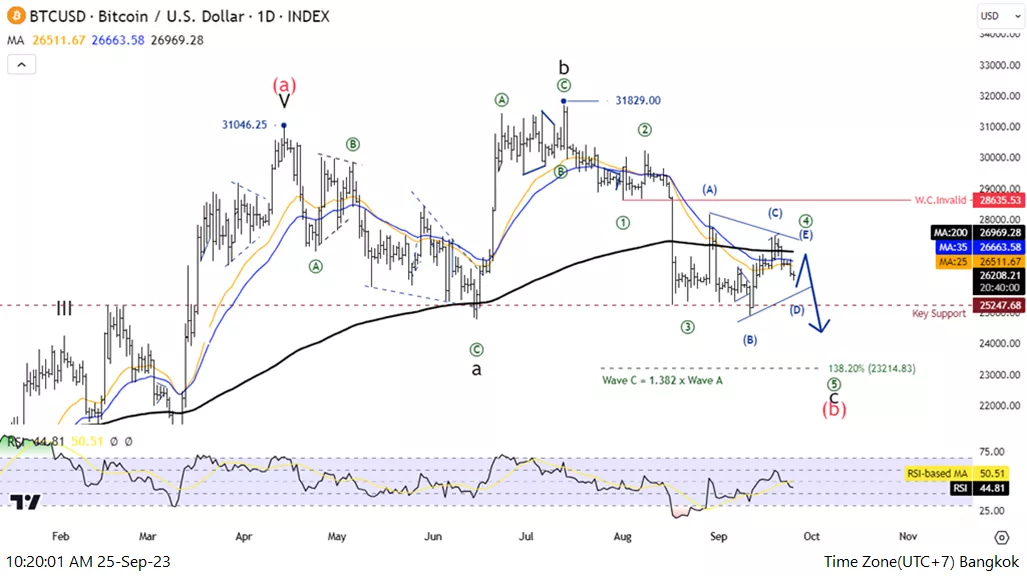

Elliott Wave Technical Analysis: Bitcoin/U.S. Dollar - Monday, Sept, 25

Elliott Wave Analysis TradingLounge Daily Chart, 25 September 23,

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave((C))

Direction Next higher Degrees: wave II of Motive

Wave Cancel invalid level: 28167.47

Details: Wave ((C)) trend move to 138.2% of Wave ((A)) at 23214.83

Bitcoin/U.S. dollar(BTCUSD)Trading Strategy: Bitcoin overview is still in a downtrend, as the price is below MA200 and wave C is not complete The price has a trend move to 23214.83 which is a 138.2% level of wave A

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, RSI is a Bearish momentum.

(Click on image to enlarge)

Elliott Wave Analysis TradingLounge 4H Chart, 25 September 23,

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Triangle

Position: Wave 4

Direction Next higher Degrees: wave ((C)) of Flat

Wave Cancel invalid level: 28167.47

Details: we are still missing two moves for a triangle to be complete

Bitcoin/U.S. dollar(BTCUSD) Trading Strategy: The retest is at MA200 and the price make is a higher low, indicate that the Buyer is weak, so we looking for turning down below 24612

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, RSI is a Bullish momentum.

(Click on image to enlarge)

More By This Author:

Stock Trading: AAPL, AMZN, NVDA, TSLA, GOOGL, META, NFLX, MSFT

Elliott Wave Technical Analysis: AAVEUSD - Friday, Sept 22

Day Chart Elliott Wave Technical Analysis: GBPJPY - Friday Sept 22

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817