Weekend Reading: Goldilocks Employment?

Here are some things I think I am thinking about:

1) The Goldilocks Labor Report. Friday’s employment report came in weaker than expected, which is, weirdly, very good news for the economy and the Fed. The important point is that it was weak, but not too weak. It was just right. Private payrolls came in at 99K which was well below the consensus estimate of 143K. The underlying data was broadly weaker with hours worked declining, average hourly earnings declining, and large downward revisions to the last two months of data. It’s good news because it’s consistent with a slowing, but growing economy which means the Fed can breath a little easier about inflation and future rate hikes.

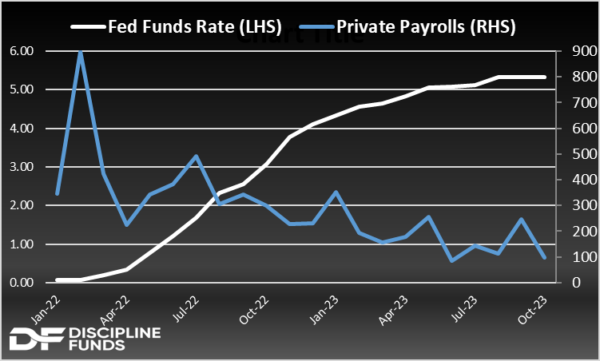

What’s interesting in this data is that it’s becoming abundantly clear just how impactful rate hikes are. There’s been a strange narrative in recent years claiming that interest rates put upward pressure on the economy. But the data increasingly shows the opposite. In fact, it looks like employment growth AND inflation both peaked at almost the exact same time the Fed began raising rates.

But what’s most important in this data is that there remain no signs of the much-feared second wave of inflation like we saw in the 1940s and 1970s. The strongest sign there is average hourly earnings which ticked down again to 4.4% from 4.5%. That’s still too high for the Fed’s comfort, but it’s all moving in the right direction.

2) SBF is Guilty. Well, that was fast. The jury wasted no time coming back with a guilty verdict for Sam Bankman-Fried and his Ponzi scheme at FTX.

I’ve made my peace with this issue, but I do want to say a few things about this and hopefully, it helps someone avoid a very big blunder:

- The number one way to avoid these kinds of fraud is to ensure that you work with a reliable third-party custodial relationship.

- If you work with a broker-dealer you should ensure that they have custody with a third party.

- If you work with a financial advisor you should ensure that they work with a third-party custodian.

- Do not ever write checks directly to a financial advisor.

- If you do write checks directly to private placement funds (like Venture Capitalists or hedge funds) then you should be fully prepared to part ways with that money.

This issue is so easy to avoid. For instance, at Discipline Funds we custody our assets with Charles Schwab. Charles Schwab custodies your assets with third parties like the DTC or Bank of NY. We will help clients transfer money, but we do not ever handle money transfers directly. So our clients are safeguarded not only from Schwab, but also from Discipline Funds. It’s a beautifully simple arm’s length arrangement where we can help people and leverage the resources of a huge institution like Schwab, but clients don’t ever have to worry about their money just disappearing overnight because it’s literally impossible for us to run off with the money or transfer it into another account to trade it in some opaque fraudulent hedge fund.

You can’t be too careful with circumstances like asset custody because there will always be frauds in finance. Money is complex and people are all prone to behavioral biases and irrational behavior. No financial system is going to recreate modern finance without fraud. But smart regulations can place safeguards within the system to reduce the potential for fraud. Yes, regulations are annoying and the “decentralized” mantra is idyllic sounding and all that, but the reality is that you can’t remove fraud entirely from a financial system with irrational humans so please be careful about where you place your funds and who can access those funds.

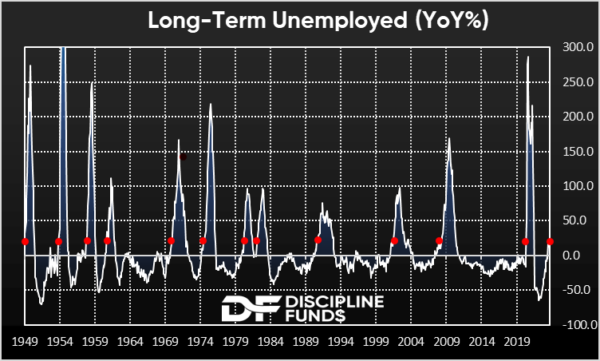

3) A Canary in the Labor Market Coal Mine? I want to circle back on that labor report for one second because it was a Goldilocks report, but there might have been some canaries in this coalmine. For instance, here’s a chart of long-term unemployed. This gives us a gauge of people who are falling out of the labor market and then having a hard time getting back in. This would generally be indicative of a softening labor market. But the really interesting thing about this data is that EVERY SINGLE TIME it has ever risen more than 15% on a year over year basis we’ve either been in a recession already or we’ve entered one within 12 months. Well, we’ve now been over 15% for three months.

The more worrisome piece of this data is that when it breaches 15% it doesn’t ever stop there. Without fail it rises to 50%. In 8 of the 13 circumstances it has risen to 100%. This means that long-term unemployment tends to become entrenched once it gains momentum. And when it gains momentum it tends to gain a lot of momentum.

Of course, everything about the Covid era has been strange and a lot of data has been thrown out the window because of the uniqueness of this environment, but this is just another sign that things are softer than many think and potentially getting softer. It’s also another sign that the rate hikes are working. Maybe working more than we think? Stay tuned.

More By This Author:

Chart Of The Week: Is The Fed About To Fumble?

Weekend Reading – Commuting, Credit And Fumbling In The Red Zone

Chart Of The Week: Booming GDP?

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more