Why You Should Keep A Close Eye On Your Credit

When the subject of credit pops up in a conversation, some of the most prominent terms discussed in such conversations include items like credit score, identity theft, debt, and mortgage. Yet many forget about the important aspect of keeping a close eye on their credit statements.

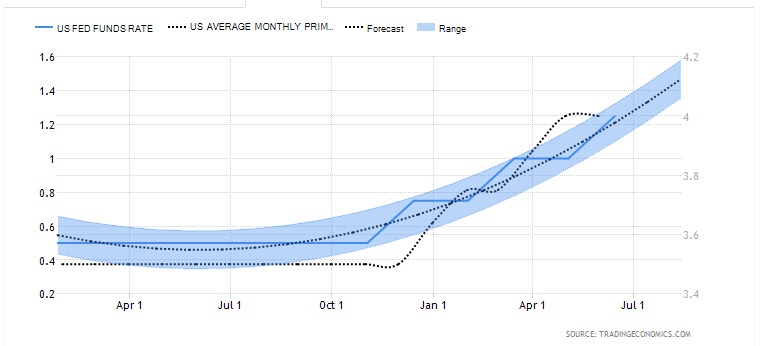

There are many factors that should keep consumers concerned about their credit. One, is the rate at which the federal reserve has been hiking interest rate lately and another, is the rise of cybercrime, which has grown some muscle due to the increasing usage of online payments. Also, the fact that mobile wallets and electronic payments expose consumers to cybercrime does not make credit cards any safer.

As such, credit monitoring has become an important part of every consumer’s money management strategies. It is highly recommended that consumers keep a close eye on every change on their credit statement to ensure that no one is spending on their behalf.

In addition, given the frequency of rate hikes over the last few months, it’s clear that the slow and cautious approach once applied by the Federal Reserve is now a thing of the past. This means that credit card balances, mortgage rates and auto loans could be affected, which in turn could have an impact on consumer credit scores.

With the increasing cases of credit card and identity theft coupled with the rapidly rising lending rates, keeping a close eye on your credit statement can help you to monitor the credit score. As such, you can easily readjust your credit spending to ensure that you do not overburden yourself when it comes to servicing your debt.

Based on recent data, credit card users can expect to pay an additional $1.5 billion this year if the projected three rate hikes are implemented. At the moment, two are down with just the one to go to confirm this level of additional burden to outstanding credit card balances.

Illustratively, according to CNBC, Nerd Wallet published a report recently that estimates the additional credit burden to consumers to be about $6 billion in 2017 following the rate hikes we’ve already experienced compared to a scenario where there were zero rate hikes.

While the federal reserve continues to hike interest rates, the US markets still appear very choppy going into the third quarter of the calendar year. This could be an indication that some investors are still concerned by the potential impact of the rate hike should the economy fail to deliver according to expectations.

Most tech stocks especially the mega players in the market have experienced significant volatility in the last few months. It is hard to tell if they have completely weathered that storm yet. On the other hand, the price of oil currently cannot maintain a smooth curve while the cryptocurrency market continues to woo speculative investors.

All these are major forces in any economy and given the level of their unpredictability, it is hard to tell whether the continuous hiking of interest rates will do the US economy any good.

The credit market has also exhibited signs of concern over the last few months after slowing significantly in April. In March 2017, consumer credit came in at $19.5 billion, but in April, it slowed to just $8.2 billion following the rate hike in March.

It is unclear whether the increment was the main factor behind that slowdown, but with lending rates also rising in tandem with the Funds Rate, it is a sound hypothesis to make. With these rapid increments, consumer credit scores could be affected if not monitored for readjustments especially for those on floating rates.

Conclusion

In summary, there are several factors that can affect the credit score. Some of them are tied to the economy and the overall lending market while others are purely tied to personal spending and sustainable income.

However, it is also good to remember that a person’s credit score can be affected if personal information and credit card details are stolen.

Therefore, it is always good to keep an eye on your credit score to make sure no surprise expense items on your next credit card statement.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

Does getting your credit card stolen affect your credit score if it's been reported? Or only if your identity is stolen?

If your credit card information (including your identity) is stolen and you are unaware of it. Someone else could be spending on your behalf without your knowledge. That could affect your credit score. So it's always good to keep a close eye on your statements and alerts if linked to your phone or email.