US Economy Is Slowing, But Recession Risk Remains Low

New data published on Monday reaffirms that the US economy is still growing, and the odds remain low that a recession has started or is imminent. The rapidly changing state of tariffs could change the outlook, but for the moment, economic activity looks relatively resilient.

Let’s start with the Chicago Fed National Activity Index, which shows that US economic activity rebounded in February. The monthly reading strengthened last month and the 3-month average rose to a 3-year high. On both counts, the data reflects a solid pace of growth and far above levels that indicate recessionary conditions.

February, of course, doesn’t reflect the impact of tariffs, the effectes of which may start showing up in the March profile. It will take several weeks at a minimum before a clear picture via hard data begins to emerge on this month’s profile, but PMI survey data published yesterday suggest that the broad trend remains resilient.

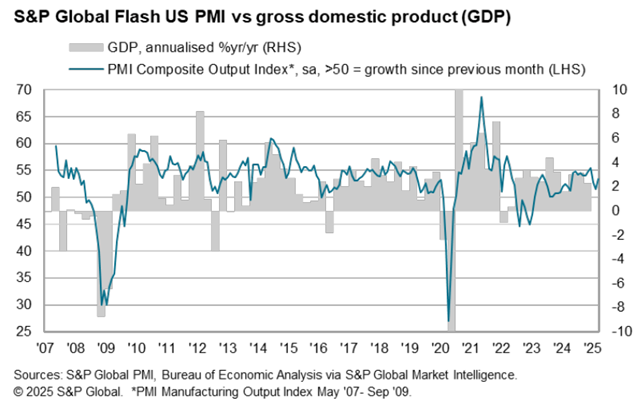

US business activity growth strengthened in March, rising to a 3-month high, according to US PMI Composite Output Index, a survey-based GDP proxy. A pickup up in growth for the services industry drove the improvement as activity in the manufacturing sector weakened.

“A welcome upturn in service sector activity in March has helped propel stronger economic growth at the end of the first quarter,” says the chief business economist at S&P Global Market Intelligence. “However, the survey data are indicative of the economy growing at an annualized 1.9% rate in March and just 1.5% over the quarter as a whole, pointing to a slowing of GDP growth compared to the end of 2024.”

Despite the upbeat data, the US economy still appears to be on track to slow vs. the end of 2024. As reported by CapitalSpectator.com last week, the median nowcast for a set of first-quarter GDP estimates points to a sharp slowdown in output for the first three months of this year.

Meanwhile, analysis of several business-cycle indicators paints a relatively upbeat profile for data published to date in terms of estimating real-time recession risk, notes The US Business Cycle Risk Report, a sister publication of CapitalSpectator.com. The newsletter’s primary lens for assessing the probability of an NBER-defined downturn: aggregating several indicators to extract an implied probabilty estimate, a process that continues to estimate real-time recession risk as virtually nil.

Economists, however, are an increasingly gloomy lot and have raised their estimated risk of recession to the highest level in six months, according to CNBC survey. The 32 survey respondents (fund managers, strategists and analysts) lifted the probability of recession to 36% from 23% in January.

For the moment, the forecast doesn’t match the real-time data. When and if there’s convergence, and both sides of this coin are signaling elevated recession risk, it’ll be time to worry. Meanwhile, a wary optimism prevails.

More By This Author:

Macro Briefing - Monday, March 24

Energy And Healthcare Stocks Are Big Winners This Year

Macro Briefing - Friday, March 21

Disclosure: None.