Weekly Market Pulse: Jerome Powell, Tough Guy

Jerome Powell wants everyone to know that he’s read Paul Volcker’s autobiography, “Keeping At It”. He has used this phrase repeatedly since Jackson Hole, apparently believing that he needs to channel Mr. Volcker’s gruff demeanor in order to get markets to do what he thinks they should do. He and others on the FOMC were not pleased with the stock market rally off the June lows – and made sure their displeasure was reported by the press. Neil Kashkari went so far as to say he was “happy” to see stocks go down after Powell’s JH speech.

I could be wrong but I don’t think Paul Volcker ever talked about the stock market when he was Fed Chairman. At one time, the Federal Reserve ignored the stock market with all its might. It was Alan Greenspan who changed that in December 1996 with his famous “irrational exuberance” speech. Here’s the part everyone remembers:

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

— ”The Challenge of Central Banking in a Democratic Society”, 1996-12-05

Paul Volcker is rightly praised for having the guts to kill the inflation of the 70s with punishingly high rates in the early 80s. But if you consider his entire record as a central banker, you’d probably look elsewhere for a role model. He did finally get it right but he made a lot of mistakes first, probably because the understanding of economics was being turned on its head at the time. Stagflation wasn’t supposed to happen; the Philips Curve turned out to be an illusion of a free lunch. Volcker ended up using the bluntest tool in the Fed’s toolbox because nothing else he tried worked.

But back to Greenspan’s speech. The irrational exuberance remark got all the press but it wasn’t, in my opinion, the most important thing Greenspan said that day. This speech marks the first time, to my knowledge, that a Federal Reserve Chairman talked about whether monetary policy should consider asset prices:

But where do we draw the line on what prices matter? Certainly prices of goods and services now being produced–our basic measure of inflation–matter. But what about futures prices or more importantly prices of claims on future goods and services, like equities, real estate, or other earning assets? Are stability of these prices essential to the stability of the economy?

Greenspan’s answer was that if a collapsing asset bubble isn’t having any impact on the real economy – such as in 1987 – then a central banker should not be concerned. Then he says:

But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy.

With that in mind, consider this passage delivered earlier in the speech:

If we are to maintain the confidence of the American people, it is vitally important that, excepting the certain areas where the premature release of information could frustrate our legislated mission, the Fed must be as transparent as any agency of government…To be sure, if we are to carry out effectively the monetary policy mission the Congress has delegated to us, there are certain Federal Reserve deliberations that have to remain confidential for a period of time. To open up our debates on monetary policy fully to immediate disclosure would unsettle financial markets and constrain our discussions in a manner that would undercut our ability to function.

This, to me, is the most important part of that speech and the part that has been forgotten – completely and utterly – by the modern Fed. Their desire to be open, to transmit their feelings to the public about policy, leaves them vulnerable to the temptation to manipulate markets to achieve their policy goals. The release of their projections of future policy and economic variables does indeed “undercut their ability to function”.

Jerome Powell believes he should consider stock prices as part of the Fed’s mandate because Alan Greenspan told him so. But he ignored Greenspan’s other advice – to keep the deliberations of the FOMC confidential for some period of time. His performance at the press conference last week and the release of the SEP (Summary of Economic Projections) was market manipulation pure and simple. And it seems more likely to undermine rather than enhance the Fed’s mission of reducing inflation in a controlled manner.

Greenspan also talked about the use of forecasts in the speech and the need to be pre-emptive:

Because monetary policy works with a lag, we need to be forward looking, taking actions to forestall imbalances that may not be visible for many months. There is no alternative to basing actions on forecasts, at least implicitly.

And that is where we come to Mr. Powell’s performance as the Chair of the Federal Reserve. It has been, to be blunt, a miserable one. Where were Mr. Powell’s concerns about the stock market last year when all manner of speculative dreck was going “to the moon”? Where was Mr. Powell’s concern about asset prices when Bitcoin, a purely speculative asset that has yet to find a purpose after trading for over a decade, was hitting $65,000? Where was his concern about asset prices when people were running pump and dump schemes on Redditt (meme stocks)? Where was his concern for asset prices when house prices started rising at double-digit annual rates and continued to do so for nearly two years?

If that wasn’t irrational exuberance, what the hell is? And if that kind of rank speculation doesn’t deserve a monetary response, what does? Is there any evidence whatsoever that today’s stock prices have anything at all to do with the consumer inflation we’re experiencing? They are both borne of the Fed’s inflationary policies but they don’t have the same reaction times. Stock and commodity prices react immediately while it takes time for the changes to be reflected in consumer prices. It seems pretty obvious that the reverse is true as well; a tightening of policy is felt by stock and commodity prices first. Surely that is nothing more than common sense and one can’t help but wonder why the people who work at the Fed seem to have none.

It may well be that some stock prices are still too high. We made the determination a year ago to get out of the S&P 500 because it was, in our opinion, so egregiously overvalued that it was un-investable. While it has come down since then, we still don’t find it compelling at 2.7 times sales. But that doesn’t mean that all stocks are overvalued. Small and mid-cap stocks are more than reasonably priced at 0.8 and 1 times sales (S&P 600 and S&P 400 respectively).

But when Jerome Powell makes it clear that he wants stock prices lower, there is little to no discernment in the selling – everything gets sold. And that is where Mr. Powell has overstepped his bounds by a wide margin. It is not for one man or the small group of people who make up the current FOMC to decide how to value stocks. I don’t disagree with the idea that the Fed should monitor speculative behavior in markets because that is a reflection, to some degree, of monetary policy. But they need to let their actions speak, give their policy changes time to have an effect.

The performance of the Federal Reserve has deteriorated significantly since Alan Greenspan. Bernanke, Yellen, and Powell may be the worst Fed chairs in history. Jerome Powell doesn’t want to become the next Arthur Burns but I think he may be well past that already. He is firmly focused on things that don’t matter and the Fed can’t affect. Rather than look forward, his gaze is firmly focused on the past. He sees a connection between employment levels and inflation that has been repeatedly shown to not exist.

The market didn’t sell off last week because of the change in policy or even the change in projections. It sold off because Jerome Powell stood in front of America and made it plain that he has no idea what he’s doing.

Stocks are now back down to the lows set in June and sentiment is as negative now as it was then. There is a long list of technical items that have hit levels or rates of change we associate with bottoms, short or long-term. Put/Call ratios are higher than they’ve been since March of 2020 when stocks were down even more than they are today. Sentiment surveys show overwhelming bearishness among individual investors. Portfolio managers are sitting on record amounts of cash and allocations to equities are very low. Futures markets still show large speculators with large short positions in the S&P 500 and Russell 2000.

In the end, the market will get prices right regardless of what the Fed does or says. The problem with the manipulation of the Fed is that it impacts the rate of change. Markets can be fragile because they are built on psychology and mass psychology at that; there is nothing so unstable as a crowd of humans. In trying to set stock prices the Fed could set off a cascade that is beyond their control. And all of those won’t be benign like the one in 1987. The Fed is paying with fire and the only way to put it out is for the Fed to do something it hasn’t been able to do since Greenspan left – shut up.

Economic Data

The economic data last week was mostly about real estate and was surprisingly upbeat. Unfortunately, that may not last. Housing starts surprised everyone by actually rising but that was probably due to the drop in mortgage rates in August that proved temporary. The Housing Market Index, a measure of builder confidence, fell to 46 from 49 this month. Current sales conditions are actually still in positive territory at 54 but expectations fell to 46 and buyer traffic to 31.

On the other hand, mortgage applications rose last week despite a rise in rates. More surprising still is that refinance applications rose which raises the question: who exactly is refinancing at these rates? Existing home sales were basically flat in August but at a very low rate; there are still not enough houses on the market. With prices dropping, many potential sellers are renting their houses out instead.

Jobless claims stayed low at 213k but that was the end of the good news for the week. The Conference Board reported that their leading economic indicators fell 0.3% in August, the sixth straight month of decline. The LEI is now down year over year and that is a pretty good indicator of impending recession. The only caveat one can offer here is that the index is falling from a very high level after the much higher than trend growth of 2021.

One last set of reports from last week were the S&P US PMIs. You might remember that these PMIs, especially the services version, have been diverging from the older ISM PMIs. Their US services PMI was reported last month at 43.7, a level that is probably recessionary but contrasted with the ISM version in solid expansion territory at 56.7. Well last week, in their flash readings for September, S&P reported that the manufacturing PMI rose to 51.8 and the services PMI rose to 49.2. Something is wrong with this survey; that kind of month-to-month volatility isn’t credible.

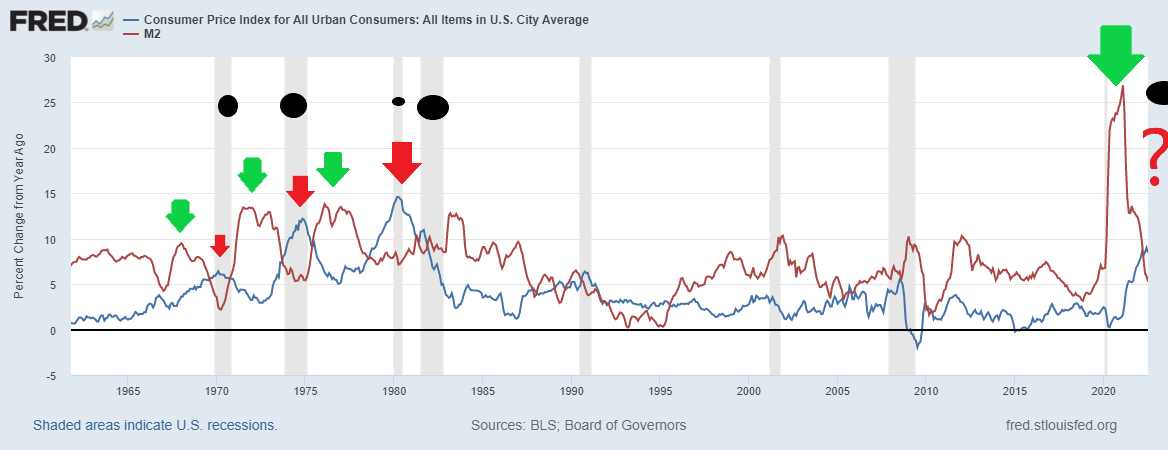

Overall, the US economy remains pretty resilient. It is obviously slowing but not precipitously and not unexpectedly, I would say. The goods side of the economy is slowing while the services side continues to recover. The result has been stagnation this year. Whether that is set to turn decisively negative I can’t say but it is obvious that is the result the Fed wants and expects. All I can say is that their belief that economic growth and high levels of employment are the cause of inflation is, to be nice, misguided, and to not be nice, ignorant. And their determination to put people out of work to correct a mistake of their own making is immoral, to say the least. The good news is that money supply growth has already collapsed and inflation is likely to follow soon:

(Click on image to enlarge)

Economic Environment

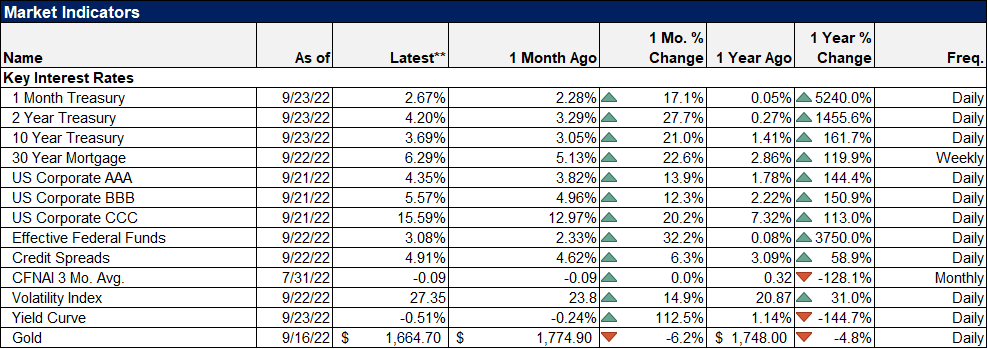

The dollar and the yield of the 10-year Treasury continue to rise but I am beginning to think we’re nearing a peak. The rate of change – of both – is at an extreme rarely seen and where previous peaks have occurred. I expect to have a significant capital gain opportunity sometime soon in bonds. The near vertical rise in rates and the dollar is not sustainable and history says that when they peak they’ll fall as fast as they rose. When that is and what kicks it off I can’t say. But it is coming.

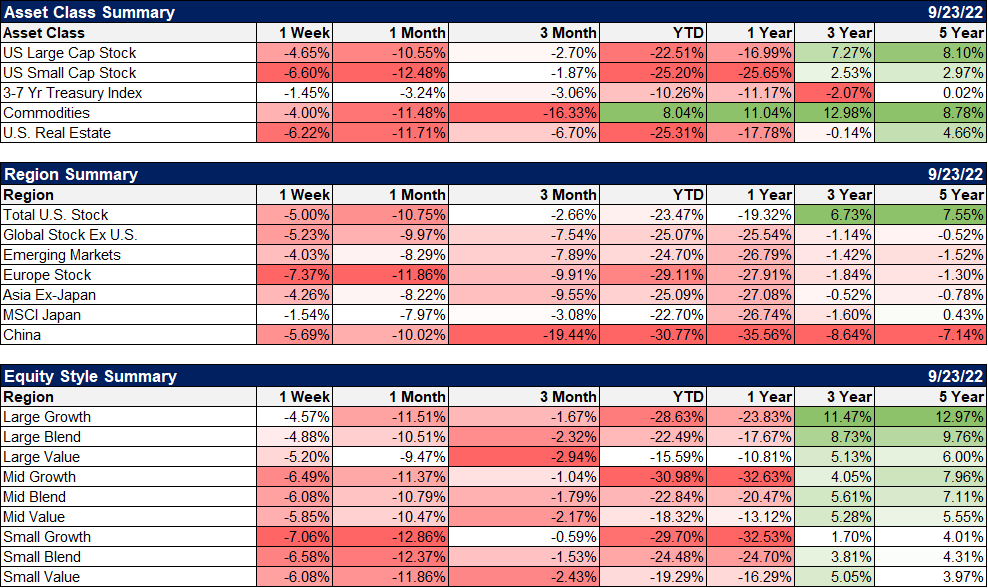

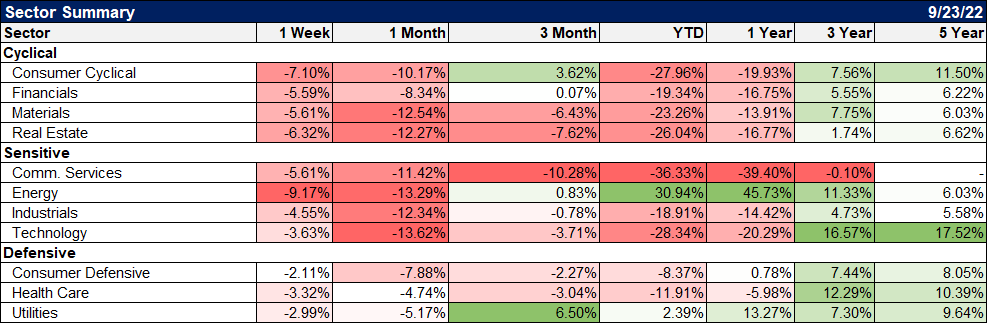

Markets

Another one of those no place to hide weeks obviously. 3-month returns are all negative now too and we’re right at the lows of the year for everything but commodities. As I said above, sentiment and market positioning are off the charts negative, a potential contrarian buy signal. That doesn’t mean markets will turn on a dime but I do think long-term investors need to be at least looking for potential long-term investments. Small and mid-cap stocks are especially cheap right now; high-quality companies are on sale.

When I got into this business over 3 decades ago, my mentor told me that bear markets are for thinking, not acting. We came into this bear market with a good dose of cash and we still have it. But we have been working assiduously, researching companies and reviewing history. It is an unprecedented time but some things, like market sentiment, never change because people don’t change. It is always hard to be positive when everyone else is negative but it is what is required to be a successful long-term investor. All I can say is that investors should be discerning in what they buy. Value matters again and those who put in the work now will be rewarded later.

(Click on image to enlarge)

Defensive stocks were the “winners” last week, not surprisingly. I would note that energy stocks were the worst performers last week as WTIC dipped into the 70s. While I’m bullish on energy and commodities long term, I think crude oil has more to go on the downside. My best guess is the mid-70s but that may be too optimistic. I would point out though, that the futures curve is still in backwardation so this isn’t due to some collapse in demand. If that were the case, the curve would flip to contango (spot price below future).

(Click on image to enlarge)

We may be headed for recession but you sure can’t tell that by looking at credit spreads which remain quite well behaved.

(Click on image to enlarge)

I don’t write about the Fed very often because I don’t generally see it as a good use of my time. The Fed, contrary to popular opinion, does not control the economy. They have historically followed the market, not the other way around. Jerome Powell is the King Canute of the economy; he doesn’t actually control anything. But there is no denying the Fed has an impact on the market, through their language and their portfolio of bonds and MBS. That influence is, however, limited and usually short-lived.

There are several causes of our current inflation but the most obvious is the massive increase in the money supply during COVID and the Fed does deserve the blame for that. I understand their need to accommodate the fiscal surge at the beginning of the pandemic (even if I think shutting down the economy was the biggest own goal in economic history). But the sell-by date on that policy expired long before they started their tightening this year.

Indeed it was their insistence on “immediate disclosure” of their internal deliberations that put them in the spot they find themselves today. They laid out a schedule for winding down QE and thought if they deviated from it, it would hurt their credibility. And so, with housing prices screaming higher, they continued to buy mortgage-backed securities until the spring of this year. It was an idiotic policy mistake for which we are all paying today.

Fortunately, money supply growth has come back to earth and inflation will soon follow. We can only hope that it happens before Powell and Co. do more damage.

More By This Author:

Weekly Market Pulse: What Changed?Goldilocks Calling

The Dog That Didn’t Bark

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more