The Illusion Of Stability, The Inevitability Of Collapse

Imagine being at a party celebrating the vast wealth generated in the last ten months in stocks, cryptocurrencies, real estate, and just about every other asset class. The lights flicker briefly but the host assures the crowd the generator powering the party is working perfectly.

Being a skeptic, you slip out on the excuse of bringing in more champagne and pay a visit to the generator room. To your horror, you find the entire arrangement held together with duct tape and rotted 2X4s, the electrical panel is an acrid-smelling mess of haphazard frayed wire and the generator is over-heated and vibrating off its foundation bolts. Whatever governor the engine once had is gone, it clearly won't last the night.

The party is the U.S. economy, and the generator room is the Federal Reserve, its proxies, and the U.S. Treasury, all running to failure. What we're experiencing in real-time is the illusion of stability and the inevitability of collapse. I've prepared a few charts to illuminate this reality graphically.

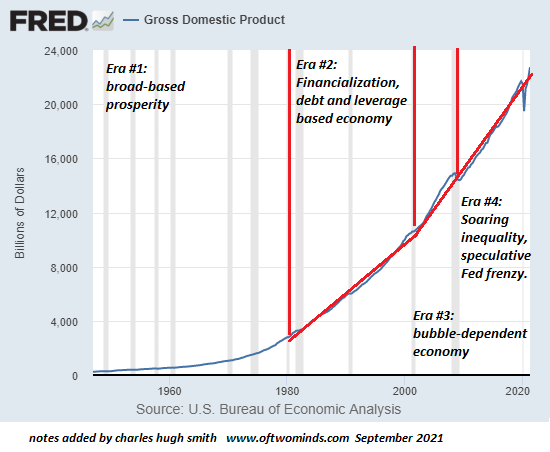

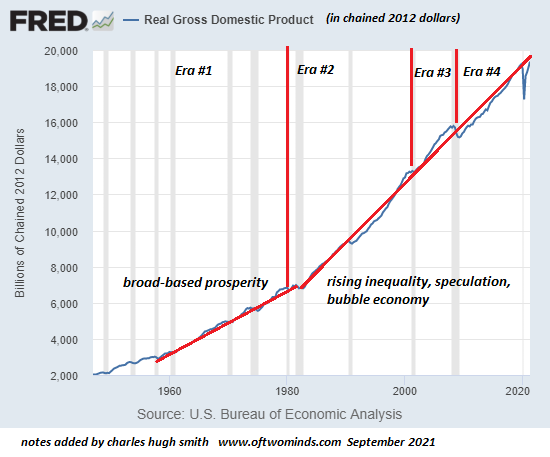

Here's the illusion of stability in a nutshell: while the broadest measure of the economy, gross domestic product (GDP) has continued marching higher (in both nominal and real/inflation-adjusted terms), the amount of Federal Reserve stimulus and Federal debt required to keep pushing GDP up at the same rate has exploded higher and is tracking a parabolic blow-off.

Let's start with a chart of GDP, which I've divided into four eras. Era #1 was the period of broad-based prosperity, defined as productivity gains that increased wages faster than inflation, i.e. the purchasing power of wages rose so each hour of labor bought more goods and services. Note that the GDP was not skyrocketing in this period, as the gains in productivity and prosperity were real and not based on financial trickery, debt, leverage, or Fed stimulus. This era lasted from the 1950s through the mid-1970s, at which point stagflation put an end to the era of rising purchasing power of labor/wages.

Era #2 began around 1981 and lasted until 1999: this was the era of financialization when debt and leverage replaced productivity as the source of profits and as a result speculation, leveraged buy-outs, and other financial gimmicks proved far more profitable than actually producing goods and services. A key element of financialization is globalization, as the big profits only flow when a debt, risk, income streams, and phantom financial instruments can be commoditized (i.e. produced, packaged, and sold as commodities) and sold globally.

Era #3 was the logical extension of financialization and speculation: the U.S. economy became dependent on debt-asset bubbles for its "growth" and expansion of phantom wealth. Bubble #1, the dot-com speculative frenzy, imploded in 2000, and Bubble #2, the debt-housing speculative frenzy, imploded in 2008.

Era #4 is the logical extension of the bubbles popping: a permanent Fed-fueled speculative frenzy that requires ever greater quantities of Fed stimulus and federal and private debt, and ever-larger extremes of speculative frenzy to keep from imploding.

Here's nominal GDP: it looks great until we look beneath the surface.

Here's real GDP, adjusted for official inflation (in chained 2012 dollars). Looks very similar to nominal GDP: if we look at the steady ascent of real GDP, we'd imagine the nation's prosperity is even more broad-based and solid than in Era #1, but we'd be wrong: Eras #2, #3, and #4 are characterized by rising inequality, the death-spiral decay of middle-class purchasing power and total dependence on skyrocketing stimulus, debt, leverage, and speculation.

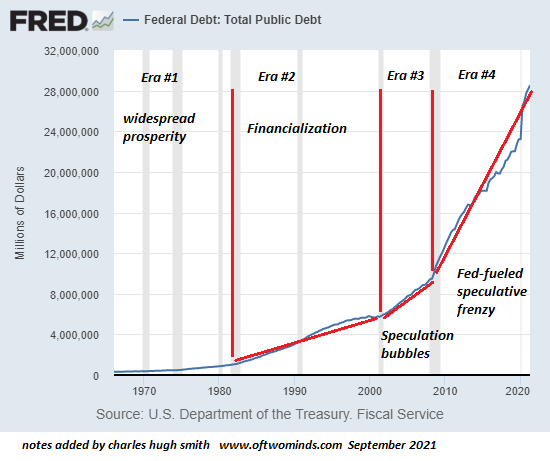

Here's a glance beneath the surface: federal debt has exploded higher: in Era #2 (Financialization), federal debt rose from less than $1 trillion in 1981 to $5.7 trillion in 2000-- about a 6-fold increase over 20 years. The next 20 years saw federal debt rise from $5.7 trillion to $23.3 trillion in early 2020 (pre-pandemic), and since then, a sharp ramp to $28.5 trillion.

You see the trend: GDP rose about 7-fold while federal debt rose 30-fold--mostly in the last 13 years of Era #4.

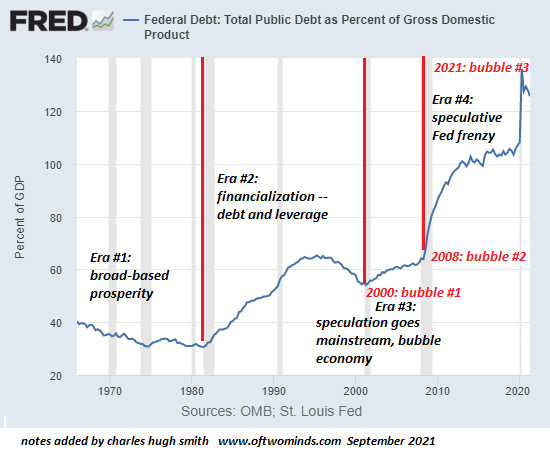

This chart of federal debt as a percentage of GDP is enlightening: notice than in Era #1 (broad-based prosperity), the percentage declined as GDP grew at a faster rate than federal debt. In Era #2 (financialization), debt rose far faster than GDP, but the dot-com boom reduced the percentage to around 60%, double the percentage in Era #1.

Era #3, the bubble economy, remained in the same range, but the trend changed in Era #4, after the Fed's Bubble #2 popped, almost bringing down the entire global financial system. In the era of speculative Fed frenzy (Era #4), the debt quickly rose to 100% of GDP and then made another quantum leap above 120%--a developing-world-kleptocracy level.

While prosperity was replaced by inequality and Fed-inflated speculative bubbles, debt as a percentage of GDP rose 4-fold.

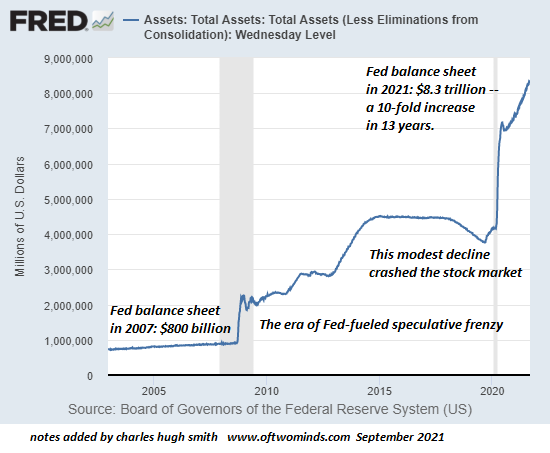

Speaking of parabolic blow-offs, here's the Federal Reserve balance sheet, up 10-fold in a mere 13 years. Remarkable, isn't it, that the U.S. economy managed decades of expansion with the Fed balance sheet far below $1 trillion, decade after decade, but now the economy needs the Fed to create $7.5 trillion and throw it on the bonfire of speculative bubbles to keep the economy from imploding.

GDP in 2007 was $14.7 trillion and the Fed balance sheet was $800 billion, or 5.4% of GDP. Now the Fed balance sheet is over 36% of GDP, about a 7-fold increase in a mere 13 years. Notice the rate of expansion is near-parabolic, even as GDP has recovered to pre-pandemic levels.

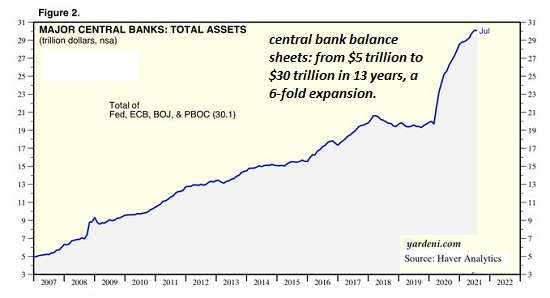

Other central banks followed this same expansion of monetary stimulus. If GDP has normalized, then why the continuing panic-expansion of monetary stimulus? The only logical explanation is the system was breaking down before the pandemic and its decay has accelerated.

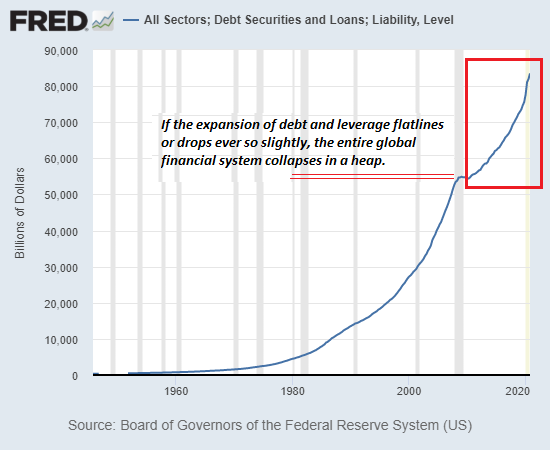

We all know what happens when the expansion of debt, leverage, speculation, and central bank stimulus falter by even the tiniest bit: the entire global phantom wealth bubble pops: this is visible in the chart of total debt, public and private:

Beneath the illusory stability of rising GDP, the extremes of debt, leverage, stimulus and speculative frenzy required to keep the phantom wealth bubble from imploding are all rising parabolically. Every attempt to return to an economy that's not dependent on debt-asset bubbles and unsustainable expansions of debt and monetary stimulus has triggered a global market crash which can only be saved by doubling, tripling or quadrupling the previous levels of debt and stimulus.

This is why collapse is now inevitable. Parabolic blow-off expansions generate instabilities that cannot be suppressed by doing more of what's failing; that is called run to failure for a reason: the only possible outcome is systemic failure, i.e. the collapse of the phantom wealth bubble, a collapse which will bring down the entire machinery of bubble-blowing.

Before you pop that bottle of champagne, you better check out the generator room first. Duct tape, frayed wiring, the scent of overheated metal, and rotted 2X4s are not going to keep the party lights going much longer.

Disclosures: None.

Excellent article.

Rather a more detailed statement of what I have been saying for quite a while. We really need to force the federal reserve bankers to tell the truth about their actual agenda, and then reward them appropriately.