With Rate Cuts Looming, A Necessary Bit Of Perspective Before Going Into Them

It is sometimes amazing what happens when you add just a little perspective. In some cases, it doesn’t require much at all to do so. One little addendum can upend the entire message, leading you off into entirely different interpretations. The implications can be enormous.

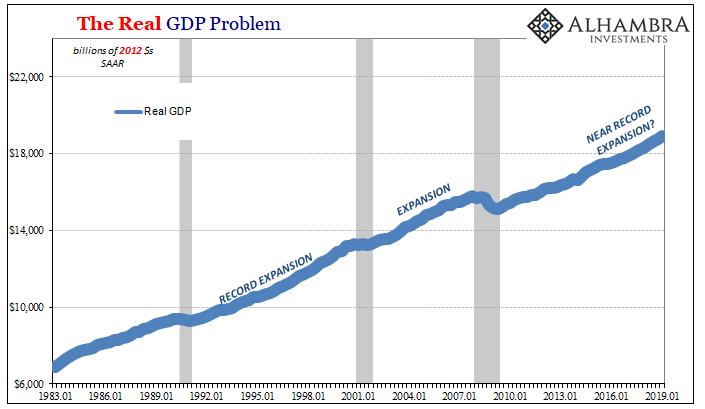

To see what I mean, let’s begin with the basics. Below is what the public is shown, or thereabouts. The economy is booming at record high GDP:

At first glance, even a deeper gaze, it’s next to impossible to see anything wrong or amiss. Even if we add a little extra official color, recession dating, all that does is strengthen the misimpression.

Not only does the economy seem to be booming, it quite clearly has been this way for almost a whole decade. This cannot be something to complain about unless you are some crank conspiracy theorist. Rather, this is cause for celebration maybe even a parade or two. No wonder the unemployment rate appears valid on its face.

The expansion has been going on for so long, why wouldn’t the rate be the lowest in fifty years? There is no legitimate economic criticism to be found above, therefore no one even bothers to challenge the mainstream narrative. Democrats, as well as Republicans right now, are arguing over which President should be given credit; the current one, or the previous one.

But you make one slight adjustment, just one, and, poof, the whole thing changes:

I didn’t change a single thing from the previous chart, adding only that one dotted line.

Now, instead of a boom and record expansion, your eyes are drawn like a magnet to that last recession. Very obviously, something big must’ve happened back then so as to have altered the entire economic course. There was one economic trend before it, one that stretches back almost to WWII, and a very different one afterward.

This can’t be a triviality, nor would it be random coincidence.

You can’t see it without just that little bit of perspective. The bond “bull” roaring back to life, missing inflation, volatile politics, even record low birth rates, all of them fall into this one gap you wouldn’t know was there when not being given the full context.

As such, no Economist nor central banker will draw that line. They have every reason to convince you (and themselves) its not real. This is one big reason why they hate UST’s and eurodollar futures. These curves remind them that, yes, in fact, the gap is very real and in fact, it is all that matters.

We have to always keep the dotted line in mind because the only task anyone should be focused upon is getting back to it. Jay Powell in raising rates says it’s not possible. This economy, the blue line, is the best that can be. And when inflation flares up, it will prove him right.

It’s been years and we are, obviously, still waiting.

Therefore, evidence in data, as well as markets, piles up for the baseline, meaning we have to seriously figure out the way to it. This requires a comprehensive explanation for the deviation in the first place. If you don’t really know what’s wrong, then what? It would be like throwing darts.

Instead, renewed turmoil as is visible pretty much everywhere on a day like today will get lost in the blue. Without that necessary perception, the growing serious pessimism will be misdiagnosed and miscatalogued. The wrong thing will be blamed, again, and therefore nothing substantive will be done toward fixing the real problem.

Right now, the only thing anyone is talking about is trade wars. A few had been thinking rate hikes and QT.

The Federal Reserve at this moment, I’m not making this up, is more worried about its portfolio of UST’s built up under the QE’s and how if it needs to shift to holding more short-term bonds to fight the next recession (way, way off in the future) it might drive up long-term rates (when they’ve been plummeting) by selling what it holds in those maturities.

Here I thought the Bank of Japan was run by clowns.

The last time there was this much turmoil, enough to spoil any positive economic momentum, it was blamed on “overseas” matters or so much oil being produced and pumped it had led to a supply glut.

Before that, Greece and Portugal. Rather than fix what was really wrong, or even bothering to find out, authorities around the world looked to the EU, the ECB, and IMF to bail out those countries and a few others promising to save the euro while doing so. If Greece wasn’t really the problem, then bailing out Greece wouldn’t actually lead back to the dotted line in any economy.

And, of course, the first one was subprime mortgages. If the Great “Recession” was truly about them then the economy would have stayed true to the business cycle; an actual recession. We wouldn’t need the dotted line because it and the blue one would have converged so many years ago it’s hard to imagine.

Subprime mortgages, Greek bonds, an oil supply glut, and now trade wars.

When you add the dotted line, however, you easily see how 2008 wasn’t actually a recession and therefore none of those other things. Some were symptoms, others at most unhelpful distractions. This was a permanent rupture which goes on to illustrate how easy it is to fall into the trap.

It is crucially important because this fourth round, Euro$ #4, is shaping up to be particularly nasty. The rate cuts are coming and relatively soon, lest something change very fast. For that to happen, it would take an epiphany, something miraculous. The lack of the dotted line on any official catalog establishes how there can’t be one, therefore what’s coming will come.

If it does turn nasty, then what might result on the other side of it could be, too. More than economic costs.

I wrote in December 2016, right on the cusp of Reflation #3:

Here, once more, we have to define our terms. Nightmare isn’t a technical term by any stretch, but when considering the context of money and economy it is natural to assume 2008 as that worst case. While that was certainly bad as an isolated circumstance, the real worst case is what followed it and what is now reflected in these eurodollar markets. Not a crash, but a world absent of its end.

If it’s left up to trade wars for blame, which is exactly what’s already happening, then all that will do is guarantee a Euro$ #5 just as “supply glut” guaranteed globally synchronized growth was doomed before it ever began. We are stuck with this up and down cycle, every few years another squeeze while the entire global economy falls further and further behind.

The only way out of it is to realize this isn’t a new thing each time, it’s the same thing every time.

The tragic part is it only takes a tiny bit of added perspective.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

The US cannot be a world leader with the New Normal in place. Only China can lead, as it did out of the Great Recession. But Trump does not want that leadership. Obama did, and we grew slowly. The Fed is happy with the New Normal and is more worried about wages soaring, though they barely do! Driving up long rates is really only a pipe dream with Greenspan's conundrum still firmly in place.