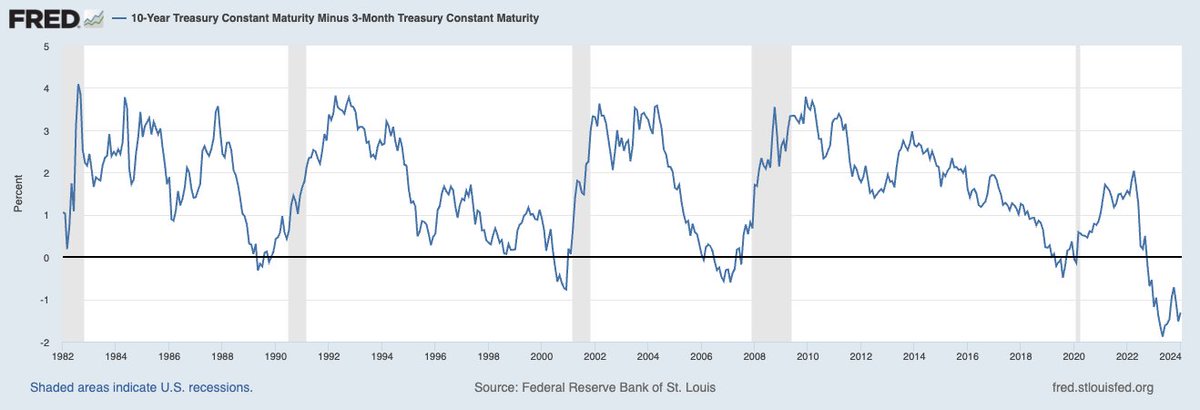

Yield Curve Signals Recession In 2024

The US 10-year Treasury yield has been below the 3-month yield since November 2022 (14 months and counting). As shown below, this rare occurrence has preceded each recession (grey bars) since 1982, with no false signals. As usual, equity bulls perpetually bet this time will be different.

These are complex systems with variable lag times, and being alert for recessions requires attention span, independence, maturity and discipline. However, given the significant financial implications, not staying alert for recessionary signals ends up being much worse in the end. Individuals must decide how to manage their financial risk accordingly.

The economist who first documented the predictive power of inverted yield curves explains the history in the segment below, as well as why a recession is indicated in 2024. Cam Harvey is a Professor of Finance at Duke University’s Fuqua School of Business, Research Associate of the National Bureau of Economic Research (NBER), Director of Research and Partner at Research Affiliates.

Video Length: 00:56:36

More By This Author:

Canadian Home Prices And Rents Amid Much Needed Mean-ReversionEmployment Cycling Down

Outlook Weakening Under Equity Market Optimsm