Tuesday, September 10, 2024 7:44 AM EST

The Federal Reserve is on the brink of initiating a rate-cutting cycle, with short-term interest rate (STIR) markets pricing in four full rate cuts by year-end. For this to unfold, one of the remaining three Fed meetings must deliver a 50 basis point (bps) rate cut. As of now, STIR markets assign a 36% probability that the September 18 meeting will feature a 50bps cut.

The latest Non-Farm Payroll report on September 6, while initially stirring the market, did not significantly alter the probability of a 50bps cut once the dust settled. That said, the upcoming Consumer Price Index report may hold the key. Should we witness notably weak CPI data, the USD could weaken, and stocks might benefit, as this would leave the door open for the anticipated 50bps rate cut.

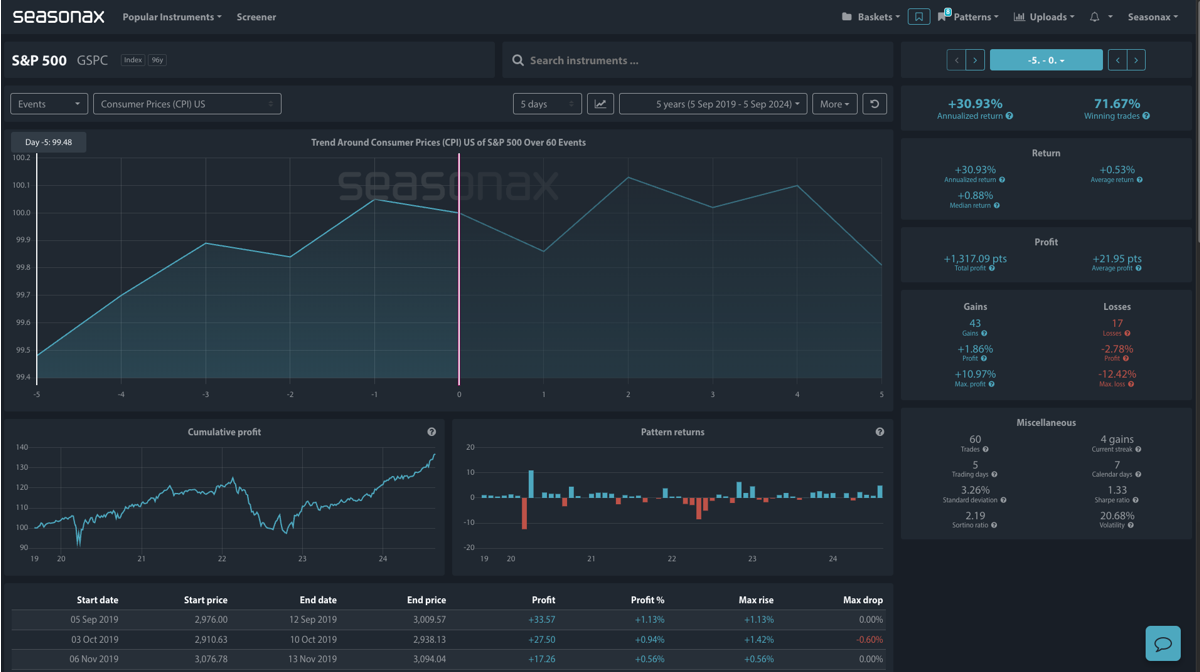

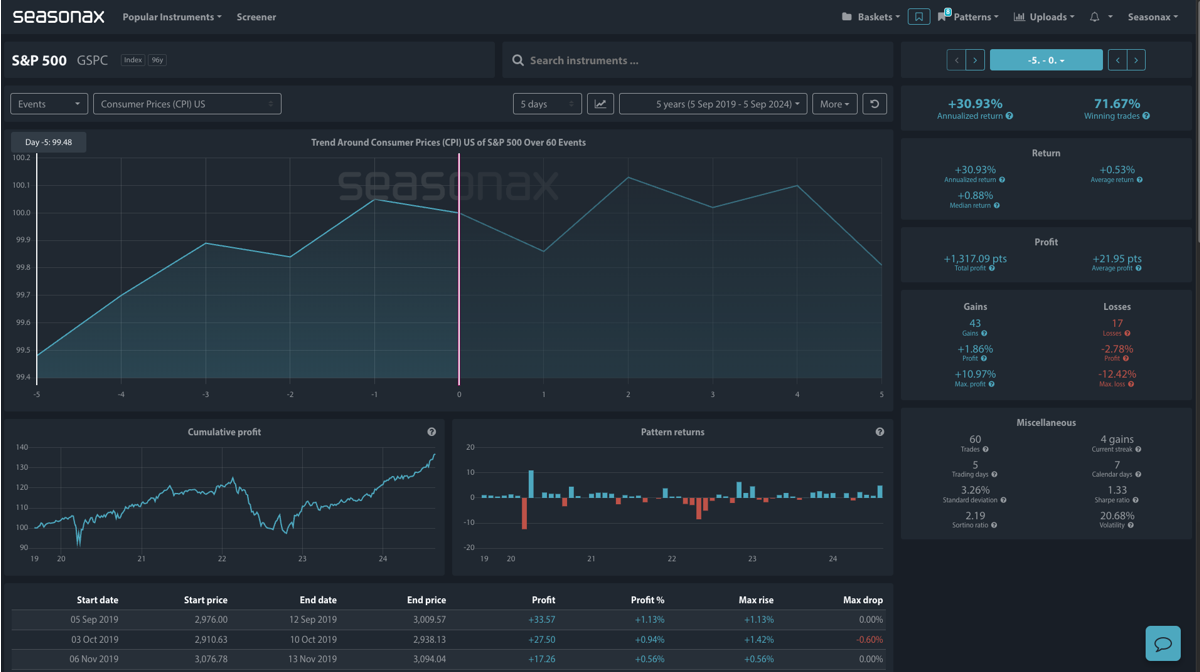

Historically, the S&P500 has shown strong performance around the CPI release, with a median return of +0.88% and a total profit of +1,317 points across 60 events. This five-day period around the CPI event has been profitable 71.67% of the time, showcasing an annualized return of +30.93%. Gains have been particularly robust, with a maximum profit of +10.97% and a maximum rise of +1.86%, indicating the potential for a positive stock reaction heading into the CPI event if an underperformance is expected.

(Click on image to enlarge)

So, will the US CPI print lift the S&P500? The next major support level for the S&P500 sits along the bottom of the second trend line around the 5300 region

(Click on image to enlarge)

More By This Author:

The Weakest Month Has Begun!

Bailey To Buckle The FTSE 100’s Recent Run?

Is Gold’s Run Coming To An End In September?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.