Will Sticky Core PCE Inflation Ease In Months Ahead?

The Federal Reserve left interest rates unchanged in yesterday’s policy announcement, marking the first time the central bank has not lifted rates since the hiking cycle began in March 2022. But Fed Chairman Jerome Powell was careful to advise that more hikes may be coming.

Speaking at a press conference on Wednesday, Powell said that while “inflation has moderated,” he added that “inflation pressures continue to run high and the process of getting inflation back down to 2% has a long way to go.”

He cited the lack of recent downside bias in core PCE inflation – a key metric for the Fed. “You’re just not seeing a lot of progress, not the kind of progress we want to see,” he said.

Although core PCE has fallen from its 5.4% peak in early 2022, it remains sticky in the mid-4% range. Through April, the most recent month available, the Fed’s preferred inflation yardstick edged up to 4.7%.

“Core PCE inflation, which excludes volatile food and energy prices, is projected to run higher than total inflation, and the [Fed’s] median projection has been revised up to 3.9% this year,” up from the 3.6% estimate published in March, Powell advised.

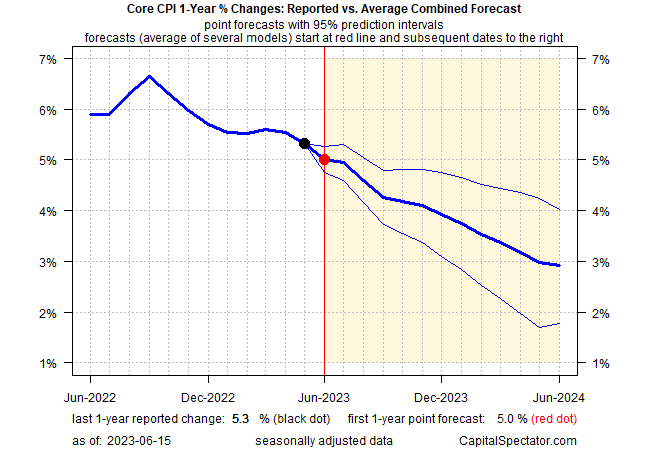

But there are hints that the upcoming PCE inflation data for May will show a firmer downside bias, based on more recently published core inflation numbers for May. As the chart below shows, the year-over-year changes through last month for three core inflation indexes dipped, which suggests that core PCE will ease in May.

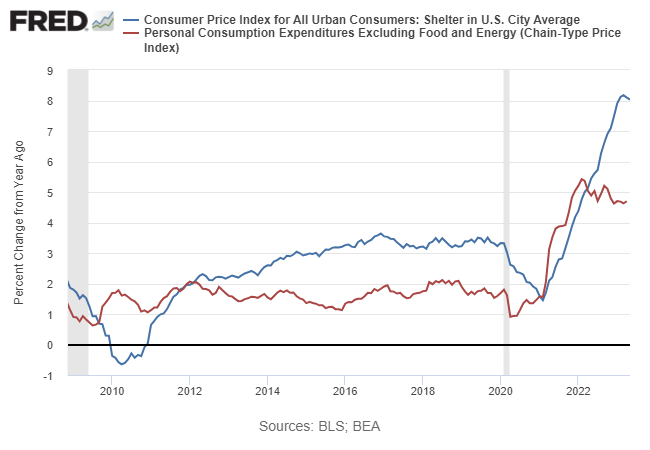

Another clue for expecting core PCE to show a stronger downside bias in the months ahead: housing inflation has recently peaked. Compared with other prices, housing inflation has remained sticky at elevated levels. But this corner has finally started showing signs of rolling over. After peaking in March at an 8.2% year-over-year pace, housing CPI has eased for two straight months, dipping to 8.0% in May.

Meanwhile, CapitalSpectator.com’s ensemble model’s point estimate for core CPI in June will continue to slide, dropping to 5.0% in the upcoming release for June.

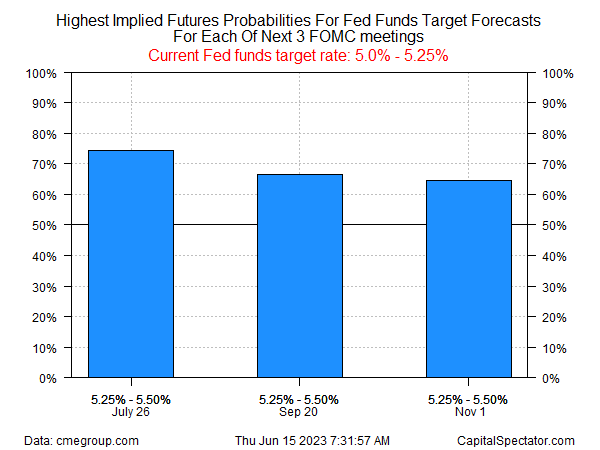

As for rate hikes, Fed funds futures are pricing in a moderately high probability for one more ¼-point rate hike to 5.25%-5.50% which will be the last for this cycle.

“The main issue that we’re focused on now is determining the extent of additional policy firming that may be appropriate to return inflation to 2% over time,” Powell explained in yesterday’s press conference.

The next round of inflation reports for June may be decisive for defining “appropriate.”

More By This Author:

10-Year US Treasury Yield ‘Fair Value’ Estimate: Wednesday, June 14

Bear Market Persists For Commercial Real Estate Stocks

Risk Assets Rallied Last Week As US Bonds Eased

Disclosure: None.