The Natural Rate Of Interest Is An Esoteric Concept That The Fed Pays Attention To

“The natural rate of interest is a real short-term rate that occurs when the economy has reached maximum employment and has stable inflation (i.e., the interest rate that occurs when the economy is in equilibrium). We define monetary policy to be accommodative, restrictive, or neutral if the policy rate is less than, greater than, or equal to the natural rate, respectively.” (Sungki Hong and Hannah G. Shell, St. Louis Fed, Feb. 2019)

The central banks in the advanced countries are all facing a similar quandary.

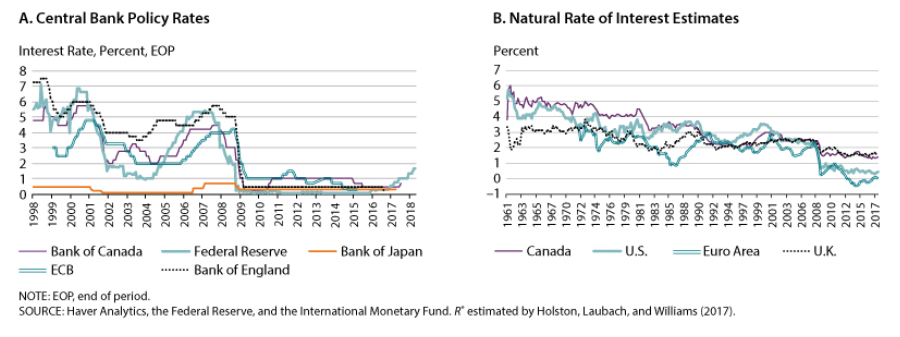

Policy interest rates have been declining over the past 20 years, and in some cases, are barely above zero. As well, the trend rate of GDP growth in virtually all industrial economies has slowed sharply.

At the same time, the natural (or equilibrium) interest rates in these countries has also declined.

Of course, the natural rate of interest cannot be observed directly, though economists can estimate it rather indirectly.

Economic theory implies that the natural rate of interest varies over time and depends on the trend growth rate of real GDP. And in principle, the estimated natural or equilibrium rate is often used as a guide for making monetary policy decisions.

That is, is the current central bank policy rate too high or low relative to where it should be in an equilibrium world where inflation is stable, and the economy is growing at full employment?

As is well known, a declining natural rate of interest reduces the ability of a central bank to respond to recessions using conventional monetary policy.

Indeed, this has been the quandary facing the central banks since the great financial meltdown in 2008-09, which triggered the reliance on unconventional monetary measures, including various versions of quantitative easing.

The following two charts illustrate comparisons between actual central bank policy rates and estimates of the natural rate of interest.

The first two sets of charts illustrate the decline in central bank policy rates since 2008 and the similar decline in estimates of the natural rate.

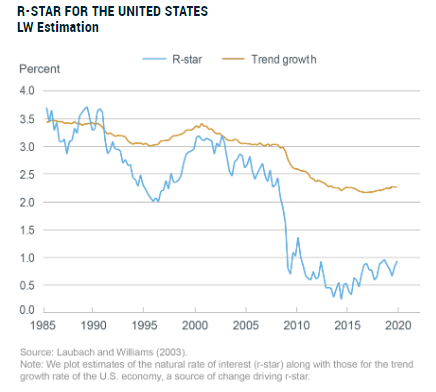

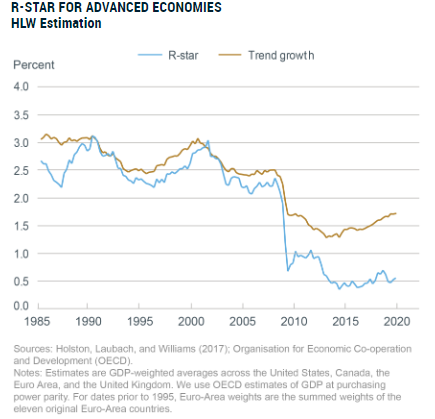

The second set of charts focuses on the relationship between trend GDP growth and the natural rate.

As illustrated in the second set of charts, the estimated US natural rate of interest has declined alongside the decline in the trend economic growth.

According to these estimates, the US natural rate was about 3% twenty years ago and recently dropped to a low of about 0.5%. The latest estimate has the natural rate back up to about 1%.

Across the whole OECD group of countries, the natural rate of interest is also estimated to be about 0.5%.

(Click on image to enlarge)

Estimates Of The Relationship Between Slowing US GDP Growth And Declining Natural Rate Of Interest

(Click on image to enlarge)

Estimates Of The Relationship Between Slowing Growth In Advanced Countries (the US, Canada, the Euro Area, and the UK) And The Declining Natural Rates Of Interest

(Click on image to enlarge)

Nice rstar charts prof. ECB is a total failure.

thanks Gary

Good charts or tables should easily tell a story.

That's why I like using charts.