Risk Assets Rallied Last Week As US Bonds Eased

Buyers pushed up prices for most of the major asset classes last week. US bonds were the downside outliers, based on a set of ETFs through Friday’s close (June 9).

Government fixed-income markets in emerging markets led the rallies. VanEck JP Morgan EM Local Currency Bond ETF (EMLC) rose 1.3% last week, ending the session at its highest weekly close in nearly 1-1/2 years. The fund continues to show an ongoing bullish trend that began in late-2022.

Stocks in emerging markets were a close second-place winner last week, although the recent trend for these equities looks substantially weaker vs. their fixed-income counterparts. Vanguard Emerging Markets Stock Index Fund (VWO) rallied for a second week, but continues to trade in a range in 2023.

All the major asset classes gained ground last week with the exceptions of US bonds. Inflation-indexed Treasuries (TIPS) and a broad measure of investment-grade fixed income (BND) edged lower.

The Global Market Index (GMI.F) rose for a second week, gaining 0.4%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

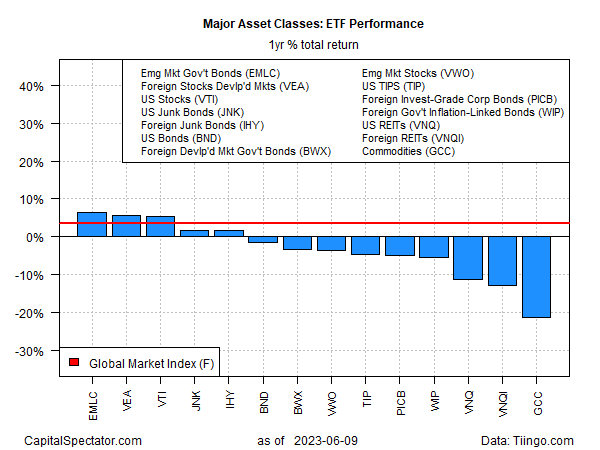

Emerging-markets bonds are now leading the major asset classes for the trailing one-year return. EMLC is up 6.4% vs. the year-ago price. A handful of other markets are also posting one-year gains, including US stocks (VTI) via a 5.5% increase over the past 12 months.

Most markets, however, are still nursing losses for the past one-year trend. The deepest cut is in broadly defined commodities (GCC), which are under water by more than 20%.

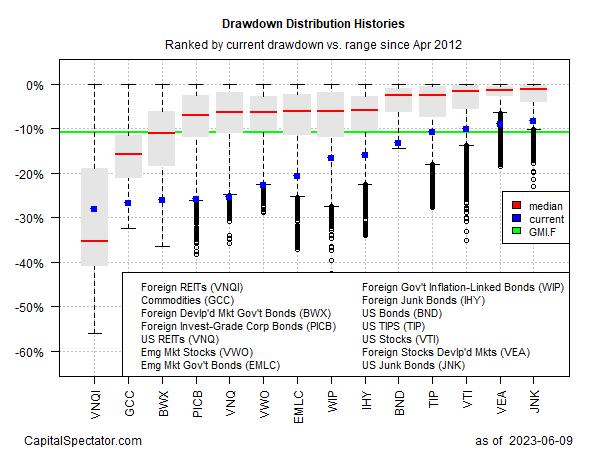

Despite recent strength, most of the major asset classes are still posting relatively deep drawdowns. The deepest: foreign real estate shares (VNQI), which ended last week with a 28.1% peak-to-trough decline.

More By This Author:

World Bank: Global Growth Will Continue To Slow In 2023Is It A New Bull Market Yet?

Tech Is The Hot Sector For Stocks So Far In 2023

Disclosure: None.