Why Stagflation Is Not In Our Future

We know that the recovery path from this economic collapse will be slow, but will it be accompanied by inflation? Stagflation is the combination of inflation with very weak economic growth. Some prominent bond fund managers are looking at the 1970s for clues for what we can expect in the coming years. [1] A decade of stagflation ended with the drastic measures by the Federal Reserve, starting in 1980, to kill inflation by a series of interest rate increases that reached into the high-teens. Other pundits stress that the current supply disruptions, due to the pandemic, have so heavily impacted manufacturing that supply constraints are adding to aggregate price pressures. Lastly, we constantly hear arguments that the unprecedented surge in government debt must ultimately force governments to inflate to ease their debt burden.

Unquestionably, supply chains in all manufacturing have been seriously disrupted because of the loss of Asian output and the drop off in world trade volumes. Yet, these disruptions will, in time, be minimized as Asian industries increase production, and domestic industries in the US and Europe slowly step up their operations. Granted, there is real concern there will be continuous disruptions as nations grapple with issues of opening up their economies while COVID-19 continues to spread. The most recent consumer price data indicates that demand remains weak. US savings rates have soared since the initial lock-downs and it is now in the range of 20%-25%, well above the historic range of 5%-10%. Supply may be disrupted, but overall demand is not supported of the argument that inflation is brewing.

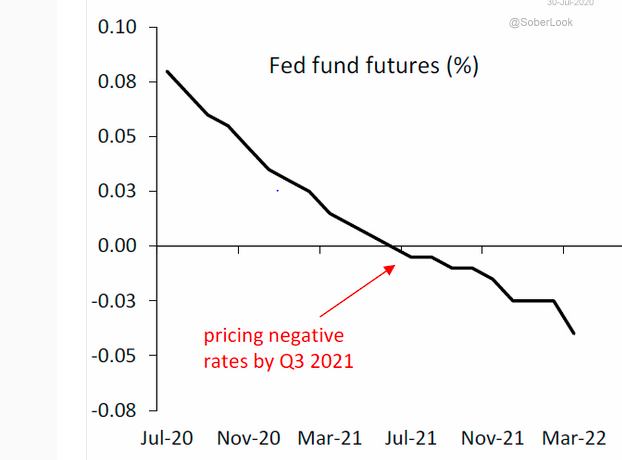

Today, we have a “deflationary” gap. The gap is a measure of how far an economy is operating below its potential. After the 2008 financial crisis, it took nearly a decade for the US to close the gap between its actual performance and its potential. This was the longest amount of time to eliminate a deflationary gap in the post-WWII era. Even as the gap was closing, the inflation rate continued to trend downward, remaining below the official target rate of 2%. The deflationary gap is evident in the credit markets, as the Fed fund futures are pricing in negative interest rates a year from now. While the central bank is balking at introducing negative interest rates, the bond market is heading in that direction. With the US Treasuries under 2-years trading at 0.10%, it would not take much worse economic data to push short-end yields below zero.

(Click on image to enlarge)

Source: WSJ, July 30, 2020

There is an argument that high debt levels will ultimately force governments to seek ways to pay for the debt through inflation. However, research by a host of economists, starting with Kenneth Rogoff and Carmen Reinhart, have demonstrated that the adverse affects of rising debt/GDP ratio only contribute to further deflation. Rising debt levels suppress economic growth in a non-linear way. As Lacy Hunt so aptly put it (https://hoisingtonmgt.com/pdf/HIM2020Q2NP.pdf ]

Considering the depth of the decline in global GDP, the massive debt accumulation by all countries, the collapse in world trade, and the synchronous nature of the contracting world economies the task of closing this output gap will be extremely difficult and time-consuming. This situation could easily cause aggregate prices to fall, thus putting persistent downward pressure on inflation which will be reflected in declining long dated U.S. government bond yields

[1] https://webmail.bell.net/appsuite/api/mail/Dan%20Fuss_%20Prepare%20for%201970s-Style%20Inflation%20-%20Loomis%20Sayles.pdf?action=attachment&folder=default0%2FINBOX&id=140157&attachment=2&delivery=view

This is an interesting point of view. Certainly any recovery will be slow and take a while, since we have not yet seen the worst of what this plague has to deliver.

How would the population or the economy do if half the people are gone??? That is a serious question, isn't it?

And now a brutal question for "the Fed": Why is it so important to have constant inflation??

It is not a matter of the constant inflation rate that is a concern. The rate is slowing down...or disinflation. This is what scares the Fed because it moves further away from their target. Disinflation is very insidious and affects everybody's decisions regarding consumption or production

OK, and that does make a lot of sense. But the herd of angry elephants in the shadow is that massive amount of debt that will need to be paid eventually, by somebody. My thinking is that it will be the large burden on the backs of folks not even born yet,

The payment without getting any goods in return will certainly be a big dampening element that will have a lasting effect that will undoubtedly slow any and all recovery. And it is the efforts to speed the recovery to aid their friends that the fed will be wanting to fuel inflation, with no concern as to the damage inflation will inflict on those not in that top few percent.

With interest rates at 0% and possibly going negative there is no real burden to carry the interest cost indefinitely.

The FED will continue to buy the debt and will not present it to the treasury department for payment but will just accept a reissuing of the debt by the treasury department and continue that indefinitely. So there really isn't a day of reckoning. Governments don't die and that's why comparison between an individual and government is not valid in this case

Interesting article and comments, thanks.