US: Fed Says Wait Until 2024

The logical conclusion from the Federal Reserve's monetary policy review was that interest rates would remain lower for longer. Updated guidance now suggests officials think it maybe 2024 before there is the need to start raising rates.

Cautious Fed still has dissent

The Federal Reserve has left monetary policy unchanged today, which is unsurprising given the decent activity and employment backdrop and the recent rise in inflation. Nonetheless, the Fed remains wary, suggesting that the pandemic will “continue to weigh on economic activity, employment and inflation in the near-term, and pose considerable risks to the economic outlook over the medium term”.

The key part of the statement surrounds the updated guidance on policy in light of the publication of the Fed’s monetary policy strategy review which heralded “average” inflation targeting. They have opted for “the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well-anchored at 2 percent.”

There wasn’t universal agreement on this though. Robert Kaplan wanted the statement to emphasize “greater policy rate flexibility beyond that point” – i.e. suggesting rates could stay low for even longer. Neel Kashkari wanted to specify they wouldn’t change rates until “core inflation has reached 2% on a sustained basis” – again, slightly more dovish than what was agreed (“sustained” versus “some time”). Neither of these are hugely significant deviations from what was agreed and in any case, the dot diagram of individual forecasts give us more specific views.

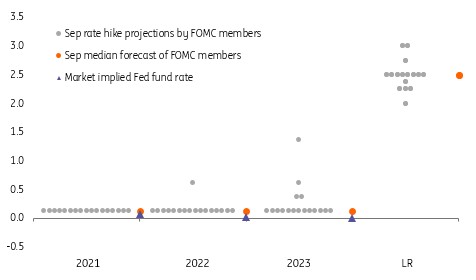

The Fed's new "dot plot"

(Click on image to enlarge)

Source: Federal Reserve, ING

Fed consensus suggests nothing before 2024

They have the median Fed funds rate projected to remain in the current 0-0.25% range through the whole of 2023 with just one out of 17 members looking for a hike before the end of 2022 and just four expecting a move at some point in 2023. Interestingly, they kept their long-term projection unchanged at 2.5% with all member clustering between 2% and 3%.

As such the Fed is telling us they don’t think that rates will need to rise until 2024, which is understandable given the new policy strategy from the Fed – acknowledging inflation shortfalls can be just as bad as inflation overshoots – and their past track record on hitting the 2% target. This is an implicit acknowledgment that they ran policy too tight in recent years.

Since the beginning of 2010 the Fed’s favored measure on inflation, the core personal consumer expenditure deflator, has been at or above 2% in just 13 months – so a hit rate of one in 10 – posting an average of 1.6% year on year over the past decade.

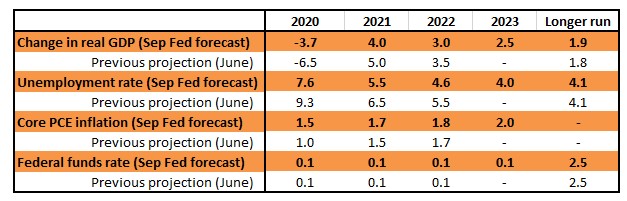

In terms of their broader forecasts they have revised up 4Q GDP YoY growth for 2020 to -3.7% from -6.5%, but because of the earlier and more vigorous rebound have cut 2021 to 4% from 5% and 2022 from 3.5% to 3%. The core inflation numbers have also been revised a little higher with the core PCE deflator expected to end 2023 at 2%.

New economic forecasts from the Fed

(Click on image to enlarge)

Source: Federal Reserve, ING

Economic slack to keep inflation and interest rates low

The shift in language and the new forecasts are fully understandable with officials emphasizing that the US economy continues to face numerous challenges from Covid-19. Recent data reinforces our view that it will be late 2021 at the earliest before all the lost output is recouped, which points to a large lingering output gap. Meanwhile, the slack in the labor market means little prospect of imminent wage inflation so the chances of the Fed meaningfully improving on its hit rate for 2% inflation anytime soon don’t look great.

Once again, Powell left the door open to further potential action, which would most likely involving additional QE, but emphasized that the Fed can’t generate demand. For that, we will need to see additional fiscal stimulus and Powell again suggested more would likely be needed, but that isn’t going to happen ahead of the 3 November elections and may not come before the end of the year.

Implications for treasuries

The net impact on the bond and rates market has been muted. However, if we take the forecast revisions (which were to the upside) and add that to the commitment to keep the funds rate anchored, the net effect is to leave the long end less protected (by the Fed). In consequence, if there were to be a break-out from this meeting, it should be in the direction of a steeper curve from the back end. As it is though, the 10yr Treasury yield remains in sub-70bp territory and the 2/10yr spread is flat-lining in sub-55bp territory.

The curve remains very directional with respect to data going forward. The anchor on front end rates has been extended through to 2023, which mean that 2yr yields are going nowhere. These should break-even versus a projected fed funds rate, which is effectively in sub-10bp territory for the foreseeable. If anything, the 2yr yield should be lower from here, as compensation through a term premium out to the 2yr is pretty meaningless. The shape of the curve will come from where 10yr and 30yr rates go to.

Any break out of flattening from here would frustrate the Fed. Part of the rationale of average inflation targeting is to give the low fed funds rate environment the biggest possible bang for its buck. A flatter curve against that backdrop would imply that the Fed needs to do more. The interesting nuance here, though, is that if the Fed did have to do more it would likely include some longer duration quantitative easing i.e. more buying of longer dates. Therein lies the dilemma for the curve, and direction – still a mean-reverting process in consequence.

Nothing to bother the dollar bear trend

Despite a flicker at the long end of the bond market, there was nothing really in the FOMC statement or the projections to un-nerve the conviction view that reflationary Fed policy is a dollar negative.

Key components to this summer’s dollar decline have been the sense of recovery (today’s Fed upgrades to 2020 GDP and employment forecasts help here) and ultra-low rates (unchanged policy Fed policy through 2023 also help) resulting in real yields deep in negative territory.

Instead, the Fed spelling out that it aims to achieve inflation moderately above 2% favors asset classes like equities and commodities. Notable over the last two weeks has been the breakdown in key $/Asia pairs, such as $/CNY and $/KRW. The Fed’s reflationary policies supports an extension of these pro-growth FX trends. EUR/USD should also stay bid in a broad 1.17-1.20 range over coming weeks and months. The biggest challenge to the EUR/USD rally is probably positioning and US elections – not the Fed.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more

Yay so basically they now need to do nothing and all the good news for the next President is pushed up to help the current president. The Fed gets more political and more permissive to help the present at the cost of the future constantly. What happened to a Fed that tries smoothing out the market cycles and preparing for the worst? What happened to constraint and not playing politics? What happened to the Federal Reserve realizing they don't know the future?

Yes, very troubling.