Wave Technical Analysis: Bitcoin/U.S. Dollar - Tuesday August 1

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave (C)

Direction Next higher Degrees: wave ((2)) of Motive

Details: We are considering the termination of wave ((2)) from breaking the upper parallel channel.

Wave Cancel invalid level: 24770.53

Bitcoin/U.S. dollar(BTCUSD)Trading Strategy: A correction in wave ((2)) is still developing and a retracement of wave ((2)) usually .50 or .618 x Length wave ((1)) may be the last phase of the correction. We are waiting for the correction to complete to join the trend again. If the price breaks out of the parallel channel, it could be a signal of the beginning of a new trend.

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, Wave Oscillator are Bearish momentum.

(Click on image to enlarge)

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave (C)

Direction Next higher Degrees: wave ((2)) of Motive

Details: We are considering the termination of wave ((2)) from breaking the upper parallel channel.

Wave Cancel invalid level: 24770.53

Bitcoin/U.S. dollar(BTCUSD)Trading Strategy: A correction in wave ((2)) is still developing and a retracement of wave ((2)) usually .50 or .618 x Length wave ((1)) may be the last phase of the correction. We are waiting for the correction to complete to join the trend again. If the price breaks out of the parallel channel, it could be a signal of the beginning of a new trend.

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is Below the MA200 indicating a Down trend, Wave Oscillator are bullish momentum.

(Click on image to enlarge)

More By This Author:

Elliott Wave Technical Analysis: US Dollar/Swiss Franc - Monday, July 31

Elliott Wave Technical Analysis 4-hour Chart For US Dollar/Swiss Franc - Monday, July 31

Elliott Wave Technical Analysis: Robinhood, Monday, July 31

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817