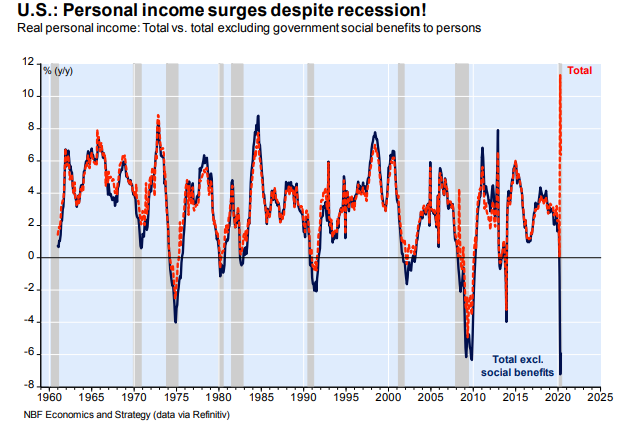

US Personal Income, July 2020

The US government's support during the early phase of the pandemic was very essential. Personal income was well supported, though the risk prevails that the republicans will cancel this support. The personal income surge may partially explain strong equity markets.

Like many of you, I have been astounded at the strength of the equity markets during the pandemic, and the Trump Administration mismanagement of the whole process.

And like many others, I never believed in the possibility of a quick V-shaped economic recovery, particularly since the pandemic has spread so efficiently around the world.

I have accepted the consensus wisdom that the equity market’s resilience can be heavily traced to the Fed’s promise to do whatever it takes in providing monetary support. This includes the strong likelihood that interest rates will remain extremely low right through to the end of 2021, and possibly even longer.

In that case, the equity market seems the only game in town.

But another explanation for the support of equity markets may lie in the evidence that personal incomes can be well supported by government programs, even in an environment of a partial or full economic lockdown.

The recent evidence underscores that despite the enormously deep US recession and the steepest job losses in generations, US labor income, heavily supported by government transfers, has been surging and retail sales has been rebounding.

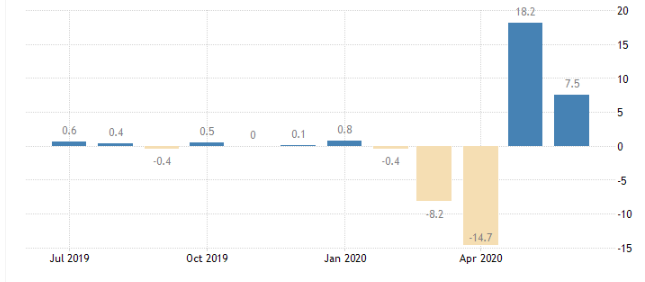

Indeed, the June sales rebound was much stronger than expected, which also indicates that many businesses reopened despite worsening coronavirus reports.

Perhaps the markets take this as an early sign of a V-shaped recovery. If so, the markets are wrong.

(Click on image to enlarge)

US Retail Sales Rebounded in May and June

(Click on image to enlarge)

The two flaws with supporting the market by creating debt are: First, that debt must eventually be repaid, and second, that creating all that instant money will tend to bid up prices, a lot like inflation. And that inflation will eat up the value of my wealth and savings. And that damage will leave me, and many others, in a bad spot, and we will be rather angry. If that happens then the intent will be to put those responsible into positions where they will never again be able to make any decisions that affect anybody.

Personal income is not surging for everybody, there are several segments seeing no surge upward at all. They will be angry also.