Why Have US Import Prices From China Been Relatively Stable?

“The continued stability of import prices for goods from China means U.S. firms and consumers have to pay the tariff tax. In annualized terms, U.S. tariff revenues were roughly $40 billion higher in the third quarter of 2019 relative to the second quarter of 2018, before the China-specific tariff hikes. This is considerably below what might have been expected. USTR estimates had a tariff hike of 25 percentage points on $250 billion of Chinese goods as of June, pointing to a $62 billion increase in annualized revenues. (The additional tariff hike imposed in September would push this figure higher.) The shortfall in duties is largely due to a steep drop in purchases of the affected goods. Detailed data show imports of goods hit by tariffs have declined by an annualized $75 billion since the second quarter of 2018, while imports of non-tariffed goods have been roughly stable.” - (Liberty Street Economics, Who Pays the Tax on Imports from China?, November 25, 2019)

The steep U.S. tariffs on most Chinese goods have had a puzzling lack of influence on import prices, raising questions about who exactly is paying the lion’s share of higher duties.

In May of last year Liberty Street Economics published an interesting article that highlighted that despite higher tariffs on Chinese goods, the prices on imported goods from China remained relatively stable.

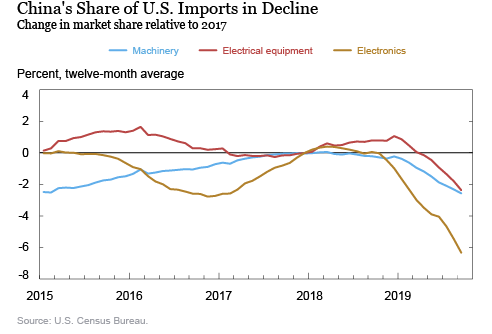

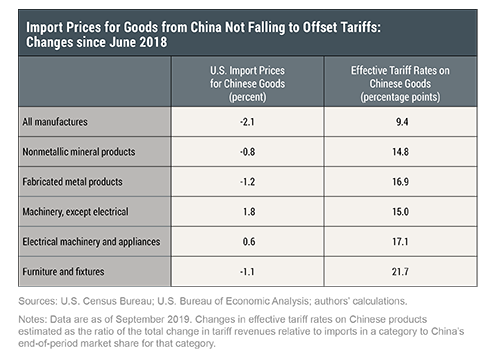

As can be seen in the chart below, the average price on goods imported from China fell by only 2% in dollar terms between June 2018, just before the first tariffs were imposed, and September 2019.

The actual import price drop was a small fraction of the amount required to offset the increase in tariff rates.

At the same time, the prices on goods purchased from Mexico and the so-called Newly Industrialized Economies (South Korea, Taiwan, Singapore, and Hong Kong) had also declined by roughly the same amount, suggesting that this small drop in price is the result of general market conditions rather than the increase in tariffs.

The Trump administration launched its first broadside against China in July 2018 with a round of tariffs. Duties up to 25% were levied on some $370 billion in imports, encompassing most Chinese goods sent to the U.S. market each year.

How do the US tariffs work? China’s government and companies in China do not pay U.S. tariffs directly. Tariffs are a tax on imported products and are paid by U.S.-registered firms when goods enter the United States. Tariffs are collected when Chinese products enter ports in cities such as Los Angeles, Miami, and Savannah, Ga. They are paid by the U.S.-based companies that receive the goods.

As the Fed article observed, Chinese firms could have cut prices to ease the financial burden on their American importers, but the price reduction would have had to equal about 20% to fully offset the effects of a 25% tariff.

Instead, China’s prices have fallen only 2% since the tariffs were first imposed. “This drop is a small fraction of the amount required to offset the increase in tariff rates,” the New York Fed article said.

As well, the Chinese currency has declined about 10% in value versus the dollar since tariffs were enacted. So Chinese suppliers could in theory cut prices they charge U.S. importers by the same amount to relieve the harm.

Why haven’t Chinese firms cut prices more deeply to protect against the loss of U.S. market share?

Importers often pass the costs of tariffs on directly to customers - manufacturers and consumers in the United States - by raising their prices. U.S. business executives and economists have concluded that American consumers foot much of the tariff bill.

That was why, immediately after Trump announced his tariffs, U.S. retailers sounded the alarm that it was another tax increase on American businesses and consumers

In closing, it appears that America’s businesses and consumers are bearing the biggest direct cost of billions in dollars in U.S. tariffs.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)