Will The Supreme Court Rule Against Trump’s Tariffs?

The answer is pending as early as tomorrow (Friday, Jan. 9), when the High Court is expected to issue rulings, which could include a decision on the legality of President Trump’s global tariffs. Hanging in the balance: the potential for billions of dollars in tariff refunds, along with a major setback for Trump’s use of presidential authority over trade policy. Add in a hefty dose of confusion about the implications for markets and the economy and it’s clear that Supreme Court’s decision on tariffs could be a significant event that reverberates through the months and years ahead.

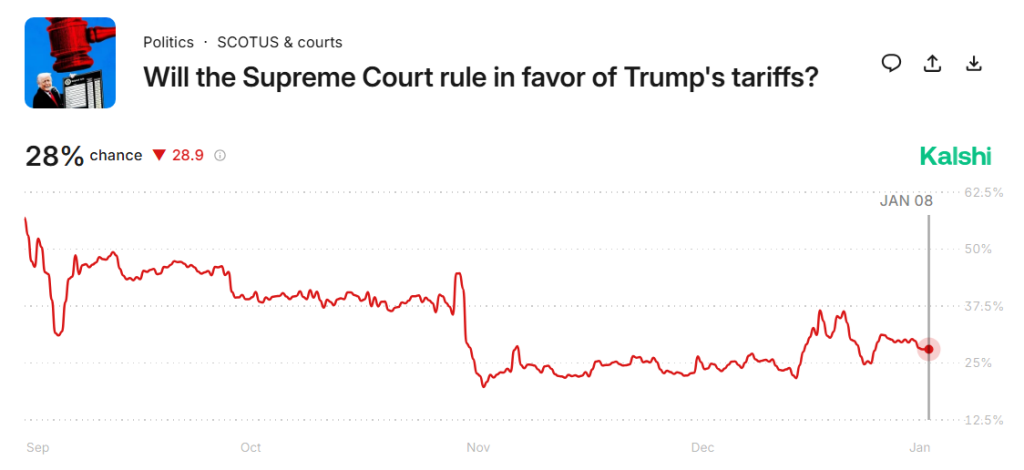

Betting markets are pricing in low odds the court will rule in Trump’s favor. At the betting site Kalshi, the crowd is pricing in 28% chance that the President will win and continue to wield near total control over US tariff policy by invoking the International Emergency Economic Powers Act on imported goods. Polymarket’s current estimate is lower, trading at 24% this morning.

A court smackdown on Trump’s tariffs would be a blow to the administration’s economic playbook and mark the biggest setback for the President’s agenda. A warning shot for the White House arose on November 5, when several Court justices raised doubts about the legal integrity of Trump’s use of emergency power to impose tariffs. As Politico reported at the time:

Chief Justice John Roberts questioned why Trump believed he had the authority to impose tariffs under a nearly 50-year-old law, the International Emergency Economic Powers Act, that has never been used for that purpose.

Tariffs are a form of taxation and “that has always been the core power of Congress,” Roberts said. “So, to have the president’s foreign affairs power trump that basic power for Congress seems to me to kind of neutralize between the two powers, the executive power and the legislative power.”

The President recognizes the high stakes for his economic agenda, writing in a social media post on Friday that a ruling against his tariff policy would be a “terrible blow” to the US.

According to a Reuters report, over $133.5 billion in tariffs might have to be handed back. In that case, a tsunami of questions would emerge about when the money is refunded, how it’s paid, and what replaces those policies? There’s also the issue of how tariff refunds affect the federal budget deficit.

Perhaps the biggest uncertainty is the effect on the economy.

“If the tariffs are here to stay, then I would expect this leads to more price increases to come by those who have, for now, held back and not changed prices yet because they’re unsure about the permanence of these tariffs,” Felix Tintelnot, a professor of economics at Duke University, told ABC News in November.

Alternatively, “If we remove these tariffs, it would reduce the inflationary pressure and that might give the Fed more room to cut interest rates than if we kept these tariffs for longer,” Tintelnot said.

More By This Author:

Markets Barely Blink After U.S. Removes Venezuela’s Maduro

US Economy Expected To Cool In Q4, Based On Latest Nowcasts

Total Return Forecasts: Major Asset Classes - Monday, Jan. 5