This Is The Big Story: A 100+ Year Near-record Decline In Commodity Prices Is Enabling Continued Record Wage Growth And Employment

No important economic data today, so let me elaborate on the matter of “immaculate disinflation,” i.e., the decline in inflation without a decline in growth. I’m going to argue that, to the extent there is causation, it is the reverse of what is generally assumed, to wit: that there is decent growth without any meaningful hit to employment, which somehow is occurring while inflation is declining.

To the contrary, it is precisely *because* inflation is declining under the present set of circumstances that we are continuing to get good growth in employment and overall consumption.

Let me start by running a long term version of a graph I have highlighted many times over the years, average hourly wages YoY (red) vs. CPI (blue) and also CPI ex-fictitious shelter (blue green):

(Click on image to enlarge)

Going back 60 years, whenever wage growth exceeds inflation (the red line is higher than the blue or blue green lines), you are either in an economic expansion, or the end stages of a recession setting the stage for the next expansion. Consumers have an increasing amount of money to spend, and they are spending it.

Note the converse isn’t always true. Particularly from about 1970 to 1995, there were times when average wages weren’t keeping up with inflation but we were nevertheless in expansion. This is because that was the era of women entering the workforce by the millions. This operated to tamp down average wages. BUT, median household income grew. If that statistic were updated monthly or even quarterly, that’s what we would want to use. Unfortunately, it is only updated annually, so it’s realistically not available.

But do note that approaching recessions (with the exception of the pandemic), average wages either dip below inflation, or at least the gap is almost entirely closed.

Currently average hourly wages are growing at a rate of 4.8% YoY, while headline inflation is up 3.2% and CPI ex-fictitious shelter is up only 1.0%. Consumers have more money to spend, and they are spending it.

But to look for why consumer inflation has become so tame, let’s look at commodity prices for producers.

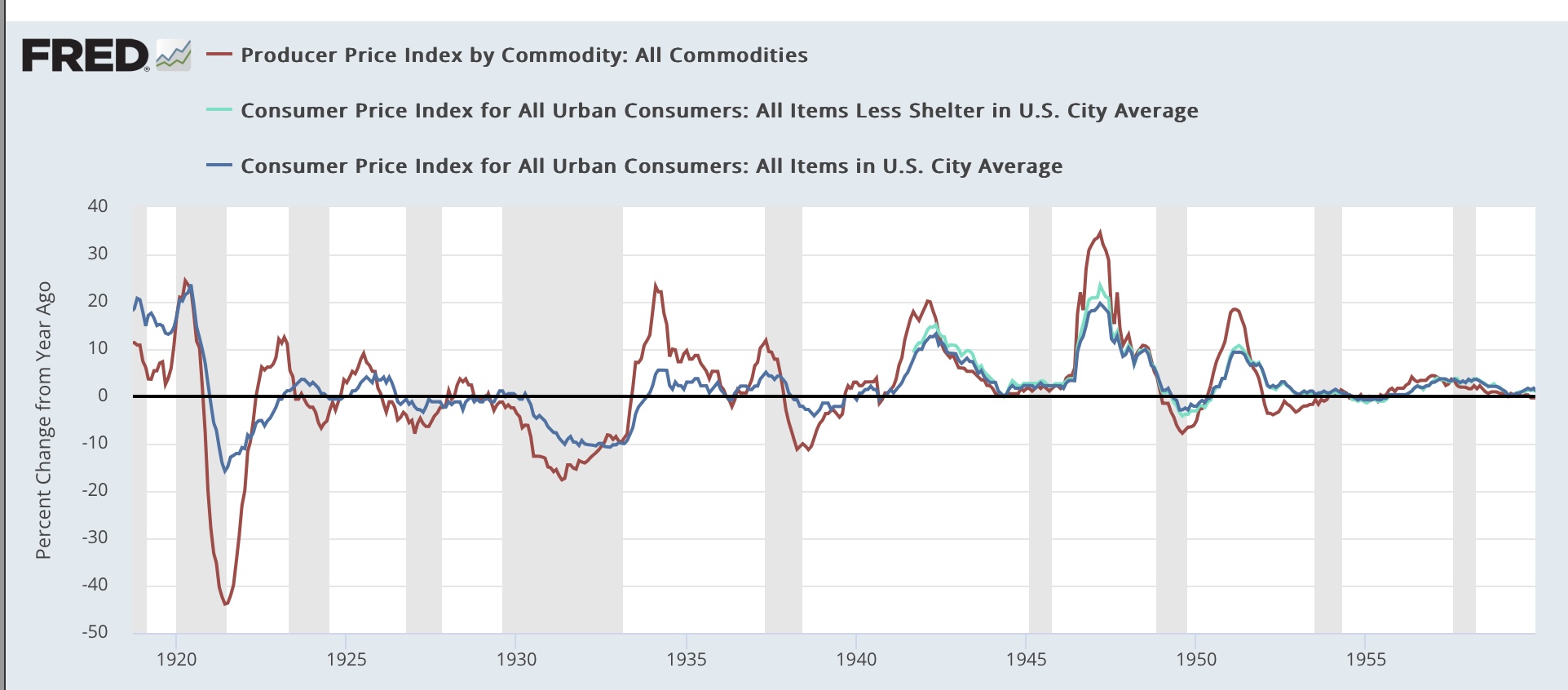

Here are two graphs of commodity prices (red) vs. headline consumer inflation and inflation ex-shelter going back 110 years:

(Click on image to enlarge)

(Click on image to enlarge)

At the far right of the second graph, you can see that producer prices were down close to -10% YoY one month ago. If you go back over the entire 110 year period, declines that steep only happened once in the past 70 years (at the end of the Great Recession). Before that, declines of -10% or more only happened late in or at the end of the recessions of 1920, 1938, and over -5% near or at the end of two recessions in the 1920s, and the 1950 recession. Recently declines nearly that steep happened at the end of the 2001 recession, during the 2015 “shallow industrial recession,” and the pandemic lockdowns.

It’s no coincidence that those steep declines are at or near the end of those recessions. Those big declines in costs to producers enabled them to cut sales prices to consumers (note that consumer inflation is also declining at those times), which made it earlier for consumers to buy those goods. And a new expansion began!

In fact, the disparity between producer commodity costs now and consumer inflation (shown in the graph below) is close to its most extreme in that entire 110 year period, as consumer prices YoY are running more than 10% above producer commodity prices). Only at the end of the Great Recession and the end of WW1 was the disparity so huge):

(Click on image to enlarge)

This huge decline in producer prices in the past year has enabled them to hire more workers at substantially higher wages and yet still pocket increased $$$, especially if they have market power and are able to maintain their recent price hikes.

As shown in the graphs above, typically sharp declines in producer prices occur because of demand destruction during recessions. But this time around, prices have declined because of the unspooling of pandemic-caused restrictions and bottlenecks. Because commodity prices are set globally, there may also be an element of a slowdown in Chinese manufacturing to the story as well, but for purposes of any impact on the domestic US economy, this is irrelevant.

This is the Big Story. This is why there hasn’t been any recession - at least not yet -despite huge Fed rate hikes. This is why I am temporarily paying much more attention to producer prices than I normally do. It’s also why I am looking for signs of that downdraft (hello, $3.80 gas prices again) ending.

More By This Author:

July Producer Prices: Economic Tailwind Weakens, But Still In PlaceJuly CPI: Almost Everything Except Fictitious Shelter Costs Are Getting Close To The Fed’s Comfort Range

Initial Jobless Claims: A Little Soft, But Continued Expansion Signaled

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.