Elliott Wave Technical Analysis: Bitcoin - Monday, July 7

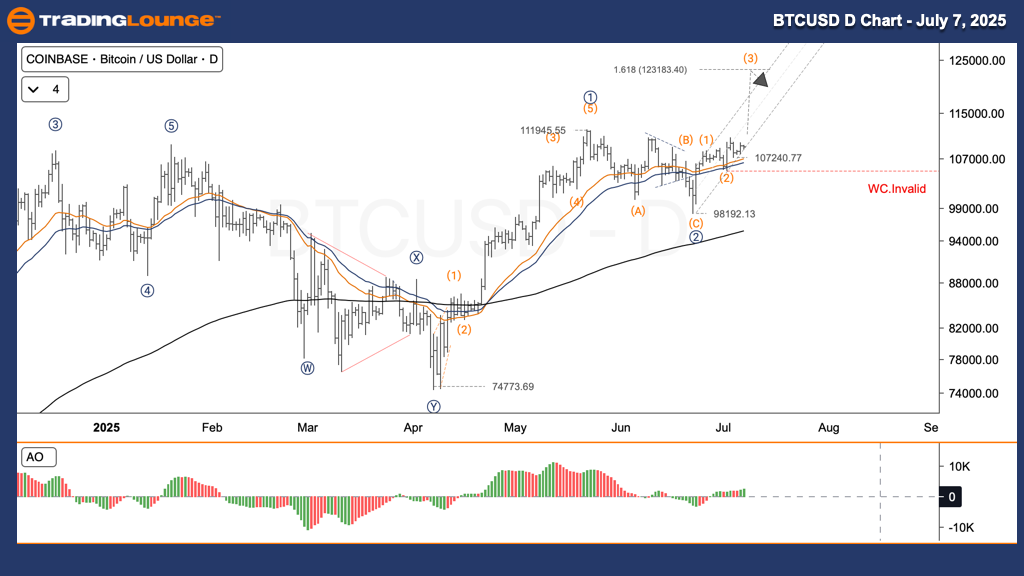

BTC/USD Elliott Wave Technical Analysis – Daily Chart

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Wave Position: Wave 3

- Direction of Higher Degrees: Uptrend expected

Trading Strategy (BTC/USD - 07 July 2025):

Following the completion of wave (2) at 98,192 USD, Bitcoin has entered wave 3 of a new upward impulse. This move projects potential price action to the 1.618 Fibonacci extension at 123,183 USD.

Trading Tips for Swing Traders:

- Strategy: Use minor dips as buying opportunities to ride wave 3 acceleration.

- Invalidation Level: A break below 107,240 USD would negate the current wave count.

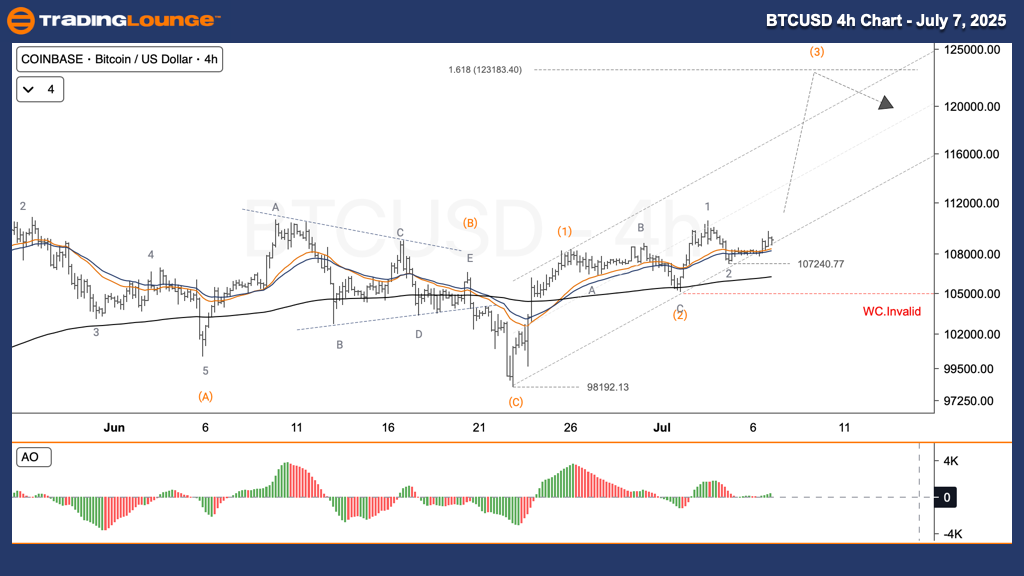

BTC/USD Elliott Wave Technical Analysis – H4 Chart

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Wave Position: Wave 3

- Direction of Higher Degrees: Continuation to upside expected

Trading Strategy (BTC/USD - 04 July 2025):

The 4-hour chart confirms the daily structure. Bitcoin, post-consolidation at 98,192 USD, is now forming sub-wave 3 within a broader bullish move, with potential to hit 123,183 USD.

Swing Trade Plan:

- Buy minor corrections within the uptrend to join wave 3.

- Invalidation Level: Drop below 107,240 USD will cancel this wave count.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Technical Forecast: Newmont Corporation - Friday, July 4

Elliott Wave Technical Analysis Riot Platforms, Inc.

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Friday, July 4

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more