“Yellen Rebuffs Trump Argument On Dollar Hurting US Manufacturing”

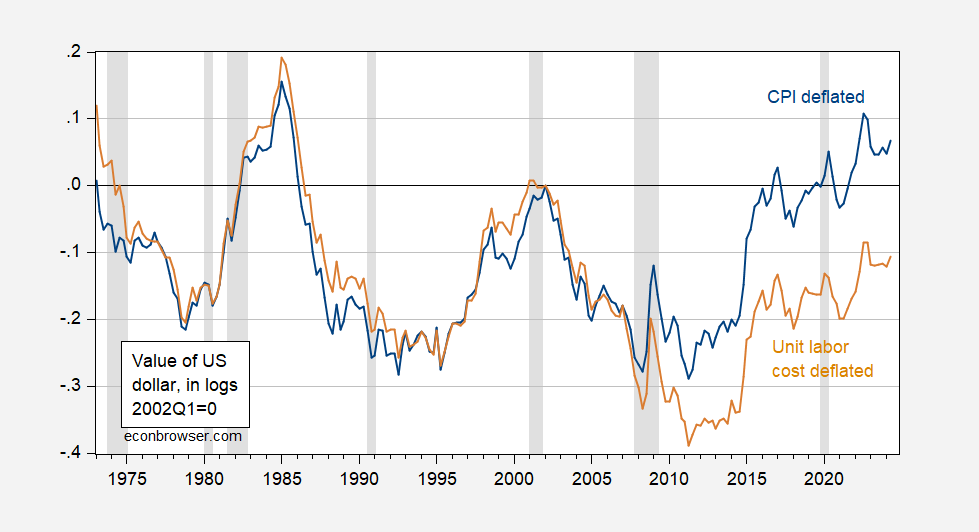

That’s a title of an article by Christopher Condon, in Bloomberg a few days ago. What’s the evidence? Figure 1 shows the typically referenced CPI deflated trade weighted dollar.

Figure 1: CPI deflated trade weighted dollar (blue), and unit labor cost deflated trade weighted dollar (tan). NBER defined peak-to-trough recession dates shaded gray. Source: OECD via FRED.

The unit labor cost (ULC) deflated real exchange rate comes closer to the idea of competitiveness than the CPI deflated (see Chinn (OER, 2006)). That’s because the CPI measures prices of goods and services traded and nontraded, while ULC usually applies to the manufacturing sector (which is likely to be tradables) and the cost of production.

While the dollar hit a trough in 2015Q1 according to both measures, by 2024Q2, the ULC deflated series has only risen 12.4% vs. the 19% recorded by the CPI deflated series. Now, the ULC deflated series only encompasses data countries for which the requisite data is available, so omits for instance China. Nonetheless, Ahn, Mano and Zhou (JMCB, 2020) show that in general ULC deflated exchange rates are the only exchange rates that consistently exhibit the posited behavior regarding trade balances (i.e., appreciation deteriorates the balance).

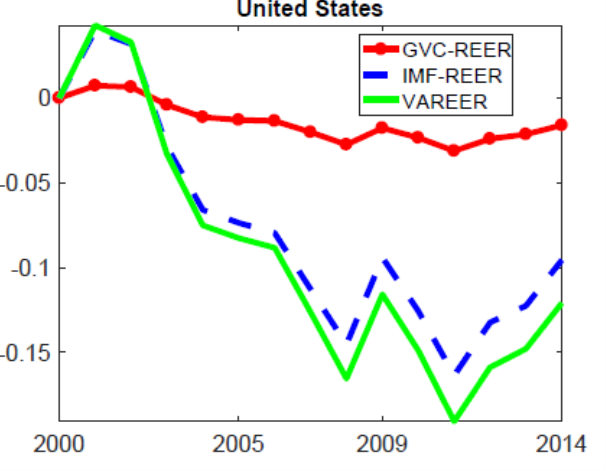

It’s also true that real exchange rates usually use prices or costs of final goods, rather than the value added. Bems and Johnson (AEJ Macro, 2017) calculate such exchange rates. In addition, one might want to take into account global value chains. Patel, Wang and Wei (JMCB, 2019) calculate the value added and global supply chain adjusted real exchange rates, up to 2014.

Source: Patel, Wang, Wei (2019).

The global value chain adjusted exchange rate shows much less variation than the CPI deflated, or even ULC deflated. That being said, the sample ends before the sharp nominal dollar appreciation in 2015.

Finally, it should be noted that whatever policies Trump has proposed — including tax cuts, new tariffs — they are likely to cause greater, rather than less, dollar appreciation.

More By This Author:

GDP Per CapitaInflation Expectations In July (And June)

Russia: Policy Rate Raised To 18%