The Uncomfortable Relevance Of Growth And Debt

The reality is that property values and stock market values, which were once dependable indicators of the health and strength of the economy, are no longer accurate indicators of economic health.

Additionally, when inflation is taken into consideration, real wage growth over the previous 40 years has slowed to a pathetic $0.32 per hour in real terms.

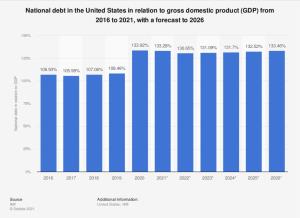

As a consequence of the fast growth in the country's public debt, the country's ability

to meet its financial obligations is becoming more challenging.

The economy of the United States reached its pinnacle in 1980, when the country's debt was $908

billion USD, marking the conclusion of the country's prosperity and advancement.

It is currently worth $29 trillion USD, according to market valuations.

The quantity of debt has increased by 3,181 percent.

Between then and today, the Gross Domestic Product (GDP) of the United States has increased by 632

percent, growing from $2.86 trillion to a total of $20.94 trillion.

The bottom line, at the end of the day, is that it all comes down to one thing: generating money in

some form or another.

Truth be told, in the world of financial markets, the fortunes of a country are inextricably connected

with the fortunes of a certain currency.

Academics and economists have been studying the relationship between government debt and economic development since the 2007-2008 financial crisis. For example, in 2010, economists Carmen Reinhart and Kenneth Rogoff released "Growth in a Time of Debt," a frequently quoted and influential work among commentators, academics, and politicians in the debate over austerity and fiscal policy in debt-ridden nations.

Since the release of "Growth in a Time of Debt," In their paper, “Debt and Growth: A Decade of Studies,” Veronique de Rugy and Jack Salmon from The Mercatus Center at George Mason University review the literature to assess the assertion that high government debt-to-GDP ratios have negative or significant (or both) effects on economic growth.

While not all of the 24 research papers reviewed in their study identify a common threshold, it shows that 17 of the 24 do, with half finding a barrier between 75 and 100%.

Except for two studies, increasing government debt has been linked to slower economic development. This is true even when no common threshold is found.

The evidence is overwhelming that high government debt has a detrimental impact on economic growth potential, and that impact often grows as debt increases. The effects of a large and expanding public debt ratio on economic growth could amount to a loss of $4 trillion or $5 trillion in real GDP, or up to $13,000 per capita, over the next 30 years.