The IMF’s Latest Bleak Projections For The Global Economy Are Too Optimistic

Image source: Pixabay

“Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook. Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.” (IMF, Latest World Economic Outlook Projections, October 2022)

There are so many risks and unknowns on the horizon that it is difficult to be optimistic about whether or not global economic conditions will really start improving later next year (i.e. 2023).

Indeed, from this economist’s perspective, the evidence is overwhelming that we will encounter a major global economic downturn in 2023.

Among the many risk factors, there is skepticism that inflation will moderate sufficiently in the short run to deter the US Federal Reserve and other central banks from raising their policy interest rates too steeply.

In addition, there is also the general understanding that since inflation is such a global phenomenon, any one country’s curbing of domestic demand will not accomplish very much on the inflation front, other than deepening the downturn and increasing unemployment.

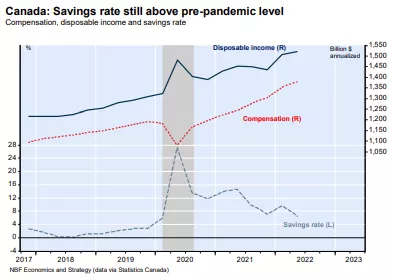

Ironically, early on western governments and central banks acted quite promptly when facing the steep pandemic downturn and were able to generate a surprisingly quick recovery from the pandemic downturn. However, mistakes clearly followed.

With the benefit of hindsight, it is also clear that the Fed and the Bank of Canada continued with their near-zero policy interest rates for far too long.

Indeed, it is now certain that central banks are snatching defeat from their early victories by causing a global economic downturn.

The problem is in relying on tight monetary policy to tackle the current wave of inflation which is mainly being driven by international factors (the Ukraine War, the oil and natural gas price shocks, etc.). Restrictive economic policies will cause a widespread economic slowdown but will have only a minor influence on curbing the international sources of inflation.

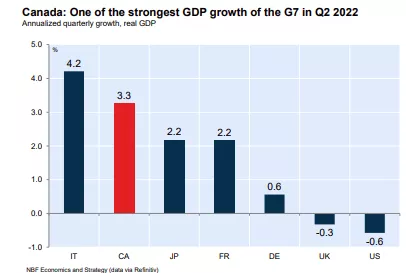

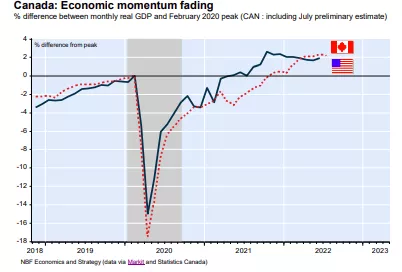

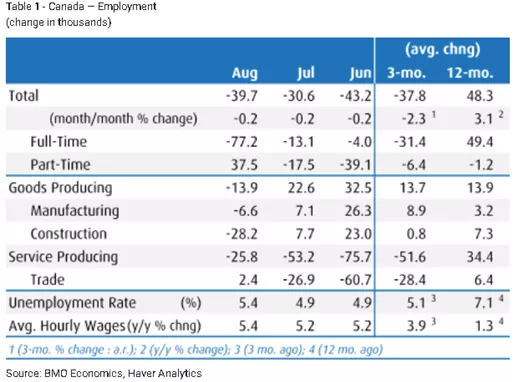

Turning to Canada and the US, the Canadian economy expanded a robust 4.5% in the rebound year 2021, and according to the IMF, the economy is projected to grow 3.6% this year and 1.5% in 2023. However, one of the private banks has Canada’s economy growing by only 1.1% next year.

The US economy also expanded 5.7% in its rebound year 2021 and is projected (on the pessimistic side) to grow only 1.6% this year and only 0.9% in 2023.

In closing, 2023 will be a tough year for the western economies and the entire global economy. As the tables and charts highlight, the economic hardship will be even more severe for highly indebted developing countries.

More By This Author:

U.S. Inflation Over The Next 5 YearsCanada Will Not Be Able To Avoid The Coming Global Downturn

US Inflation May Have Peaked, But What About The Lasting Effects?