The World Bank Identifies The Lingering Effects Of The Pandemic

With so much focus on the near-term recovery efforts, economists are starting to examine what the pandemic will do to our long-term economic prospects. To this end, a rather sobering report by the World Bank identifies the long- term effects of the pandemic in both advanced and emerging markets. The picture is far from pretty. (World Bank report)

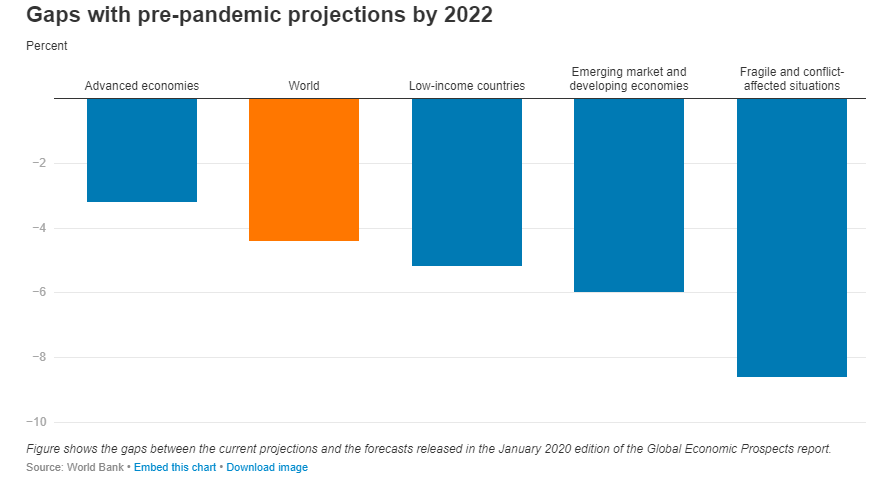

To begin with, they start with scenarios of global growth for 2021 and 2022. This is a difficult task, given there is so much uncertainty, and so the World Bank projections are presented within a range. At best, growth in 2021 and 2022 will be in the range of 2.0-3.5% for the advanced countries and slightly higher, 3.5-4%, for the emerging markets. While these growth rates are favorable, the reader should bear in mind the rates are calculated on a base that is considerably below the pre-pandemic growth pattern, hence the need for even faster growth to close the gap. Advanced economies are currently operating at 3% below the 2019 output levels. In other words, in 2022 there will be sizable gaps to be made up before the world economies return to their 2019 output levels.

(Click on image to enlarge)

Notwithstanding the anticipated growth recovery in 2021, the Bank projects that global growth will be 4.4 % below pre-pandemic conditions.

One of the big factors influencing the Bank’s projections is what they refer to as “fiscal impulse”. Simply, this a technical way to measure fiscal expansionary policies over time. Graphically, we see that government spending to deal with the 2008 financial crisis pales in comparison to the expansionary expenditures in 2020 needed to deal with COVID-19. However, the Bank fully expects those fiscal impulses to fall off sharply in 2022. The report notes:

Fiscal support played a significant role in cushioning the economic blow from the pandemic. As the crisis abates, policymakers need to balance the risks from large and growing debt loads with those from slowing the economy through premature fiscal tightening. In most countries, much of the fiscal support provided last year is expected to be withdrawn, weighing on growth. Whereas deficits are generally expected to shrink over the forecast, they will nonetheless contribute to rising debt, potentially planting the seeds for future problems—particularly if borrowing is not used efficiently.

(Click on image to enlarge)

This is probably the governments’ biggest fear: the need to funnel financial resources continuously into the economy in order to sustain growth. Yet, without this support, the economies will continue to operate below full employment levels.

The economy was not doing well prior to this plague hitting the world. Certainly the impact took the economic conditions from uneasy to seriously painful, screaming agony painful for many folks. Tut the closures and lock-downs are not the cause of the pain, they just make it a lot worse. It is obvious to me that additional regulations need to be in place as far as spending non-existent funds, in particular

Sobering assessment.