Rates Jitters Inch Back To The Fold

Yen. Image Source: Pixabay

On Wednesday, the S&P 500 managed to eke out a modest gain as investors reassessed their portfolios following a stellar first half of the year driven by the relentless surge in artificial intelligence stocks. While tech giants continue dominating due to the insatiable investor appetite for anything AI-related, the broader market exhibited a sluggish demeanor. Traders eagerly await fresh inflation data, specifically May's personal consumption expenditures (PCE) price index, set for release on Friday.

This metric, closely monitored by the Federal Reserve, has investors cautiously optimistic that continued moderation in price increases could prompt the central bank to lower interest rates later this year. However, the recent pullback in the broader market has sparked speculation about whether the 2024 rally, fueled mainly by Nvidia, has reached its zenith.

While investors, for the most part, were in a holding pattern ahead of the presidential debate and Friday’s PCE data, with U.S. Treasury yields inching higher, the S&P 500 retreated from its session highs.

Treasuries dipped, pushing most yields to their highest levels in over a week following surprising inflation data from Australia and Canada. Adding to the complexity is a steep slide in the Japanese yen and anxiety among bond, gold, and currency investors due to Federal Reserve Governor Michelle Bowman's midweek declaration against a rate cut in 2024. Although Bowman's view likely doesn't represent the consensus thinking within the Fed, it still adds an element of discomfort for investors who have been mulling that possibility for some time.

Shortly after the U.S. trading day commenced, the yen's decline further unsettled traders already jittery from the rout in Australian government bonds sparked by domestic inflation data. Australia's consumer price index rose 4% year-on-year in May, surpassing economists' estimates. This prompted a surge in Aussie two-year yield to the highest level since November, as traders ramped up bets that the Reserve Bank will resume raising interest rates at its next meeting.

U.S. bond traders are similarly grappling with uncertainty over whether the Federal Reserve will deliver rate cuts this year, significantly ahead of the crucial PCE inflation data on Friday. Interest rate futures traders are no longer fully pricing in more than one rate cut by year-end, starkly contrasting to the six predicted at the start of the year.

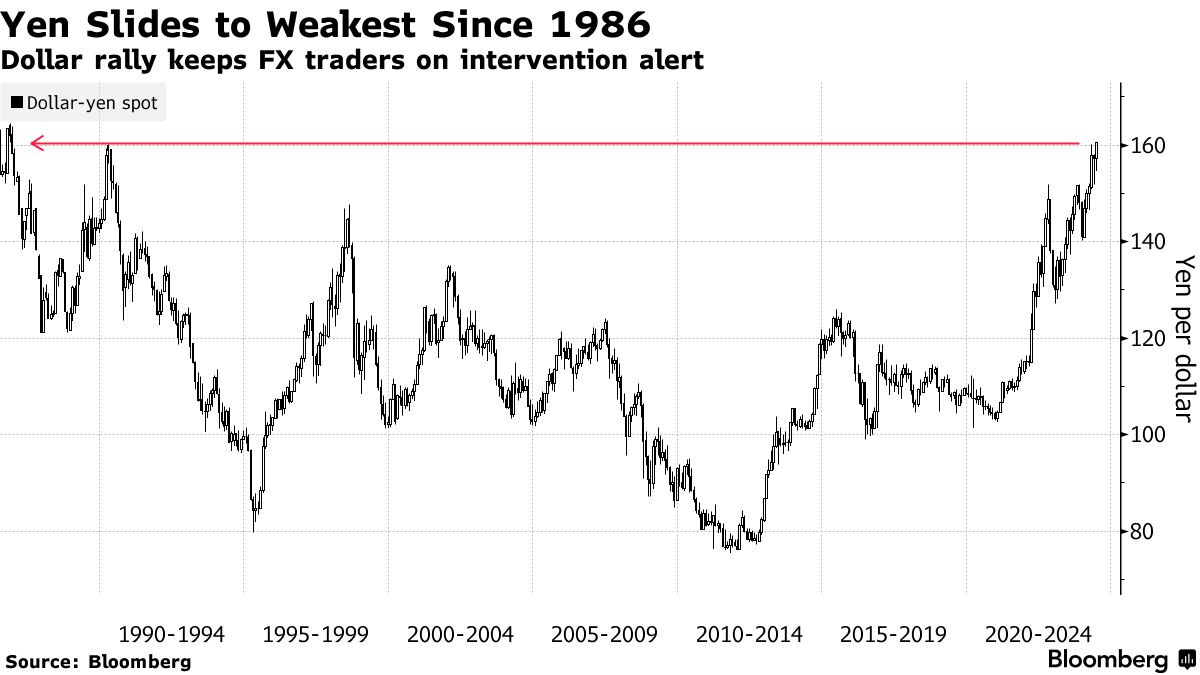

A grim reality is dawning for Japanese authorities as the yen continues to plummet through key levels in rapid succession. The slide will likely persist until the Federal Reserve eases its higher-for-longer policy stance, which is beyond its control.

Some traders have been attempting to time the peak of USD/JPY by selling at the 158 through 159.50 level, anticipating potential intervention from the Bank of Japan in bonds, interest rates, or the currency market. However, these traders capitulated as USD/JPY breached the 160 mark without any sign of a rate check from the BoJ. This added selling pressure only exacerbated the yen's decline, fueling its further meltdown.

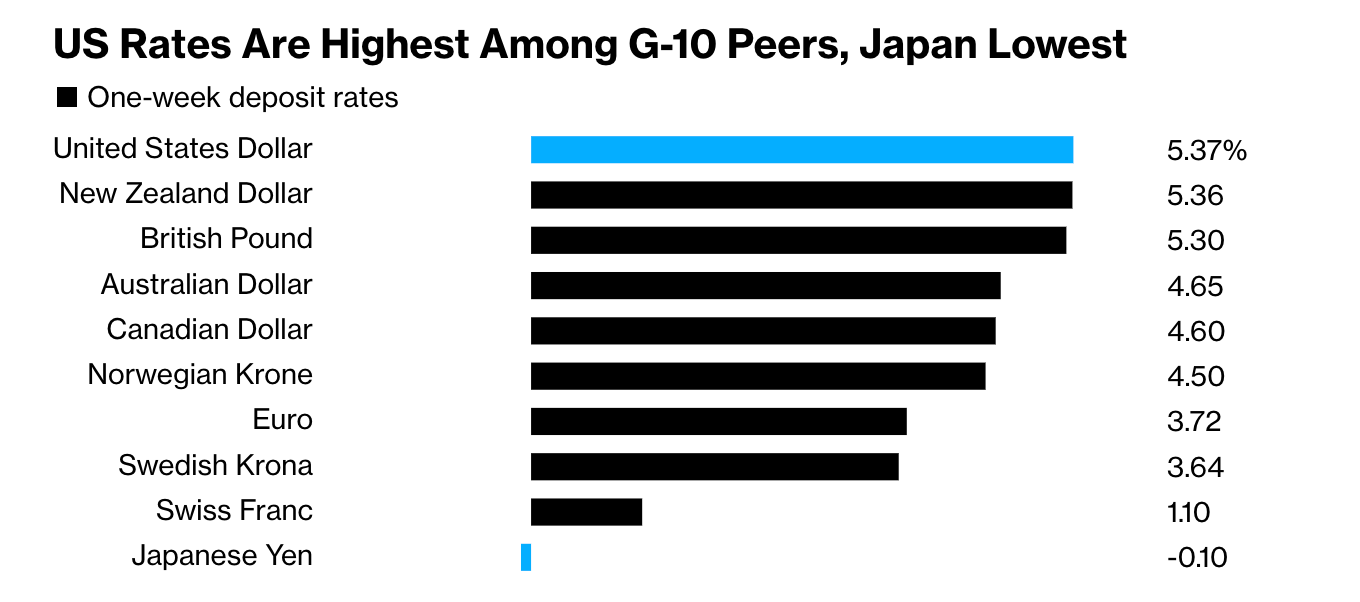

Despite many high-risk reversion traders betting on a yen reversal, the higher-for-longer policy keeps U.S. short-term rates elevated, acting as a magnet for surplus cash.

As illustrated in the chart below, a wide array of G-10 currencies offer an attractive carry compared to the JPY. Not to be outdone, the yen has dropped to a record low against the euro.

(Click on image to enlarge)

Amid these turbulent moves, Japan's top currency official, Masato Kanda, reiterated that authorities will closely monitor foreign exchange markets and take appropriate steps.

(Click on image to enlarge)

However, efforts by Tokyo officials to prop up the yen have thus far been futile. The Japanese currency has weakened despite the nation's record ¥9.8 trillion (over $60 billion) intervention in the forex markets. Further intervention is expected to be equally ineffective if Fed officials maintain a hawkish stance.

Japanese officials may need to sit this one out, lest they waste reserves in a futile effort. So much for the "Year of the Yen."

More By This Author:

Tech Stocks Bounce Ahead Of Nvidia's Shareholder Meeting

Nvidia's Market Cap Takes Significant Hits Amid Pedestrian Pullbacks

Busy Week Ahead On The US Macro Front, Including Presidential Debate