Will A Demand-Side Shockwave Keep Inflation Muted?

It’s no small thing when a massive, supply side shock wreaks havoc across the global economy. Economic theory predicts a sharp rise in prices from such events. All else equal, if supply drops, prices are expected to rise. But all else has been far from equal in the coronavirus crisis of 2020.

As a first step in quantifying the demand shock that’s been unfolding in the economy, consider the change in the US personal savings rate. Since 1960, savings as a percentage of disposable personal income has ranged from roughly 3% to 15%, holding within a 5%-to-10% range since 2010. But that was before the coronavirus. In April, the savings rate skyrocketed to 32%. The rate pulled back in May to 23%, but that’s still far above the historical range.

What are the economic implications for a sudden surge in saving? One possibility: the change reflects pent-up demand that, once unleashed, will generate strong upside pressure on prices, which in turn will fuel higher inflation. That’s a relatively positive scenario in terms of the economic outlook because it suggests that the recession will soon fade as consumers begin spending again.

But that’s a textbook analysis that faces a number of real-world complications, starting with the obvious one: coronavirus. America continues to struggle with managing Covid-19 and so the prospects remain unclear for the timing of a return to something approximating normality.

One of the critical pieces of blowback is the high rate of newly unemployed workers. Initial jobless claims have been rising by an usually high one-million-plus every week for months. The trend suggests that the forces of demand destruction in the consumer sector aren’t about to fade in the foreseeable future.

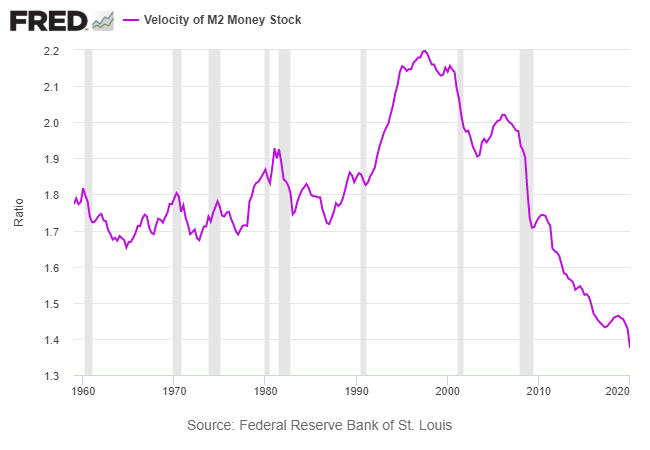

It’s also important to recognize that even before the coronavirus crisis there was a long-running disinflationary bias coursing through the US economy. Consider the history of the velocity of the money supply (a measure of the rate that money is exchanged), based on M2 money stock. A downside trend has been in force for most of the past two decades and there’s a good case for assuming that the coronavirus shock has only strengthened the slide.

A key factor for the relatively low and declining rate of inflation is bound up with the secular fall in M2 velocity. To understand the power of this trend on pricing it’s useful to consider that the Federal Reserve has spent the past dozen years moving monetary heaven and earth to support inflation. The results so far: inflation remains moderate.

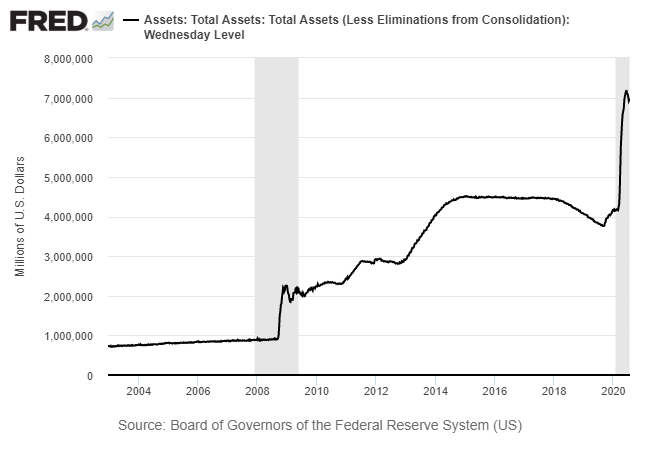

Inflation hawks expected otherwise. One factor that’s been widely cited on this point: the Fed’s balance has exploded skyward in recent years. The first major spike came in the 2008-2009 financial crisis, but that shocking change paled in comparison to this year’s massive expansion of the balance sheet.

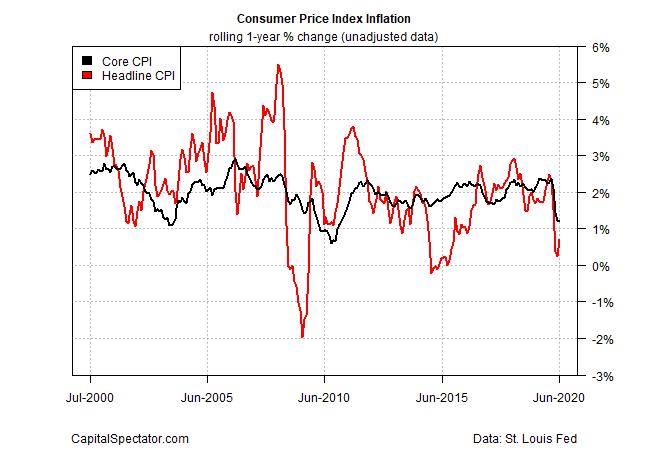

Inflationistas worried that in the wake of the 2008 financial crisis the surge in the central bank’s asset holdings would lay the groundwork for a sharp rise in inflation. That turned out to be widely off the mark. The core rate of consumer price inflation, for instance, has remained (mostly) stable over the past decade at around 2%, the Fed’s target. Note, however, that core CPI has stumbled recently. Is this a sign that disinflation/deflation risk is heating up? Unclear, but the possibility seems to be rising.

It’s extraordinary that inflation has remained tame in an era of aggressively dovish monetary policy – a policy that’s been in force since 2008!

The coronavirus almost certainly will extend the Fed’s policy of keeping interest rates lower for longer and for maintaining other stimulus policies.

“We are committed to using our full range of tools to support our economy in this challenging environment,” Fed Chairman Powell said yesterday. He also advised that “the path forward for the economy is extraordinarily uncertain and will depend in large part on our success in keeping the virus in check.”

Unfortunately, there’s little sign that the US has turned the corner on Covid-19 management. The latest data (through July 29) shows a worrisome rebound in the rate of fatalities while the daily change in reported cases remains near a record high.

The counterargument is that in contrast with the 2008-2009 financial crisis, prices aren’t widely collapsing. House prices, for example, continue to rise. In addition, government fiscal policy has been much more aggressive with respect to stimulus vs. the Great Recession.

For these and other reasons, there’s a reasonable case for thinking inflation risk could rise in the years ahead. But so far, markets aren’t pricing in that risk and it’s debatable if a substantial change in sentiment any time soon is likely. Indeed, real Treasury TIPS yields are deeply negative, a sign that pessimism about the economic outlook continues to resonate.

In the current scenario, the conflicting forces pushing for higher and lower inflation still look set to favor the latter. That could change, of course, and perhaps quickly. When and if that change arrives it’ll be obvious in market and economic data. But for the moment, expecting a surge in inflation is a speculative affair. Until further notice, demand destruction appears set to prevail and quite possibly overwhelm the effects of a supply side shock.

Disclosure: None.

The economy would be healthier if wealth was distributed more evenly and if the middle class was larger. That said, inflation is not a concern yet because of falling demand and lower consumption. Most excess money is going into further asset inflation which tends to create bigger wealth disparities.

Deflation will accelerate when stimulus ceases.

Definitely an interesting post. And an explanation of why inflation has not already taken off. And the explanation makes sense if I understand it, I suppose. But the reasonably rational logic states that creating lots more available money will bid up prices is based on a lot of examples where it did just exactly that. So it is a reasonable expectation, even if it is wrong. So now the question becomes who is correct?

But the part about "the velocity of money" brought out a term that I was not familiar with at all. Oh Well.