Elliott Wave Technical Analysis: AAVE/USD Crypto Price News For Wednesday, June 18

Image Source: Pexels

Elliott Wave Analysis – AAVE/USD – Daily and H4 Charts by TradingLounge

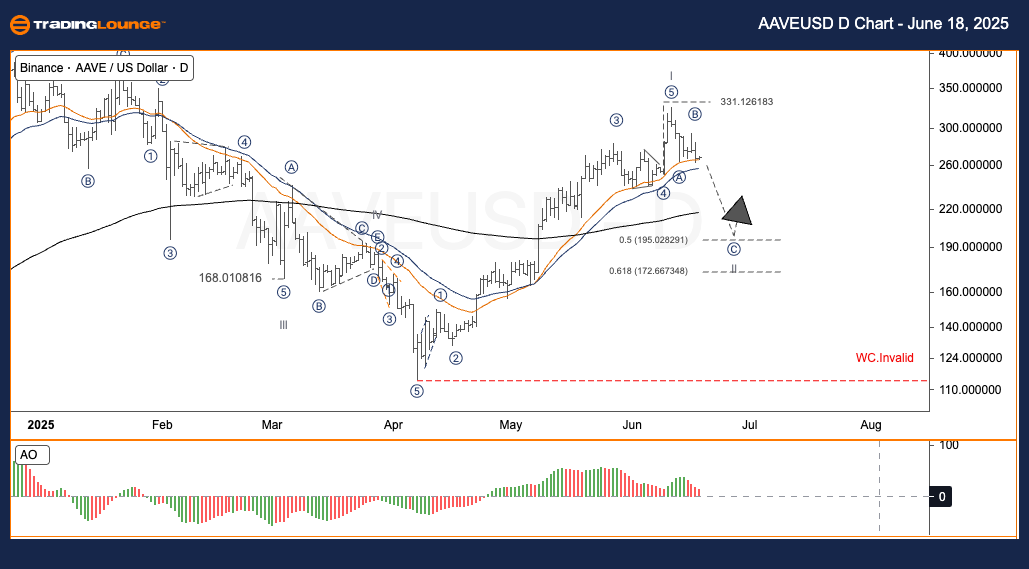

AAVE/USD Elliott Wave Technical Analysis (Daily Chart)

- Function: Counter Trend

- Mode: Corrective

- Structure: Not Applicable

- Position: Wave 2

- Invalidation Level: $116

Analysis Summary:

Following the end of its Wave V downtrend near the $50–$60 zone in April, AAVE/USD began a strong recovery, forming a complete impulsive move up to Wave I, which peaked at $331.12. Currently, the price action is showing weakness, which aligns with the onset of Wave II, typically seen as a pause and correction phase before a longer-term Wave III uptrend emerges.

AAVE/USD Trading Strategy (Daily Chart)

- Short-Term Swing Trade Strategy:

✅ Look for a reversal pattern in the $195–$172 range as a potential entry zone for positioning with Wave III. - Risk Management:

🟥 The bullish outlook holds as long as the price stays above the invalidation level at $116.

AAVE/USD Elliott Wave Technical Analysis (H4 Chart)

- Function: Counter Trend

- Mode: Corrective

- Structure: Not Applicable

- Position: Wave 2

- Invalidation Level: $116

Analysis Summary:

AAVE completed its V-wave decline around the $50–$60 zone, then initiated a clear uptrend to complete Wave I at $331.12. The current downward movement could be the start of Wave II, commonly a pullback before the beginning of a stronger Wave III bullish phase.

AAVE/USD Trading Strategy (H4 Chart)

- Swing Trade Entry Plan:

✅ Watch for reversal confirmation signals between $195–$172 for a potential long position targeting the next major move. - Risk Management:

🟥 The current wave count remains valid unless $116 support is breached.

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Unlocking ASX Trading Success: Mineral Resources

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, June 17

Elliott Wave Technical Analysis: Shanghai Composite Index - Tuesday, June 17

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more