The S&P 500 Eked Out A Gain As Two Grumpy Old Men Take Center Stage

Image Source: Pixabay

MARKETS

The S&P 500 eked out a narrow gain on Thursday as Wall Street looked ahead to fresh inflation data for clues about when the Federal Reserve might begin to lower interest rates. Traders are mainly focused on the release of May’s core personal consumption expenditures (PCE) price index, the Fed’s preferred measure of inflation. Economists polled by Dow Jones expect core PCE to have risen 0.1% month-over-month and 2.6% year-over-year.

Traders hope this report will support an increasingly dovish narrative from the Federal Reserve this summer, potentially leading to a rate cut in September.

However, concerns are growing amid a string of soft U.S. economic data and warning signs in the labour market, with continuing applications for unemployment benefits hitting their highest level since November 2021 last week. If the PCE data disappoints( higher), expect headlines about stagflation to dominate.

After numerous false signals, initial jobless claims in the U.S. have definitively moved higher. While headline claims undershot expectations again in Thursday’s update, they remained above 230,000.

It's important not to overstate the case. Claims are down 10,000 over the last two weeks, erasing most of the jump that pushed the headline to 243,000—the latest print of 233,000 marks a three-week low.

However, the four-week moving average has risen to 236,000, the highest since September 2, 2023.

Markets are cautiously closing the quarter and the year's halfway mark on Friday. Investors are expected to tread carefully, keeping interday risk exposure minimal. This approach comes ahead of crucial U.S. inflation data due later in the day and with the weekend looming.

The headlines from the Thursday U.S. presidential debate between Joe Biden and Donald Trump add to the prudent watchfulness. Topics such as trade protectionism and tariffs on imports from China will likely be particularly influential, potentially shaping market sentiment as the day unfolds.

FOREX MARKETS

In the Forex markets, expectations are high for an uptick in inflation in Tokyo for June, potentially paving the way for a rate hike by the Bank of Japan (BoJ) as early as July. Despite these expectations being primarily priced in by the market, USDJPY opened at 160.70 in Asia. This suggests that policymakers seeking a stronger yen will need more than just a July rate hike to influence the currency's trajectory positively.

Japanese authorities closely monitor the USD/JPY exchange rate, particularly as it surpasses previous intervention thresholds in April. According to Masato Kanda, Japan's top currency official, recent movements in USD/JPY are considered "rapid" but not yet deemed "excessive." This distinction suggests a nuanced approach, where a significant 10 yen move within a month could trigger intervention. In April, USD/JPY rose from 150 to just under 160 over a similar period, aligning with Kanda's criteria.

With USD/JPY reaching around 160 within two months of the last intervention and potentially eyeing 165, Japanese authorities are cautious about further action. Despite spending USD 61 billion in previous interventions, they view these measures as short-term solutions to manage volatility rather than fundamentally correct a structurally weak yen. Importantly, decisions on future interventions hinge significantly on US economic indicators, particularly the Federal Reserve's policies, which exert considerable influence over the yen's strength.

Looking ahead, Japanese officials may resort to verbal interventions and closely monitor market reactions before considering additional measures. Any escalation towards 165 in USD/JPY could prompt reassessment and potentially trigger further action, contingent on upcoming US data, notably the core PCE figures.

TWO GRUMPY OLD MEN

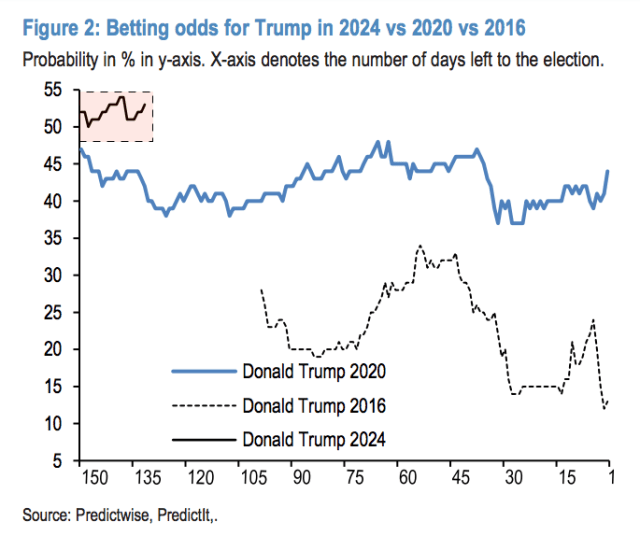

Today is the big presidential debate day if you’ve been off the grid. The spotlight is on whether Joe Biden's cognitive abilities will impact his fitness for another term. Some believe a poor performance could rule him out for another run. Meanwhile, polls and betting markets suggest Trump’s odds of winning in November are strong.

(Via a JP Morgan Note)

However, polling in crucial swing states suggests a more significant win for Trump, with some even predicting a landslide victory.

While it's impossible to predict precisely what Trump's economic policies will be and their impact on the market, expectations lean towards a pro-business stance and tax cuts, which traditionally support market sentiment. However, there's a growing chorus of concern about the implications of a potential GOP election sweep on U.S. fiscal policy, bond yields, and inflation.

These concerns aren’t limited to Donald Trump’s critics. The worry is that under a unified Republican government, which may implement sweeping new tariffs, immigration restrictions, and potentially unproductive tax cuts, any progress made in the fight against inflation could be reversed. This scenario could also exacerbate fears surrounding deficits and national debt.

More By This Author:

Rates Jitters Inch Back To The Fold

Tech Stocks Bounce Ahead Of Nvidia's Shareholder Meeting

Nvidia's Market Cap Takes Significant Hits Amid Pedestrian Pullbacks