Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself.

Nobel Prize-winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

This neglect of other aspects of the system has been made easier by another feature of modern economic theory – the growing abstraction of the analysis, which does not seem to call for a detailed knowledge of the actual economic system or, at any rate, has managed to proceed without it.

Economists think they’ve solved all the problems worth solving. Debates today revolve around fine-tuning; how we make out models a little bit better. No one ever stops to ask, do we even know what we are doing?

Because Economists have taken over the top jobs at every central bank, and because central banks are the world’s first real beta test of technocratic capabilities, they’ve been handed carte blanche and covered at each and every turn. There’s a lot riding on their success both within and without.

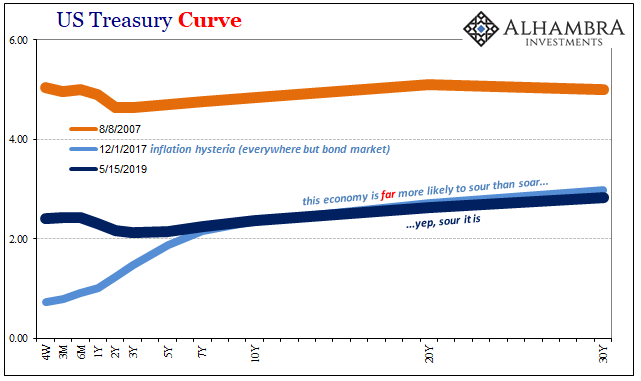

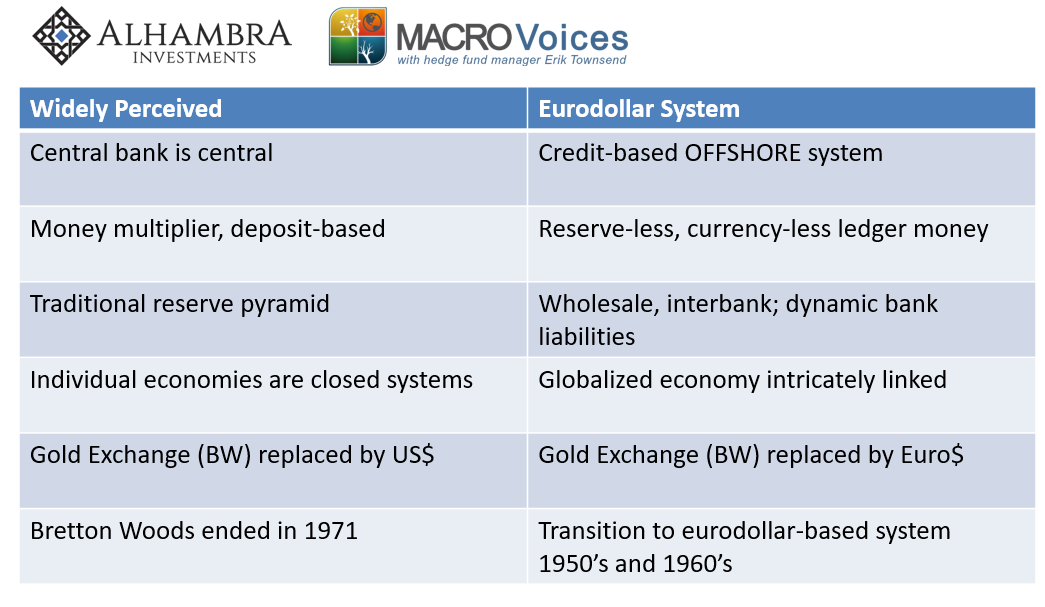

No matter what, central banks are central, they say. This clouds what should be often very straightforward analysis and interpretation. The Fed says rate hikes and inflation. The bond market says something very different. Bonds wrong!

Investors and Federal Reserve officials watch the gaps between shorter- and longer-term interest rates to gauge the health of the U.S. economy. Right now, the two groups are seeing different things.

Even though the article acknowledges how federal funds futures now show a greater than 50% chance of a rate cut in October (2019, not 2020), the guy they pick to quote is quite positive about all this reduced rate benefit.

Lower short-term lending rates could stimulate growth and inflation by making borrowing more attractive, leading the 10-year yield to rise relative to the two-year yield. Mr. Ellenberger said he is betting that the gap between two- and 10-year yields will widen.

The Fed’s pause will work because Economists have all said a Fed pause will work.

Well, maybe not all Economists. Harvard’s Andrew Lilley and Ken Rogoff prepared a paper last month (thanks M. Simmons) for a Hoover Institute conference which may be one of the best, most unintentionally damning treatments of monetary policy you’ll see.

Lilley and Rogoff intended to make the case for NIRP; that is, negative interest rates as a normal feature of everyday central banking. They argue this is necessary because, well, nothing else has really succeeded. The Zero Lower Bound (ZLB) has proven to be, in their view, one increasingly shared, an undefeated menace.

The world needs NIRP ostensibly because the ZLB has so thoroughly hamstrung regular policy proposals like ZIRP and QE. Another way of saying that is ZIRP and QE didn’t actually work. The problem central bankers were confronted with was much larger and more intractable than the one those proposing “quantitative” “easing” had imagined.

Thus, to make their case for NIRP these Harvard Economists have to be honest for once.

The main problem is that zero bound episodes last for years if not decades, making the credibility and commitment problems to promising elevated future inflation (after escape from the zero bound) exceedingly challenging. [emphasis added]

As I’ve written many times before, if you get to the ZLB you’ve already failed and that’s why the ZLB lasts as long as it does – current case included. The ZLB isn’t a trap because of the mathematical reality of positive nominal rates, the ZLB is a trap because it proves something about Economics and those who practice it.

The rest of the paper dances lightly around this very issue. On the one hand, the authors have to acknowledge this harsh reality in order to state their cause for NIRP. On the other, they have to avoid the most obvious conclusion.

The experience of Japan in raising its inflation target to 2% in 2013, accompanied by a large fiscal stimulus, and still failing to raise medium-term inflation expectations, is emblematic.

Emblematic of what, exactly?

Lilley and Rogoff must even deal with the bond market.

…the credibility struggles that major central banks have had in keeping inflation expectations at target over the medium term, arguably greatly exacerbated by investor skepticism that central banks have the tools to create inflation, even when the situation warrants it.

And there it is. Do “central banks have the tools to create inflation?” The bond curve has resolutely said, NO. This was the hard-earned lesson of 2011 as well as 2014; or what Richard Fisher inadvertently though correctly highlighted in 2013 as a massive monetary head fake.

But that’s not really what these Harvard types are arguing. They are saying that the ZLB creates a new situation where the old tools, which aren’t very old, just aren’t enough. New tools like NIRP (or a higher inflation target, which Lilley and Rogoff find problematic) are demanded in part because the bond market has questioned central bank effectiveness.

Take the gloves off, central bankers just need to prove themselves freed from all constraint.

All the evidence keeps pointing instead to the one place they will never look – they really don’t know what they are doing. If being stuck at the ZLB lasts for years even decades most normal, honest people would think this way if it wasn’t for the unnecessary mathematical complications Economists have piled on top of what should be straightforward analysis (what Coase was saying).

If you fail year after year, decade after decade, maybe the issue is not what tools you need for your toolkit, the problem is very likely you. Economics, as it is today, leaves Economists no way out, no way to check their most basic assumptions because they’ve been carved into Economic “law” by the Great “Moderation” even though the Great “Moderation” was built upon nothing more than “good luck.”

It is absolutely absurd. This is all astrology, or, as I called it three years ago, magic number theory.

In other words, this is no time to be timid because everything that he [Paul Krugman] and others like him promised didn’t work, which to them means that it didn’t work because it wasn’t big enough even though when they planned what didn’t work they said then that it was bigger and better than the time before that. There is apparently no economic ill that the “right” amount of policy can’t fix, even if that ill is policy. Unfortunately for the world, economists obviously aren’t permitted to know what the “right” amount of policy is until they actually see whether what they did do was it (I am not making this up). Why not just dispense with the façade of science and discipline and just throw darts? It’s as likely as what they are doing now to come up with the magic number answer.

If it takes you eleven, nearly twelve years to figure out after rounds of QE and the like that you now might need NIRP, then you don’t really need NIRP. You need to start all over from the beginning.

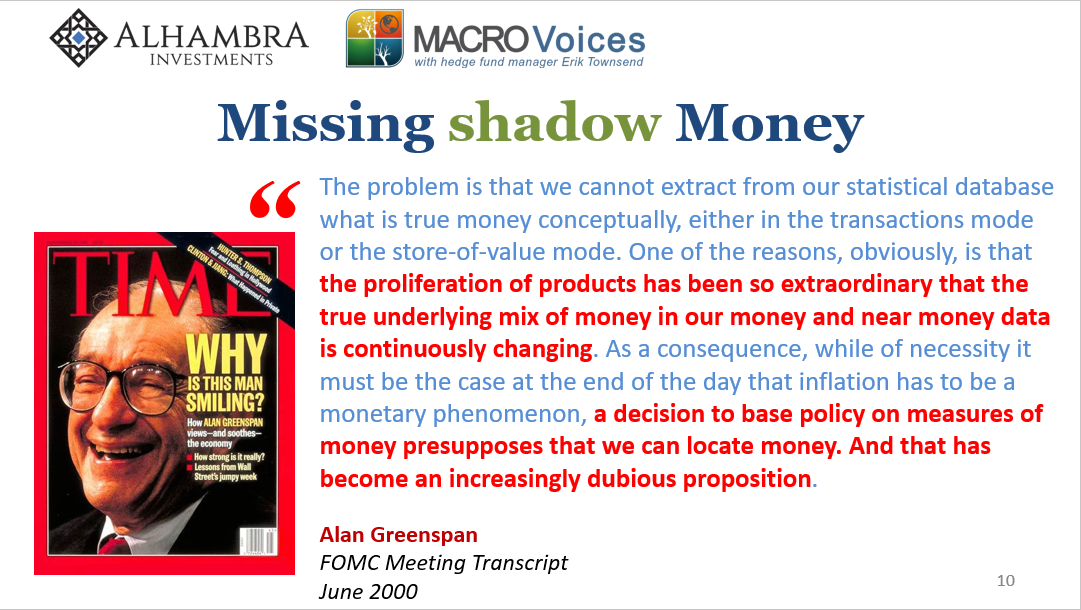

It really is a simple thing in the end. If you can’t define money as a central bank, and you haven’t even bothered trying for decades, how the hell would you even know the system has a monetary problem? Even if you did manage to figure out there was one, where would you even begin trying to fix it? Like throwing darts.

Somehow, though, I doubt Ben Bernanke and Alan Greenspan will call a press conference tomorrow and confess that they’ve been in the dark about the monetary system for four and five decades. Then again, like Lilley and Rogoff, they still don’t think it matters.

The bond market knows better.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more